President Donald Trump’s tariff agenda has thrown the financial world for a loop for much of the past month . The on-again , off-again trade escalation with other nations — most notably China — has upended markets with investors fleeing U.S.

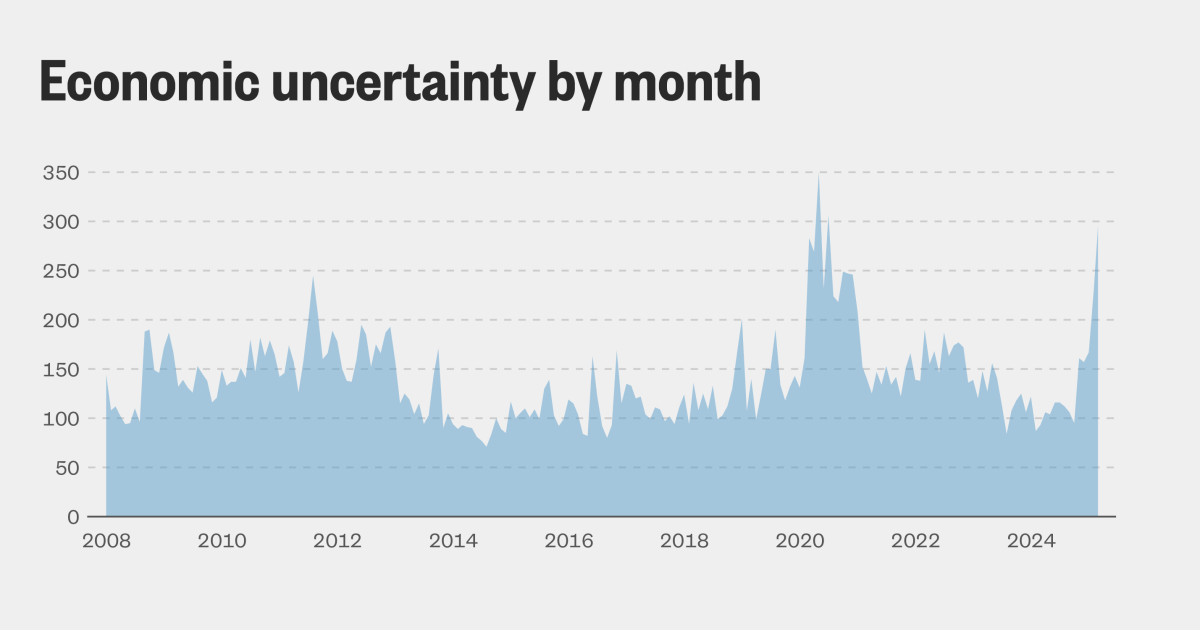

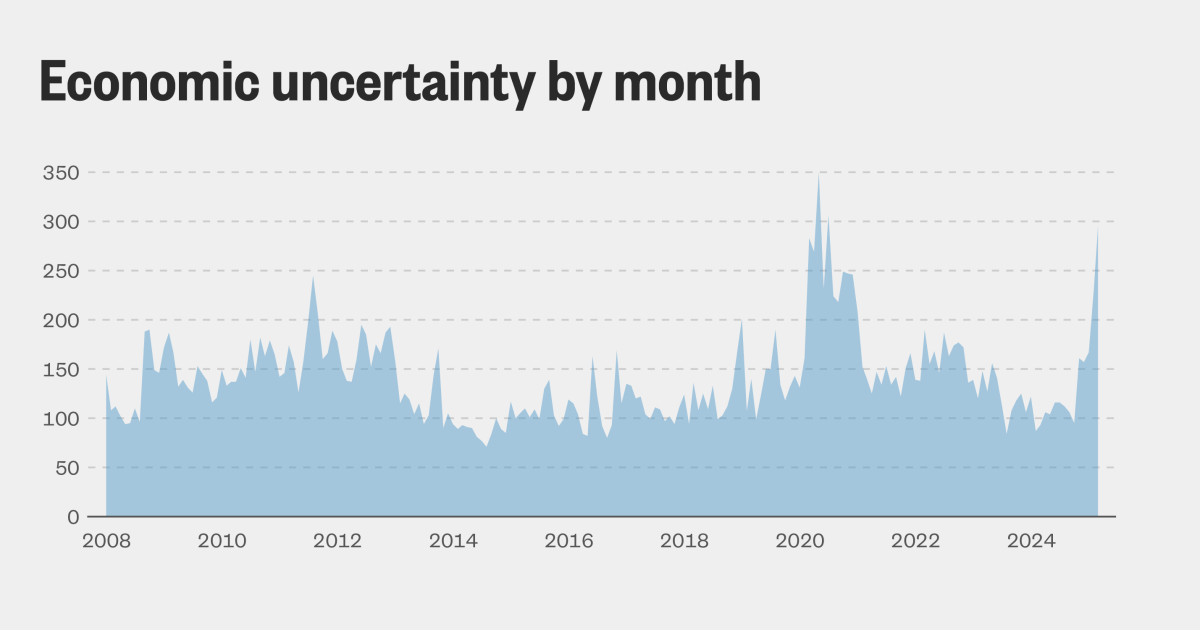

stocks in search of more stable ground . And as experts and business leaders say the lack of clarity around the tariffs is every bit a challenge as the levies themselves, data shows economic uncertainty is the highest it has been in years. Economists have a way of quantifying economic chaos, as multiple measures show just how uncertain the market and the economy in general are.

One measure, the Economic Policy Uncertainty index from researchers at Stanford and Northwestern universities, uses an analysis of news reports, tax code data and economic forecast disagreement. According to the EPU index, uncertainty spiked in March to levels last seen during the Covid pandemic. Kevin L.

Kliesen, an economist at the St. Louis Federal Reserve , noted that the change in uncertainty from last spring to this spring is the sharpest such increase in almost 40 years. “It’s a historically unprecedented increase,” Kliesen said.

The instability makes it harder for companies and consumers alike to make decisions, and it can be a scene-setter for recession s. “Firms will delay investment in response to higher uncertainty,” Kliesen said. “Consumers facing higher uncertainty about job prospects, they might cut back on spending.

” Menzie Chinn, a professor of public affairs and economics at the University of Wisconsin, said, “People are maximally confused.” To show how uncertainty plays out, Chinn gave an example of potential homebuyers: Lowering interest rates might entice them, but worries about a big drop in home prices over the next year — the kind that might arise from a recession — might scare them away. “It’s better news, but washed out by this bad uncertainty,” Chinn said.

The uncertainty extends into the bond market: Government bonds are being sold more than they’re being bought — even as stocks sour, flouting historical trends. Traditionally seen as a safe harbor, bonds tend to be purchased by investors when markets are on edge. That’s not the case today, with 10-year Treasury yields surging above 4.

5% . As overall stability is eroding, any news — even if it’s inaccurate or positive — has the potential to send things haywire. U.

S. stocks soared briefly on April 7 when an errant headline on X said Trump was considering a pause, only to sink when the White House said the claim was false. And while the market took off after Trump dialed down most tariffs Thursday, stocks faltered the next day .

Prominent business leaders have warned about the uncertainty in recent weeks, with both JPMorgan Chase CEO Jamie Dimon and BlackRock CEO Larry Fink saying the lack of clarity is pushing the economy closer to recession. “We have the strongest economy in the world. It would be good not to add to the uncertainty out there,” Dimon said Wednesday on Fox Business , adding that a recession is now a “likely outcome.

”.

Business

What soaring uncertainty means for the U.S. economy

As experts and business leaders say the lack of clarity around the tariffs is every bit as challenging as the levies themselves, data shows economic uncertainty is the highest it has been in years.