Quick Links Network WHAT IS HAPPENING WITH WORLD TRADE? Create a free account to read this article * President Donald Trump announced a slew of tariffs on US trading partners, ostensibly to correct a decades-long trade deficit after complaining America had been taken advantage of * Global markets went into freefall, with the S&P 500 dipping almost 20 per cent since its February high, as the risk of a US recession and higher inflation ratcheted up WHY DOES IT MATTER? * The tariffs will hit Australian exporters, including industries such as beef, steel and aluminium, but the broader slowdown in global growth and trade is expected to have a heavier impact on the domestic economy * Treasury forecasts Australian GDP growth to be 0.2 per cent lower in 2025 and inflation to be 0.1 per cent higher, although many economists predict the impact on growth to be heavier and the trade war to push inflation downwards * AMP chief economist Shane Oliver predicted unemployment would increase from 4.

1 per cent to about 4.5 per cent as a result of the economic slowdown * Australian equity markets have plummeted more than 10 per cent since their February peak, but rebounded two per cent on Tuesday * That technical correction has wiped hundreds of billions of dollars off company values and sent Australians' superannuation balances tumbling * The Australian dollar has fallen more than five per cent against the greenback since the tariffs were first announced - bad news for travellers but good news for exporters * Uncertainty has a chilling effect on business investment and household spending, with Australian consumer confidence already down six per cent in April, according to Westpac HOW DID WE GET HERE? * The world had been moving away from free trade since the US imposed tariffs on China and other nations in Mr Trump's first stint as president in 2018 * In his second term, Mr Trump first imposed tariffs on imports from China, Canada and Mexico before delaying imposts on its North American neighbours * Mr Trump announced 25 per cent tariffs on aluminium and steel, before identical-sized tariffs on auto imports * On April 2, US time - dubbed "Liberation Day" - came the big one: blanket 10 per cent tariffs on all countries, with higher taxes on imports from some countries, including China, the European Union and the tiny Australian external territory of Norfolk Island * China has announced tariffs of 34 per cent on the US in retaliation, heightening the risk of an escalating global trade war * Some sectors, such as critical minerals and pharmaceuticals were exempted, but more sector-specific tariffs have been promised down the track WHERE TO FROM HERE? * Mr Trump has promised additional 50 per cent tariffs on China on Wednesday, if China does not withdraw its retaliatory tariffs * In Australia, the Reserve Bank is predicted to bring forward rate cuts, with markets expecting a mega 50 basis point cut in May followed by a further 75 basis points by the start of 2026 * The falling Australian dollar should act as a shock absorber, shielding Australia from the worst impacts of the global economic turbulence * Australia is especially vulnerable to a downturn in the Chinese economy, given it is far and away Australia's biggest trading partner. Much of the extent of the economic fallout depends on how much stimulus the Chinese government announces in response to boost the nation's economy to its 5 per cent growth target this year * Beyond the economic implications, the tariffs have also given Prime Minister Anthony Albanese a boost in the polls during the federal election campaign against challenger Peter Dutton, who has suffered as a result of his perceived closeness politically to Donald Trump WHO STANDS TO WIN AND LOSE? * Mainstream economists agree free trade benefits all nations and the return to economic isolationism will wreak widespread damage * But Australian consumers could benefit from cheaper imports of goods diverted from Australia because of the tariff walls.

For example, Chinese auto manufacturers could flood Australia with cut-price cars initially destined for the US * Trade diversion isn't all good news, with the federal government promising to prevent dumping of goods in Australia that threaten to undercut local industries such as steel * Australia's main exporters to the US will be primarily hit by the direct impact of tariffs, including beef farmers, steel and aluminium smelters and vaccine manufacturers, if more sector-specific pharmaceutical imposts are imposed * Exporters to China also stand to lose big time, especially iron ore miners, with sales to be smashed by any deeper downturn in Chinese construction Australian Associated Press Get the latest Katoomba news in your inbox.

Politics

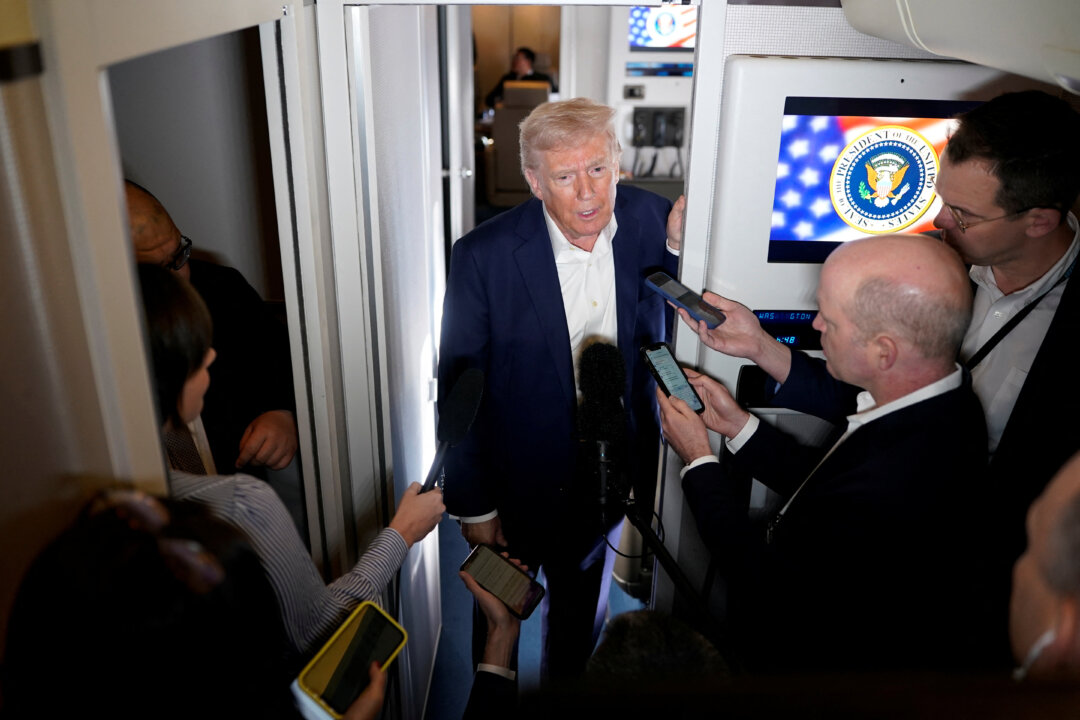

Tariff storm blows economy and election off course

Donald Trump's tariffs have sent markets tumbling, but unlike other downturns it's been self-inflicted. Why did the US president impose them and where to now?