The 2024 presidential election, the 60th in the United States and the election of the 47th president is just around the corner on 5 November. Experts say the race between Kamala Harris and Donald Trump is as intense as ever, full of emotion and visceral confrontation. Regardless of who wins the US presidential election, markets are poised to be dramatically or minor affected by the movement of various factors.

External conflicts, economic indicators, and recent policy changes complicate the political landscape for investors. Analysts closely watch how these events unfold and their implications for market stability. The Influence of External Conflicts Recent conflicts in neighboring regions, particularly in the Middle East, are introducing layers of uncertainty to the economic environment.

The ongoing war has raised concerns about potential escalation, which could disrupt global oil supplies and impact trade routes. These developments feed into market anxiety regarding stability and growth prospects, particularly as the U.S.

is strategically intertwined with many regions. The U.S.

crude inventory rise reported at 1.643 million barrels last week signals a potential oversupply issue, which typically aligns with waning demand. However, the precarious situation in the Middle East complicates this narrative.

While inventories are growing, the prospect of falling demand could be overshadowed by supply disruptions stemming from regional conflicts, driving prices upwards. Investors are left to navigate these mixed signals, evaluating how geopolitical tensions might sway asset prices and inflation rates. IMF's Global Growth Forecast Further complicating the market outlook is the International Monetary Fund's (IMF) recent downgrade of its global growth forecast for the year ahead.

While the IMF noted that inflation remains under control, allowing for a more stable macroeconomic environment thus far, the organization also expressed concern over rising geopolitical risks. The potential for future wars and the rise of trade protectionism could further jeopardize economic expansion, leading to market volatility. The IMF’s assessment presents a dual-edged sword.

On one hand, inflation control is often seen as a positive. On the other hand, threats from political instability can stifle growth, leading to a cautious approach among investors. The findings reinforce that market participants should maintain a vigilant eye on international relations and their consequential impacts on domestic economies.

Fed's Monetary Policies and Rising Market Rates A pivotal factor influencing market behavior in the lead-up to the elections is the U.S. Federal Reserve’s recent "Big Cut" in September, which significantly reduced interest rates.

Typically, such cuts stimulate economic growth by lowering borrowing costs. Yet, paradoxically, market rates have continued to rise since then. This perplexing trend raises essential questions among investors: Why are rates increasing when the Fed implements cuts? Market participants often argue that rising rates in this context could reflect increasing confidence in economic recovery or inflation control, leading to higher expected investment returns.

Alternatively, it could signal concern over long-term growth potential amid a volatile environment marked by external conflicts and internal political divisions. The riddle surrounding the Fed's actions may also suggest a reevaluation of risk appetites, where investors are pricing in the potential economic fallout from the uncertain future. Alongside these primary factors, several other economic issues merit attention as the election season unfolds.

The labor market shows signs of resilience, yet it remains affected by inflationary pressures and potential alignment shifts across political dynamics. Retail sales have been fluctuating, and consumer confidence, which often waxes and wanes based on evolving notions of economic stability, has been fluctuating. Moreover, supply chain challenges, partially resulting from international unrest, continue to pose risks to U.

S. economic growth and inflation management. The ripple effects of these supply chain disruptions have delayed production timelines and contributed to price increases, impacting consumer behavior.

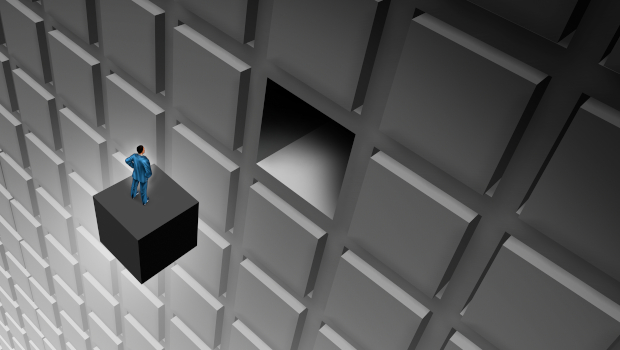

As traders and institutional investors focus on the elections, sentiment will be influenced heavily by political platforms and the outcomes of debates surrounding fiscal and monetary policies. Voter decisions could sway the national economic direction toward more progressive spending on infrastructure or a more conservative approach focused on fiscal restraint. Amidst Market Uncertainty In summary, the intersection of U.

S. elections, escalating external conflicts, and complex economic signals is creating a labyrinthine environment for market decision-making. Investors are tasked with sifting through various indicators, including geopolitical strife, commodity supply concerns, evolving monetary policies, and shifting consumer confidence.

The experts say maintaining a close watch on these developments will be crucial as Election Day approaches. The markets appear poised for potential volatility, and the outcomes may significantly shape the economic landscape heading into 2025. Finding opportunities amidst uncertainty will require an acute awareness of local and international dynamics and a nimble investment strategy to adapt to rapid changes.

As history has shown, elections can serve as pivotal inflection points for the markets, and this cycle is shaping up to be no different..