THE Trinidad and Tobago Chamber of Industry and Commerce has called on the Board of Inland Revenue (BIR) to clean up its records to prevent the issuance of notices beyond the period for which taxpayers are legally required to keep documentation. “We note that in some instances, notices have been issued by the BIR for taxes owing for more than a decade. Moreover, audits are being conducted by the National Insurance Board (NIB) for periods exceeding 15 years.

This seems highly unreasonable given that the tax legislation generally provides for a period of six years to retain books and records in T&T. We would therefore like to request that this process is revisited and a clean-up exercise done on the records of the BIR to avoid these dated notices being issued,” the T&T Chamber stated. The call was made in the T&T Chamber’s recently published 2024 to 2025 Budget Recommendations document.

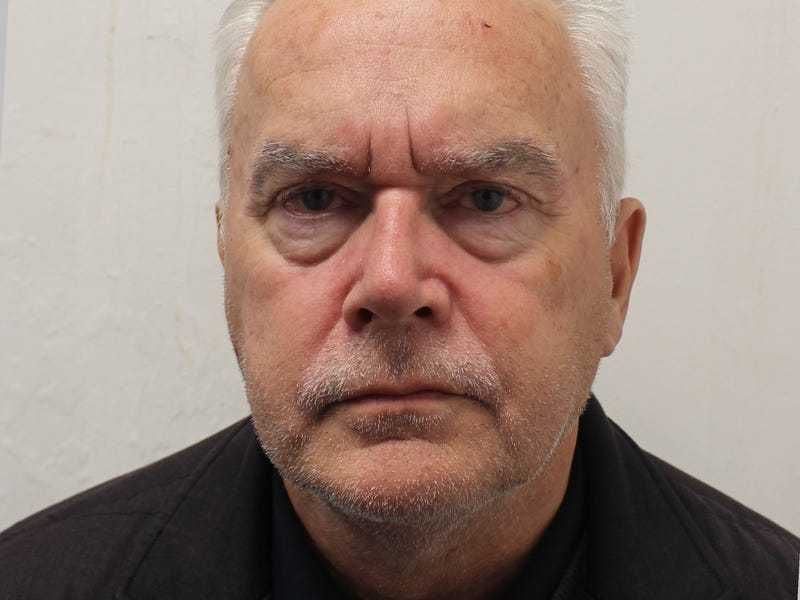

This year, two prominent businesspeople, Tony Chow Lin On and his company Trinidad and Tobago Radio Network (TTRN) and Derek Chin and his company MovieTowne, were reported to be owing millions of dollars in outstanding tax payments to the BIR. Previously, when the situation with the outstanding taxes was raised, the T&T Chamber issued a release stating it expected the business community to operate within the law, including paying taxes on time. The T&T Chamber in its budget document also commended the Government’s efforts to improve the efficiency of the BIR and Customs and Excise Division through the proposed establishment of the Trinidad and Tobago Revenue Authority (TTRA).

“Other countries in the Caribbean, namely Jamaica, Barbados and Guyana, have introduced revenue authorities, and it is no surprise that T&T is pursuing the implementation of a TTRA,” it stated. Blueprint for growth, resilience, equity The T&T Chamber also recommended Value Added Tax refund offsets. “Section 92 (2) of the ITA and section 35 (2) of the VAT Act of T&T both grant the BIR the authority to offset tax refunds owed to taxpayers against outstanding tax liabilities.

Whilst the BIR has used such provisions to unilaterally apply refunds owed to taxpayers against outstanding tax liabilities, the practice of granting offsets when requested by taxpayers has not been done frequently based on our experience,” it stated. “It should be noted that other regional territories such as St Lucia and Guyana allow for automatic offsets of refunds against outstanding tax liabilities, whilst other territories such as Barbados allow for such offsets once a written application is made to the Barbados Revenue Authority. Such an approach of offsetting refunds owed against tax liabilities computed (provided that the liabilities in question are not under dispute) may assist in reducing the amount of VAT refunds owed by the Government of T&T to taxpayers, and would ease the cash flow burden experienced by companies who are owed such refunds.

This would encourage further business expansion and increased investment as cash flows directly invested in business generating activities versus in VAT and TAX refunds,” it stated. This country’s fiscal year comes to an end on September 30. The national budget is soon to be read, although a date for its presentation has not been officially announced as yet.

The T&T Chamber’s president Kiran Maharaj stated that the organisation recognised that the national budget must be a blueprint for growth, resilience, and equity. She said the key recommendations are ones which the Chamber believes will “drive our nation forward by improving the ease of doing business, increasing productivity, enhancing our digital infrastructure, expanding our export capabilities, and more.” “Our first priority must be to streamline and simplify the processes that businesses encounter.

By reducing bureaucracy and eliminating red tape, we can significantly decrease the time and cost associated with starting and operating a business. This will not only encourage entrepreneurship but also attract foreign investment, driving economic growth,” Maharaj said. Maharaj said productivity was the engine of economic growth.

“To elevate productivity across all sectors, consideration must be given to targeted investments in skills training and workforce development. We are in the AI revolution and we must support the adoption of advanced technologies in both the private and public sectors, ensuring that our workforce is equipped to excel in a rapidly changing global economy,” she stated. According to Maharaj, in today’s digital age, robust infrastructure is essential for competitiveness.

“Digital expansion will facilitate e-commerce, enable remote work, and connect our citizens to global opportunities. Furthermore, we must invest in cybersecurity measures to protect our digital assets and ensure the integrity of our online platforms. Our nation’s prosperity is tied to our ability to compete on the world stage.

We commend our Government on the development of the Trinidad and Tobago Trade and Investment Promotion Agency and the Special Economic Zone Authority, which both seek to enhance our export potential and can increase our foreign exchange earnings and strengthen our economic resilience,” she stated. Maharaj said sustainability is no longer an option but a necessity. “We propose a bold strategy be developed in renewable energy projects, including solar, wind, and hydroelectric power.

This includes the development of public-private partnerships to accelerate the transition to a green economy. “Additionally, we must provide incentives for businesses and households to adopt renewable energy solutions, reducing our carbon footprint and decreasing our dependence on fossil fuels. As we seek to move away from a reliance on the oil and gas sector, we must also review the opportunities in service sectors and the creative sector where we can harness the potential of the orange economy,” she said.

Maharaj said innovation was the key to unlocking new opportunities and ensuring long-term economic diversification. “Research and development, particularly in emerging sectors such as technology, agriculture, and renewable energy, must be encouraged. Moreover, we must provide targeted support for micro, small, and medium enterprises through access to capital, mentorship programmes, and incubation hubs.

By nurturing these businesses, we can create a vibrant and diverse economy that is resilient to external shocks,” she said. She said while economic growth is essential, it must be both inclusive and equitable. “Access to quality healthcare, education, and social services is always considered and we look forward to Government’s inclusion of these aspects.

A nation’s success is measured not just by its wealth, but by the well-being of its people,” she stated. She said the recommendations outlined in the Chamber’s 55-page document are not just about numbers and economic impact, but also about people, communities, and the future to be built together. “By focusing on the ease of doing business, productivity, digital infrastructure, exports, renewable energy, innovation, and social equity, we can pave the way for a brighter, more prosperous future for all,” she stated.

Tax deduction for $1m TTPS donation The Chamber’s Budget Committee is chaired by Charles Pashley and Colin Ramsey, and comprised members Bryan Ramsumair, Jean Paul de Meillac, Susan Morgan, and Lorraine Waldropt. Among the recommendations made by the T&T Chamber was a repeat of its suggestion last year for the introduction of a 100% tax deduction to individuals and companies who donate up to $1 million to the Trinidad and Tobago Police Service (TTPS) to provide alternative funding to help combat crime. The Chamber is also recommending a similar tax deduction for entities and individuals that support Crime Stoppers.

The recommendations were placed in 11 focus areas, including the construction sector, the energy sector, and Tobago. SOME RECOMMENDATIONS: CONSTRUCTION: 1. Remove property tax on all industrial plant and machinery.

2. Reduce rates of stamp duty on the transfer/sale of residential and commercial properties. In the case of residential land, remove stamp duty altogether, or alternatively, revisit thresholds which are quite antiquated.

Also revisit stamp duty on financing instruments—substitute with a flat fee. GO GREEN: 1. Expand incentives for investments in solar panels by individuals and businesses.

2. Introduce legislation to encourage investments in charging ports for electric vehicles. 3.

Update laws to allow the repurchase of power from providers that have developed green energy sources—for example, solar panels, allowing the sale of excess power back to the grid. 4. Extend VAT and duty concessions to hybrid vehicles.

TOBAGO: 1. Move reporting lines for landholding licences in Tobago to the chair of the Tobago House of Assembly (THA). 2.

Create an “in-transit” desk to Tobago, mainly targeting international travelers. AGRICULTURE: 1. Clearly define the process for accessing tax exemptions.

2. Address land tenure issues. 3.

Address praedial larceny issues. DIGITISATION AND TECHNOLOGY: 1. Cybersecurity Investment Tax Allowance.

Amend legislation to clarify that the allowance should be capped at $500,000 per income year, Consider also extending beyond 2025. 2. Amend the Seventh Schedule of the ITA to include computer software.

.