Qatar tribune Over the last several years, the US Federal Reserve (Fed) was at the forefront of most macro and investment discussions, given the importance of interest rates and quantitative policies for growth, liquidity and inflation. However, in recent months, a plethora of new policies by the Trump administration has completely changed the terms of debate and focus of attention. This movement was underpinned by concerns about a potential inflationary economic overheating if Trump were to enact the expansionary policies suggested during his campaign.

However, once the administration started, as tariff discussions and DOGE became the main priorities for the government, the balance of risks to the US macro outlook reversed rapidly from economic overheating to a possible recession. Investor and consumer sentiment deteriorated with major equity indexes breaching the 10% correction territory for the first time in years while retail sales showed further weakness alongside plummeting consumer confidence metrics. A forecasting model by the Atlanta Federal Reserve currently points to a contraction of 2.

8% in Q1 2025 US GDP, a sharp move from a 2.3% expansion in the previous quarter. But the Fed still needs to operate under this elevated level of uncertainty, and monetary policy choices could be key to mitigate some of the impacts from uncertainty or potential negative shocks coming from the political front.

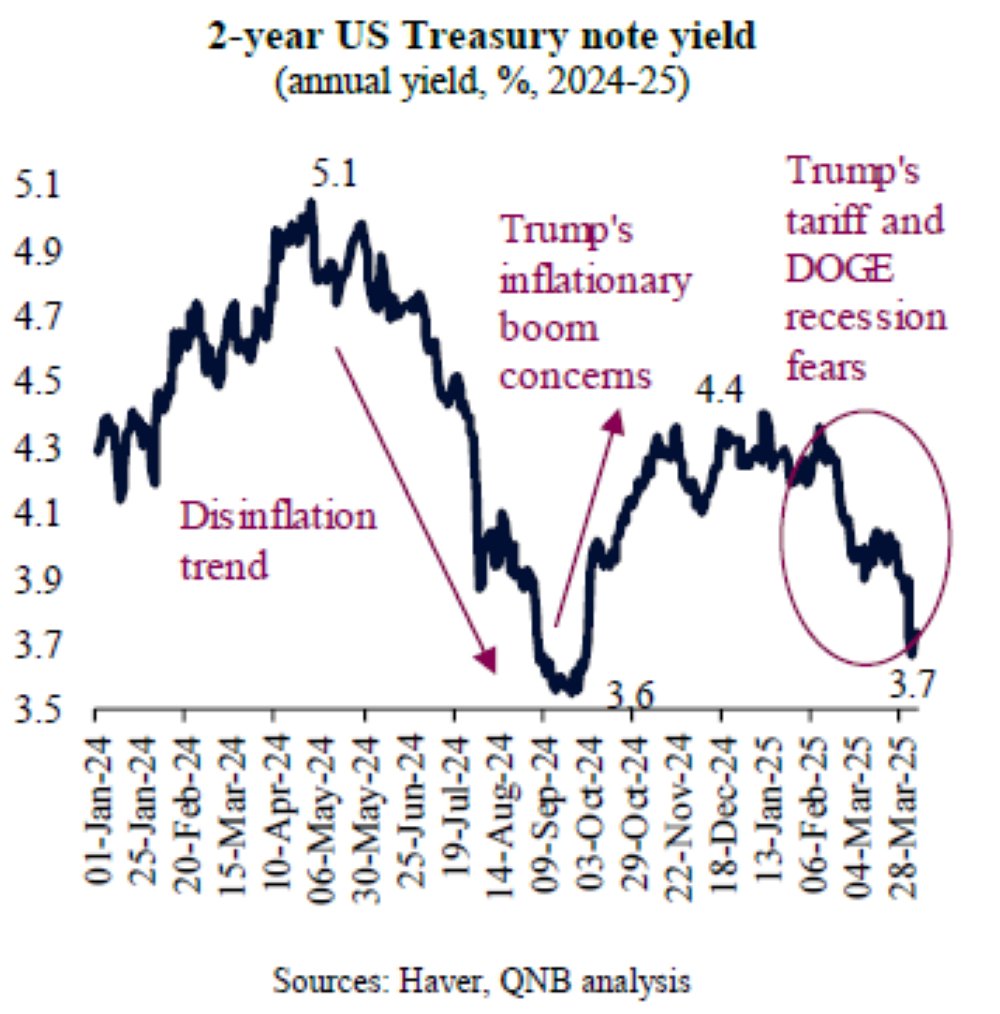

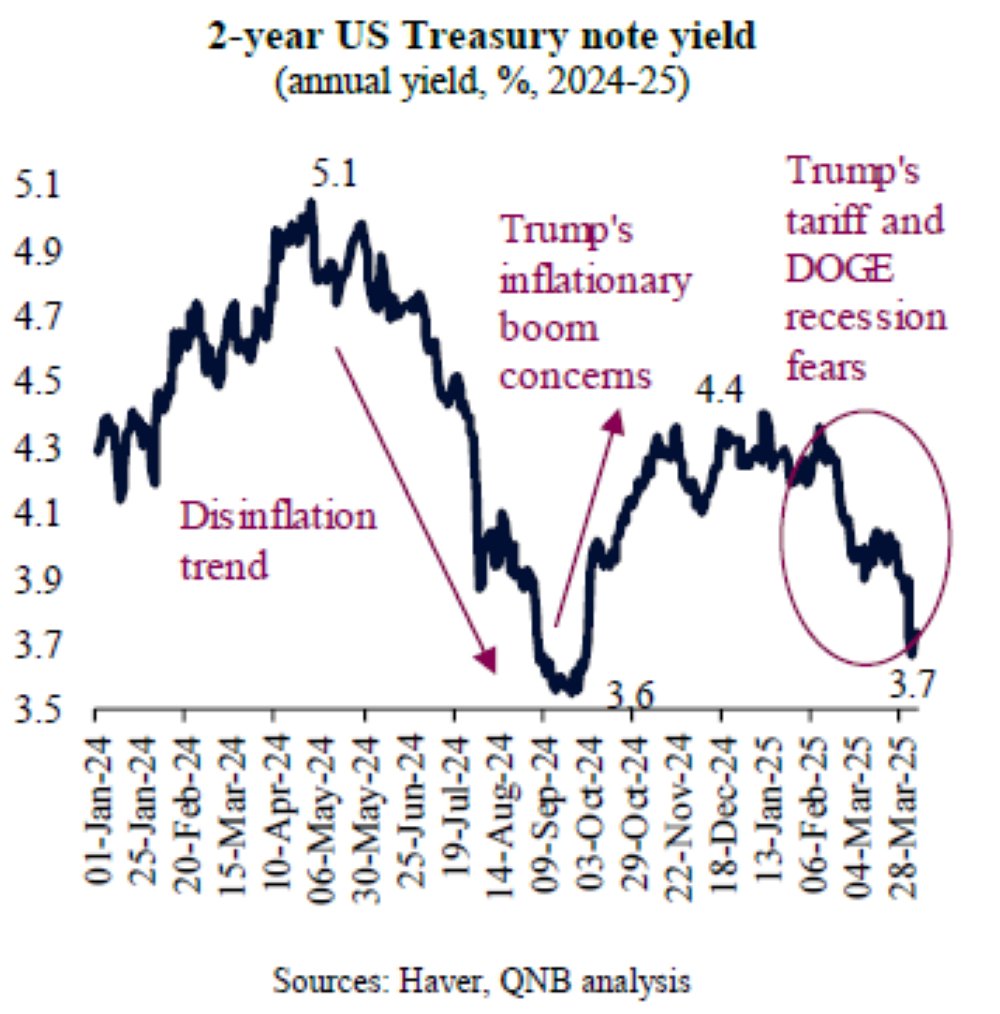

It is not an easy task for the Fed to operate under this environment. As a reference, medium-term policy rates have swung significantly, expressing a rather fleeting market consensus about the timing and even direction of Fed fund rates over the next few quarters. Yields for 2-year Treasury notes, which had collapsed in Q2-Q3 2024 on the back of rapid disinflation and expectations for aggressive monetary policy easing, surged during Q4 last year, as Trump took the lead in the US election with a pro-growth platform.

Since February 2025, as aggressive trade measures and DOGE policies negatively affected investor and consumer sentiment, yields were driven down. Investors are currently expecting the Fed to resume the rate cutting cycle that started in September 2024, with four more 25 basis points (bps) in cuts to the Fed funds rate “priced in” by the end of 2025 and further rate cuts in 2026. In our view,prevailing market expectations seem to be aligned with the macro environment, suggesting enough space for the Fed to provide further policy accommodation.

Two main factors support our view. First, Fed officials continue to communicate their own expectation of further rate cuts this year. The March 2025 Fed “dot plot,” which shows the projected target range for policy rates from each of the 19 Federal Open Market Committee (FOMC) meeting participant, is not far off from the prevailing market position for the next few quarters.

This is supported by the view from most Fed officials that the economy is gradually decelerating, with inflation normalizing, and that any potential impact on inflation from tariffs are likely to be transitory and “looked through.” Second, the combination of economic weakness and negative policy shocks to sentiment suggests that further policy rates are not only possible but also perhaps even necessary. US capacity utilization, measured in terms of the state of the labour market as well as industrial slack, indicates that the US economy is set to run below potential.

In other words, there is a healthy supply of labour for job openings available, whereas industrial activity is running below its long-term trend. The labour market, which reached maximum tightness in early 2023 with the unemployment rate much below equilibrium at 3.4%, fully adjusted and is now at a normalized level with the unemployment rate at 4.

5% in February 2025. These conditions support additional rate cuts to accommodative levels over the coming quarters, i.e.

, policy rates that are below the estimated neutral threshold of around 4%. All in all, despite above target inflation and potential short-term inflation pressures coming from the imposition of tariffs, the Fed is expected to further cut rates in 2025. This comes on the back of a weakening economy and the need to move the monetary policy stance from the current restrictive territory (4.

5% Fed funds rate) to accommodative (below 4% Fed funds rate), in order to prevent a sharper economic deceleration or even a recession. — By QNB Economics Copy 13/04/2025 10.

Business

What could US Fed do amid recession fears?

Over the last several years, the US Federal Reserve (Fed) was at the forefront of most macro and investment discussions, given the importance of interest rates and quantitative pol...