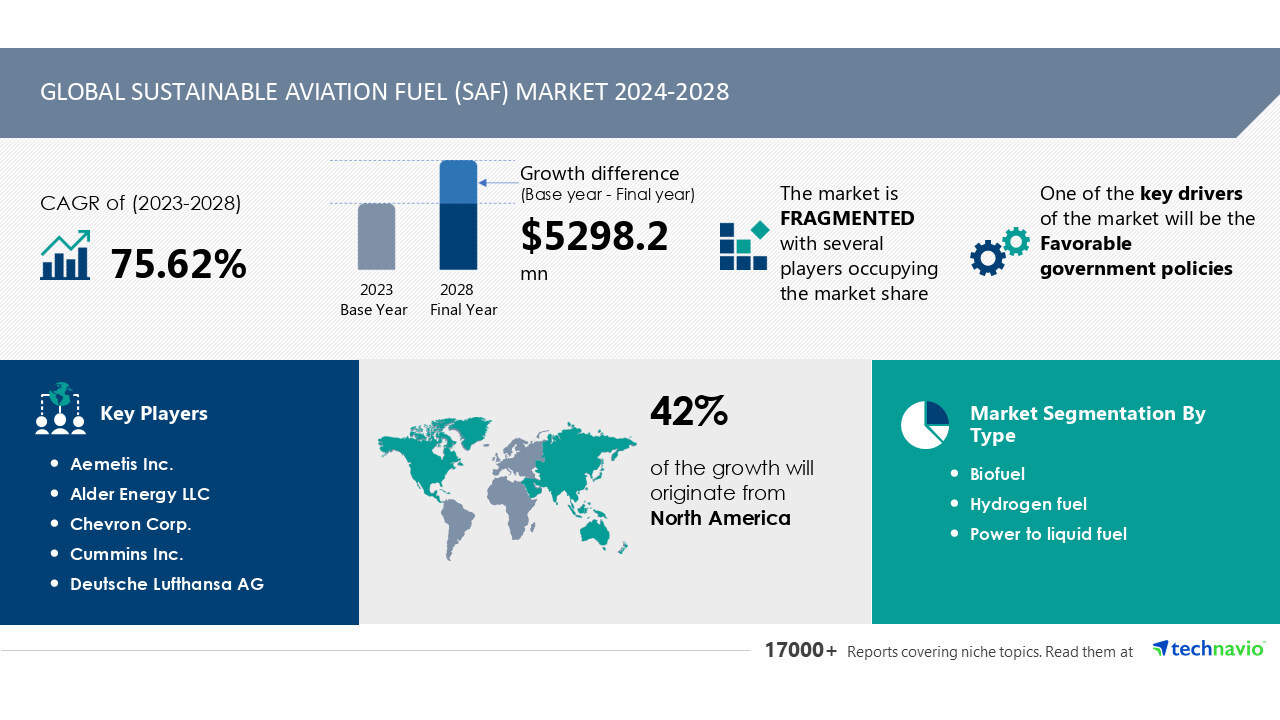

NEW YORK , Nov. 14, 2024 /PRNewswire/ -- Report on how AI is driving market transformation - The global sustainable aviation fuel (SAF) market size is estimated to grow by USD 5.3 billion from 2024-2028, according to Technavio.

The market is estimated to grow at a CAGR of about 75.62% during the forecast period. Favorable government policies is driving market growth, with a trend towards research on third-generation biofuels.

However, higher cost of production compared to conventional fuels poses a challenge.Key market players include Aemetis Inc., Alder Energy LLC, Chevron Corp.

, Cummins Inc., Deutsche Lufthansa AG, Eni SpA, Fulcrum BioEnergy Inc., Gevo Inc.

, LanzaTech Global Inc., Neste Corp., OMV Aktiengesellschaft, Pan Oleo Energy Ltd.

, Preem Holdings AB, Sasol Ltd., Shell plc, SkyNRG BV, SYNHELION SA, TotalEnergies SE, Velocys Plc, and World Energy LLC. Key insights into market evolution with AI-powered analysis.

Explore trends, segmentation, and growth drivers- View Free Sample PDF Market Driver The aviation industry is under pressure to reduce its carbon emissions and address climate change. Sustainable Aviation Fuel (SAF) is a promising solution, made from renewable feedstocks like plant-based materials and waste. SAF produces fewer greenhouse gas emissions during its lifecycle compared to traditional jet fuels.

Major players like Metafuels, Energy Impact Partners, Contrarian Ventures, and Biofuel are investing in SAF production. Hydrogen fuel cells and biofuels are among the potential SAF types. SAF's economic viability is a concern, but international climate goals push for wider adoption.

Airline companies are testing fuel blends, and some have already committed to using SAF. Infrastructure investments in Biofuels facilities, fuel terminals, pipelines, and airport fuel operations are crucial for SAF's widespread adoption. SAF production costs are high, but advancements in technological scalability and sustainability standards are making it economically competitive.

The aviation sector, including commercial, military, and unmanned aerial vehicles, is exploring SAF as a sustainable alternative to petroleum refinery-derived jet fuels. The Renewable Fuel Standard and the Blending limitations are key regulations driving the SAF market growth. Sustainable Aviation Fuel (SAF) is a second-generation biofuel derived from non-food feedstocks, such as wood waste, corn stover, jatropha, camelina, and switchgrass.

These sources differ from first-generation biofuels, which use vegetable oil, starch, and sugar. SAF production offers numerous advantages, including reduced carbon emissions and decreased reliance on fossil fuels. The biofuel industry has advanced with the introduction of third-generation biofuels, derived from algae.

Algae have the unique ability to produce a diverse range of high-quality biofuels, including biodiesel, butanol, gasoline, methane, ethanol, jet fuels, and vegetable oil. The use of algae as a feedstock for biofuels presents a promising solution for the aviation industry's sustainability goals. Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution! Market Challenges The aviation industry faces significant challenges from climate change and increasing carbon emissions.

Sustainable Aviation Fuel (SAF), also known as jet biofuel, is a promising solution. However, the economic viability of SAF remains a concern due to high production costs. The use of renewable feedstocks, such as plant-based materials and waste oils, to produce SAF reduces lifecycle carbon emissions.

Traditional jet fuels contribute to 2% of global greenhouse gas emissions from transport. International climate goals necessitate the adoption of SAF. Hydrogen fuel cells and Metafuels are potential alternatives.

Airline adoption of SAF is slow due to blending limitations and infrastructure investments. Companies like Energy Impact Partners, Contrarian Ventures, and Biofuel invest in SAF production. SAF production scalability is crucial for widespread adoption.

SAF must meet fuel quality standards and be compatible with existing fuel infrastructure. Collaboration between governments, airlines, and fuel producers is necessary for the economic competitiveness of SAF. SAF can reduce emissions from commercial aviation, military aviation, and unmanned aerial vehicles.

World Energy, Renewable Fuel Standard, and Petroleum refineries are involved in SAF production. Fuel terminals, pipelines, and airports require upgrades for SAF operations. The sustainable aviation fuel (SAF) market is in its early stages of development.

Current SAF production technology is less efficient than conventional fuel production methods, leading to higher costs. The acquisition of feedstock for SAF is also costly. Advanced biofuel feedstock processing poses challenges.

Commercial SAF production exists, but an efficient, sustainable, and economical processing technique is needed. SAF's high processing and operational costs make it a more expensive alternative to conventional fuels compared to electric vehicles, which offer a more economical and sustainable solution for transportation. Discover how AI is revolutionizing market trends- Get your access now! Segment Overview This sustainable aviation fuel (saf) market report extensively covers market segmentation by 1.

1 Biofuel 1.2 Hydrogen fuel 1.3 Power to liquid fuel 2.

1 Commercial aviation 2.2 Business and general aviation 2.3 Military aviation 2.

4 Unmanned aerial aviation 3.1 North America 3.2 APAC 3.

3 Europe 3.4 Middle East and Africa 3.5 South America 1.

1 Biofuel- The aviation industry's growing contribution to greenhouse gas emissions, driven by increasing air traffic and passenger numbers, has led regulatory bodies to intensify efforts to reduce emissions. For instance, the EU Emissions Trading System (ETS) includes carbon dioxide emissions from aircraft and airports since 2012, while the European Aviation Safety Agency (EASA) plans to grade aircraft based on carbon emissions and pollution. To meet stringent emission norms, manufacturers are collaborating to develop advanced solutions, such as biofuels, which are expected to gain traction in the global aviation industry.

The aviation biofuel market is anticipated to expand due to government initiatives like the US's commitment to reducing GHG emissions and the Commercial Aviation Alternative Fuels Initiative's (CAAFI) efforts to accelerate biofuel development. However, challenges such as feedstock availability, preparation time, and high cost hinder market growth. The recent decline in crude oil prices has further contracted the market, but increased government support and blending mandates are expected to fuel growth during the forecast period.

Despite these challenges, the demand for aviation biofuel is projected to rise due to its environmental advantages. However, the market's expansion is subject to various market challenges, primarily competition from conventional fossil fuels. Nevertheless, the predicted growth rates remain promising, with potential for significant expansion in the coming years.

Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics Research Analysis Sustainable Aviation Fuel (SAF), also known as biojet fuel, is a promising solution for reducing carbon emissions in the aviation industry. This alternative jet fuel is derived from renewable sources, such as waste vegetable oils, agricultural residues, or even algae. By using SAF instead of traditional jet fuels, air travel can significantly reduce its carbon footprint.

However, the economic viability of SAF production remains a challenge due to the higher production costs compared to conventional jet fuels. Hydrogen fuel cells are another potential option for zero-emission aviation, but they are still in the experimental stage. Both commercial and military aviation sectors are exploring the adoption of SAF to meet their emissions reduction targets in air transportation.

The aviation industry aims to reduce its carbon emissions by at least 50% by 2050 compared to 2005 levels. SAF is a crucial step towards achieving this goal. Market Research Overview Sustainable Aviation Fuel (SAF), also known as biojet fuel, is a promising solution for reducing carbon emissions in the aviation industry.

As climate change becomes an increasingly pressing issue, the need for more sustainable jet fuels is gaining urgency. Traditional jet fuels contribute significantly to greenhouse gas emissions in the transportation sector, making SAF an essential component in achieving international climate goals. SAF is produced from renewable feedstocks, such as plant-based oils, agricultural waste, and even waste cooking oil.

The use of these feedstocks results in lifecycle carbon emissions that are significantly lower than those of traditional jet fuels. SAF production is still in its infancy, with economic viability being a major challenge. However, advancements in technology and infrastructure investments are making SAF more economically competitive.

Hydrogen fuel cells and other alternative fuels, such as Metafuels and Biofuel, are also being explored as potential alternatives. Airline adoption of SAF is crucial for widespread use, with some major players already making commitments. The aviation industry, including commercial, military, and unmanned aerial vehicles, is exploring various fuel blends and sustainability standards to ensure the successful integration of SAF into their operations.

Infrastructure investments, including Biofuels facilities, fuel terminals, pipelines, and airport fuel operations, are necessary for the scalability and availability of SAF. Fuel quality standards and blending limitations in petroleum refineries must also be addressed to facilitate the widespread adoption of SAF. The Renewable Fuel Standard and similar initiatives are driving the development and implementation of SAF.

As the aviation industry continues to grow, it is essential that it transitions to more sustainable fuel sources to reduce its carbon footprint and meet international climate goals. Table of Contents: 1 Executive Summary 2 Market Landscape 3 Market Sizing 4 Historic Market Size 5 Five Forces Analysis 6 Market Segmentation Type Biofuel Hydrogen Fuel Power To Liquid Fuel Application Commercial Aviation Business And General Aviation Military Aviation Unmanned Aerial Aviation Geography North America APAC Europe Middle East And Africa South America 7 Customer Landscape 8 Geographic Landscape 9 Drivers, Challenges, and Trends 10 Company Landscape 11 Company Analysis 12 Appendix About Technavio Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts Technavio Research Jesse Maida Media & Marketing Executive US: +1 844 364 1100 UK: +44 203 893 3200 Email: [email protected] Website: www.technavio.com/ SOURCE Technavio.