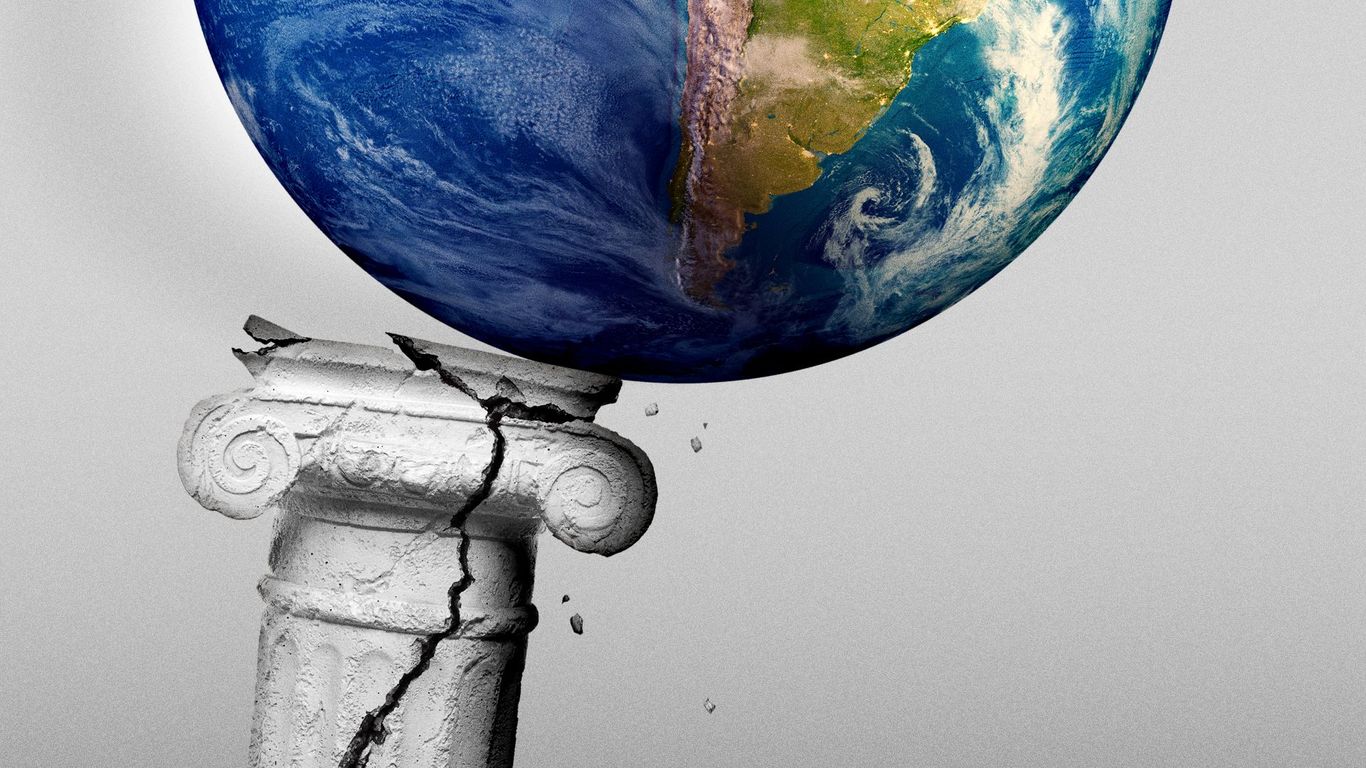

For the next three days, one man holds the global economy in the palm of his hands, literally and figuratively — and almost no one but him knows what will happen.Why it matters: Every Wall Street trader and economist has "April 2" circled on their calendars. The consensus is that tariffs are coming, but the fear is in the unknown: how aggressive the measures will be.

The big picture: Financial markets hate surprises, yet that is what the Trump administration looks set to do this week — with mixed signals from the president himself about what will happen on Wednesday.The uncertainty, already tanking the stock market and economic sentiment, might be swapped for an unprecedented trade regime that would force businesses to adjust virtually overnight."I want it to be clear.

The market does not like unknowns, and at the moment, we are sort of off the charts in our 'unknowns' inventory," Mark Malek, chief investment officer at Siebert Financial, said in a Friday note.Catch up quick: Trump has warned about reciprocal tariffs for more than six weeks — a wide-ranging scheme meant to hit back on nations said to have unfair trade practices.He has called it "Liberation Day," saying the tariffs would free American exporters that have been ripped off by other countries' trade restrictions, which the administration defines loosely.

"You'll be hearing that word a lot, "reciprocal," Trump said in early February. "If they charge us, we charge them."The S&P 500 is down almost 9% since Feb.

13, when Trump unveiled a memo directing the Commerce Department to look into reciprocal tariffs.The intrigue: Over the last week, Trump has softened his tone about how aggressive the reciprocal actions might be — even while announcing other tariffs, including a 25% import tax on foreign-made cars effective April 2.Monday: Trump told reporters he "may give a lot of countries breaks.

" Tuesday: He told NewsMax the tariffs would "probably be more lenient than reciprocal, because if I was reciprocal, that would be very tough for people."Wednesday: Trump said the administration would keep reciprocal tariffs "somewhat conservative."Friday: The U.

S. would be "certainly open" to making a deal with nations on reciprocal tariffs, Trump said.The other side: If those comments offered any comfort, it was blown up Saturday, after the Washington Post reported Trump has pushed his advisors to go bigger, including slapping a universal tariff rate on all imports.

Trump told NBC News on Saturday that he "couldn't care less" if auto companies raised prices on consumers, and that he might impose "secondary sanctions" on Russia that could effectively block imports from China. Just last week, Trump defied reports he'd ease up on tariffs.After reporting from the Wall Street Journal and Bloomberg that there would be no sector-specific tariffs on April 2, he announced sweeping 25% tariffs on the auto industry.

He warned tariffs on foreign-made drugs and lumber were coming.What to watch: Whether April 2 is the beginning of the end of the trade uncertainty, or just the end of the beginning."April 2 may be the biggest day for tariff announcements, among others.

But it will hardly resolve the uncertainty," economist and currency strategist Jens Nordvig posted on X Saturday, noting that what's likely to follow is weeks or months of negotiations, concessions and ongoing economic paralysis.The bottom line: Trump is unleashing tariff revenge as the economy softens alongside still-high inflation, the toxic "stagflationary" mix economists dread and that they say import taxes will make worse.The prognosis from one global law firm to its clients: "Buckle Up and Be Prepared .

.. One thing is certain: higher tariffs are coming.

".