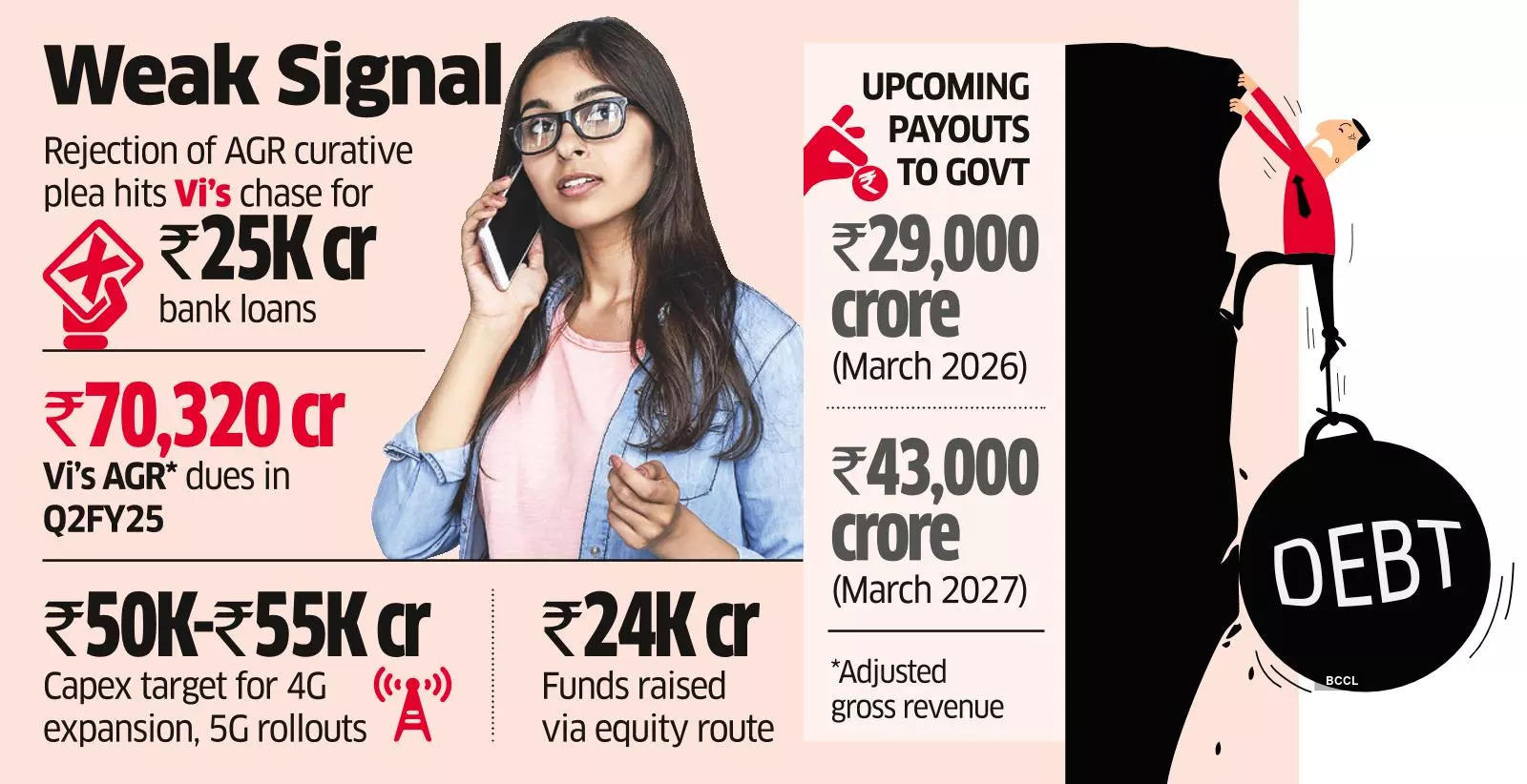

Kolkata: The expected delay of Vodafone Idea 's Rs 25,000 crore debt-funding plan now threatens to derail the debt-laden telco's financial turnaround , analysts said. They, though, expect the government to convert a large part of the telco's statutory dues into equity in a bid to provide relief to the stressed carrier. The Vi management's admission of a likely delay in raising debt-after the dismissal of its AGR (adjusted gross revenue) curative petition by the nation's top court-is a marked departure from the telco's earlier stance of securing the bank loans by late-November itself, they said.

Advt Shares of Vodafone Idea had closed 0.4% lower at Rs 7.34 on the BSE on Thursday.

The government holds 23.15% in the telco, which is co-owned by the Aditya Birla Group (14.76%) and UK's Vodafone Group (22.

56%). "The debt-raise is critical for execution of Vi's capex plan, and the AGR setback has resulted in some delay. A delayed/stalled debt-raising would pose risks to Vi's turnaround plan," IIFL Securities said in a research note seen by ET.

On Thursday, Vi's CEO Akshaya Moondra said banks now want clarity from the government on any potential relief on the company's substantial AGR dues as well as prospects of a waiver of bank guarantees (BGs), before lending. The Supreme Court rejected Vi's curative petition seeking a re-computation of its AGR dues of Rs 70,320 crore at the end of the fiscal second quarter in September. Advt Vi urgently needs the debt funding to implement a Rs 50,000-Rs 55,000 crore capex plan over the next three years to accelerate its 4G coverage and roll out 5G in priority markets.

This is vital to improve its competitiveness vs bigger rivals, Reliance Jio and Bharti Airtel, and reining in customer losses. So far, Vi has only raised Rs 24,000 crore via the equity route. The loss-making telco has to pay Rs 29,000 crore in March 2026 and Rs 43,000 crore March 2027 towards immediate government liabilities after the moratorium ends in September 2025.

In this background, "...

we see a high probability of the government converting a part of these dues into equity," IIFL said. Vi, on its part, has said that it hopes to meet any potential cash shortfall via another round of debt-to-equity conversion by the government. Separately, the telco has been actively seeking removal of bank guarantee (BG) requirements for spectrum acquired before 2022.

The telco needs to secure BGs worth Rs 24,746 crore in the coming months. "Vi's management said the lenders are wary that these BGs would increase their exposure and can limit their ability to extend the targeted debt-funding. Hence, the management has said the waiver of BG requirement would help the company in securing debt fundraise to an extent," JM Financial said in a research note.

Analysts reiterated that Vi's long-term sustainability continued to be contingent on significant favourable government support . "The outlook for Vi remains hinged on its closing the debt-raise soon, which is critically essential for the telco to invest in networks and potentially return to a modest subscriber growth path," Nomura Research said. By Kalyan Parbat , ET Bureau Published On Nov 16, 2024 at 07:50 AM IST Telegram Facebook Copy Link Be the first one to comment.

Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button. This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis. Download ETTelecom App Get Realtime updates Save your favourite articles Vodafone Idea AGR dues debt funding financial turnaround 4G coverage 5G rollout government support debt-to-equity conversion telco competition Aditya Birla Group iifl securities jm financial.