Why the 'very tricky' bond market that tripped up Trump could be your port in this tariffs storm...

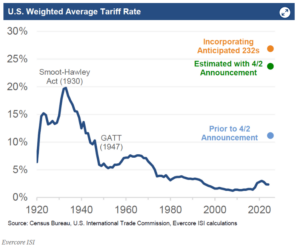

and deliver 7% returns on YOUR savings By JEFF PRESTRIDGE FOR THE MAIL ON SUNDAY Updated: 02:06, 13 April 2025 e-mail View comments What worrying times we are living in, geopolitically and financially. Scary, really scary. The see-sawing in equity and bond markets we have seen in recent days has yet to abate – despite President Trump's partial climbdown on tariffs.

For the time being, the future remains uncertain. While the President's announcement on Wednesday of a 90-day pause on new tariffs to be imposed on trading partners was widely welcomed, the world is a far more dangerous place than it was before Trump embarked on putting the United States first. China and the US are at economic loggerheads and an end to their tariff impasse is not in sight.

As my distinguished colleague, City Editor Alex Brummer, said four days ago, China's imposition of an 84 per cent tariff on US exports to the People's Republic – now increased to 125 per cent – signals 'the outbreak of a truly explosive trade war'. US tariffs on Chinese imports currently stand at 145 per cent. Rather chillingly, Brummer added: 'The consequences for international trade, financial stability and the global economy could be disastrous.

' 'I was watching the bond market,' US President Donald Trump said. 'The bond market is very tricky. People are getting a little queasy' Perhaps the 90-day pause will enable deals to be struck between the US and some of its trading partners – and maybe China and the US will sort out their differences.

But what is certain is that the weeks and months ahead will see continued volatility in both bond and equity markets. Bad news, I'm afraid, for our pensions, Isas and the wider UK economy, already battered by nine months of Labour policies sucking the life out of UK plc – the 0.5 per cent economic growth in February is, admittedly, a little bit of welcome news.

But please read on: out of adversity come investment opportunities. As Nigel Green, chief executive of financial adviser deVere, said in the aftermath of China's announcement of a top-up in the tariff on US goods: 'For investors, this likely marks the start of a period of profound [market] volatility, profound opportunity and profound risk.' Although stock markets across the world have done 180-degree turns on an almost daily basis over the past week – rising one day, only to tank the next – it is a plunge in US bond prices that seems to have spooked the President into authorising the 90-day pause.

'I was watching the bond market,' Trump said, 'the bond market is very tricky. People are getting a little queasy.' What he was really saying in his peculiarly quirky way is that lower bond prices and higher yields are bad news for US households because they push up mortgage and loan repayment rates.

Not the ticket he was elected on. And not good for his popularity with US citizens. As former prime minister Liz Truss and her chancellor Kwasi Kwarteng found out to their cost in 2022, bond markets can be unforgiving.

The UK bond market took an instant dislike to their unfunded tax cuts in September 2022, causing gilt yields to rise alarmingly and the intervention of the Bank of England to stop the rot. The heads of both Kwarteng and Truss soon rolled, with Jeremy Hunt, the chancellor's successor, forced into announcing a mix of ameliorating tax increases and spending cuts. Although UK gilt yields started rising last week on the back of higher US Treasury Bond yields, they drifted down again post Trump's announcement of the tariff pause.

On Thursday, the yield on ten-year gilts dropped from 4.8 to 4.7 per cent but edged up again on Friday.

If they keep moving up, it will cause alarm bells to ring at No 11 Downing Street, home of current Chancellor Rachel Reeves. Higher borrowing costs would be disastrous for the Government's parlous finances, triggering yet more tax rises in the Autumn Budget. Bryn Jones, head of fixed income at wealth manager Rathbones, describes the financial events of the past week as 'headline bingo'.

He says: 'Financial markets are dealing with a volatile person in President Trump, yet when it comes to bond markets they tend to have the last word. 'As the chief strategist to former US President James Carville once said, 'I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter.

But now I would like to come back as the bond market – you can intimidate everybody.' ' Donald Trump on Wednesday announced a 90-day pause on his tariffs imposed at the start of the month for most countries For those not up to speed with their baseball, a .400 hitter is a player who has a base hit strike rate of 40 per cent or more (that's pretty impressive).

Yet Jones says investors should not steer clear of UK gilts simply because higher yields are not good news for the Government. Far from it. He believes there are plenty of opportunities for investors to lock into some attractive (and nigh on risk-free) returns from gilts, provided they hold them to maturity.

'Well-structured investment portfolios are all about balance,' he says. 'Gilts and bonds in general are an important part of the portfolio jigsaw.' The key, Jones adds, is to ensure that the gilts you purchase dovetail with your investment horizons.

He explains: 'There is no point buying a gilt in order to make a big-ticket purchase in three years' time if the bond does not mature for ten years. Like equities, bond prices move up and down like yo-yos. Think about when you need your money back and buy a gilt that will mature at about the same time.

Then you will be quids in.' It's a view shared by Laith Khalaf, head of investment analysis at AJ Bell. He says: 'Like US government bonds, gilt prices have been bouncing all over the place, one minute heading up, the next minute down.

This may throw up some buying opportunities for investors who want to lock into decent yields.' Making money from UK gilts Investor gains from UK gilts come in two forms. There is the income – often referred to as the coupon – which is taxed unless you hold it inside an individual savings account (Isa) or self-invested personal pension (SIPP).

Then it's tax-free. On top, there is the additional tax-free capital gain you make from buying the bond at below par (£1, its maturity price) and then holding on until it matures. How this works to your advantage is best illustrated.

Take UK gilt, Treasury 0.25 per cent 31/7/2031. This provides an annual income (coupon) of 0.

25 per cent, with income payable every six months. Small beer, you may think, especially when you can get north of 5 per cent from putting money into a cash Isa. But the froth is provided by the fact the gilt is currently priced well below par.

Between now and the end of July 2031, it will edge ever closer to its maturity price of £1, but it won't be a smooth journey. Some days it will fall, if bond market sentiment dips. But given both the known maturity date and price, you can work out the annual return you will earn if you stick to the end.

In this bond's case, it is 4.1 per cent, assuming you bought at Friday's mid-morning price of 78.84p.

So a small income stream between now and July 2031, with the capital gain (the main part of the overall return) received when the bond matures. Not overly exciting on the surface, but it is when tax is taken into account. Given most of the return over the six and a bit years comes in the form of tax-free capital gain, the impact of income tax on the interest element is slight.

For basic, higher and additional rate taxpayers, it reduces the annual post-tax returns to 4.04, 3.98 and 3.

97 per cent respectively. We have assumed the holder has already exhausted their annual personal savings allowance – £1,000 for a basic rate taxpayer and £500 for a higher-rate taxpayer. To get the equivalent return from a savings account, you would need a respective gross return of 5.

05, 6.63 and 7.22 per cent.

According to Moneyfacts, the best gross interest rate from a five-year fixed-rate savings bond is 4.65 per cent. According to Jones and Khalaf, there are longer-dated UK gilts that offer even better returns.

But as Khalaf warns, prices of these bonds move around a lot. The US is currently imposing 145pc tariffs on China - but has made phones and laptops exempt Read More How YOU can snap up some serious bargains from Trump's bombshell tariffs in this brief golden window He adds: 'If you've got a twitchy trigger finger, it might be best to steer clear. 'The returns are only guaranteed if you are prepared to hold until the end – and, of course, if the Government doesn't default on payments.

' On Friday, someone happy to buy UK gilt Treasury 0.625 per cent 31/7/2035 at the mid-morning price of 67.12p could lock into an annual return of 4.

69 per cent for the next ten years. For a higher-rate taxpayer, the post-tax return is 4.37 per cent.

To better this from cash, they would need to find a savings account paying fixed gross interest for ten years of 7.28 per cent. Such an account does not exist.

To match the after-tax annual returns from UK gilts 1.125 per cent 31/1/2039 and 0.875 per cent 31/1/2046, a higher-rate taxpayer would have to find saving accounts paying 7.

33 and 7.95 per cent gross interest. Of course, these gilt returns look enticing – 'no brainers' according to Rathbones' Jones.

But bear in mind that there is a big unknown out there, which is where inflation is heading. Inflation is the curse of every cash and bond saver. Although currently running at 2.

5 per cent with the Bank of England determined to help nudge it down to 2 per cent, Trump's assault on the normal workings of global trade could well ignite inflationary flames. So how do I buy the bonds? UK gilts can be bought and sold through all investing platforms. For example, Hargreaves Lansdown will charge a 1 per cent fee on UK gilts bought over the phone subject to minimum charge of £20 and a maximum of £50.

Alternatively, you can buy via the UK Debt Management Office with a 0.7 per cent charge on purchases up to £5,000 (minimum fee of £12.50).

Bigger purchases incur a minimum fee of £35 plus 0.375 per cent of the amount in excess of £5,000. Some investors may prefer to get exposure to UK gilts through a fund holding a spread of bond issues.

For instance, funds run by Amundi and iShares track the performance of the FTSE Actuaries UK Conventional Gilts All Stocks Index. Or funds such as Rathbone Ethical Bond and Artemis Strategic Bond which invest in a mix of government and corporate bonds – both UK and overseas. The latest factsheet for the Rathbone fund states that if the portfolio's collection of 232 bonds were all held to maturity, they would provide investors with an average annual yield of 5.

6 per cent. Share or comment on this article: Why the 'very tricky' bond market that tripped up Trump could be your port in this tariffs storm..

. and deliver 7% returns on YOUR savings e-mail Add comment Some links in this article may be affiliate links. If you click on them we may earn a small commission.

That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Comments 0 Share what you think No comments have so far been submitted. Why not be the first to send us your thoughts, or debate this issue live on our message boards. Add your comment Enter your comment By posting your comment you agree to our house rules .

Submit Comment Clear Close Do you want to automatically post your MailOnline comments to your Facebook Timeline? Your comment will be posted to MailOnline as usual. No Yes Close Do you want to automatically post your MailOnline comments to your Facebook Timeline? Your comment will be posted to MailOnline as usual We will automatically post your comment and a link to the news story to your Facebook timeline at the same time it is posted on MailOnline. To do this we will link your MailOnline account with your Facebook account.

We’ll ask you to confirm this for your first post to Facebook. You can choose on each post whether you would like it to be posted to Facebook. Your details from Facebook will be used to provide you with tailored content, marketing and ads in line with our Privacy Policy .

.

Business

Why the 'very tricky' bond market that tripped up Trump could be your port in this tariffs storm... and deliver 7% returns on YOUR savings

What worrying times we are living in, geopolitically and financially. The see-sawing in equity and bond markets we have seen in recent days has yet to abate - despite Trump's partial tariff climbdown.