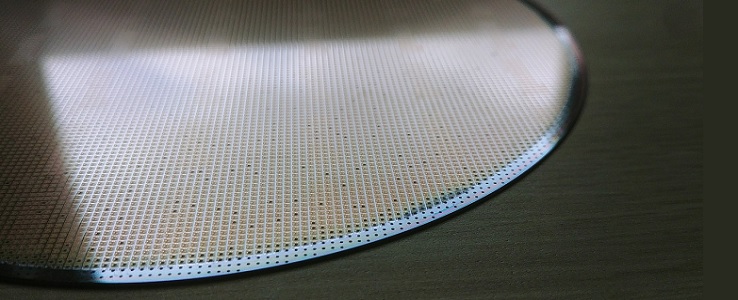

The US will extend a semiconductor manufacturing tax break to makers of solar wafers in another attempt by the Biden administration to bolster the domestic solar supply chain to further its clean energy and jobs agenda. The government has finalized rules for a 25% tax credit for chip manufacturing projects, expanding eligibility for one of the largest incentive programs from the 2022 Chips and Science Act. Solar wafers are thin silicon slices used to make solar panels, which are mostly produced in China.

Manufacturers have announced many new solar panel plants since 2022, thanks to new subsidies for clean energy manufacturing. However, the US does not have ingot and wafer production in operation yet due to manufacturing complexities and the highly specialized equipment needed to create these facilities, making incentives an important part of the equation for wafer producers, according to a media release issued by the Solar Energy Industries Association (SEIA). New rules for the 48D advanced manufacturing investment credit will allow solar ingot and wafer makers to claim a 25% tax break for new facilities.

Those facilities can also claim a separate manufacturing tax credit created by the 2022 Inflation Reduction Act. The tax refunds are one of three main subsidy streams available from the Chips Act, which also set aside USD 39 billion in grant funding and USD 75 billion in loans and loan guarantees..