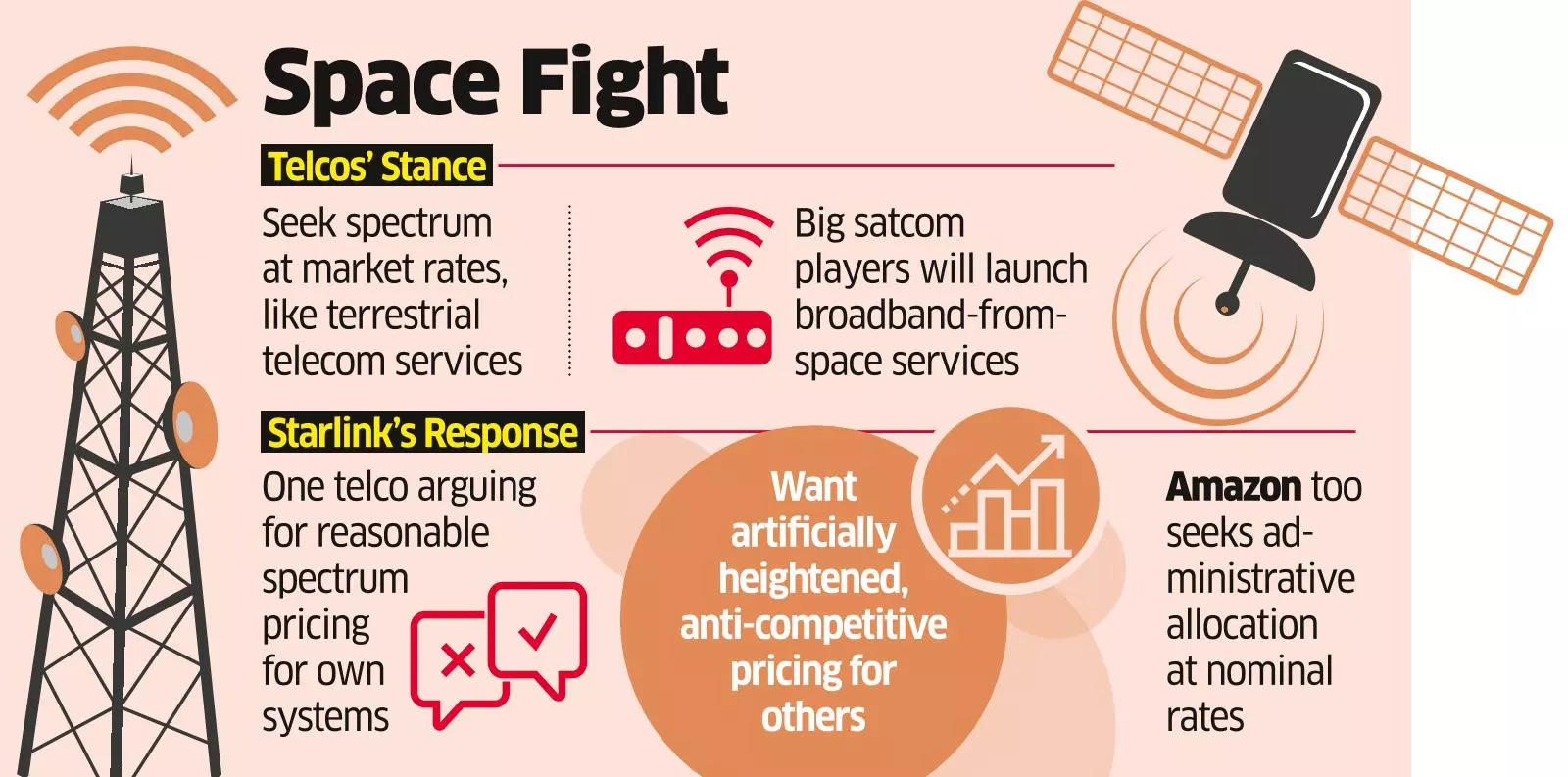

New Delhi: Elon Musk 's Starlink has hit back against Indian telecom operators ' demand that only auctioned satellite spectrum should be used to service urban or retail consumers, terming it "self-serving at the cost of underserved users". The US-based company has called out the telcos, particularly Bharti Airtel , for seeking reasonable spectrum pricing for their own satellite systems but artificially-high and anti-competitive rates for others. The telcos, however, have reiterated that spectrum should be given at market rates, the way spectrum for terrestrial telecom services is allocated, as big satcom players like Starlink and Amazon have a clear strategy to launch broadband-from-space services in urban areas and compete with India's operators.

Advt They have said that the narrative of connecting the underserved is a "fallacy" and is being used by global satcom players to seek relaxations in spectrum assignment methodology, pricing and related norms. These comments are part of the consultation process initiated by Telecom Regulatory Authority of India (Trai) on allocation of satellite spectrum and what should be the pricing and terms and conditions for it. Indian Space Association (ISpA), too, has called on Trai to check the big players from resorting to predatory pricing.

Further, smaller satellite players like Viasat have opposed Starlink and Amazon, regarding ITU (International Telecommunication Union) filings and its relevance to spectrum allocation. Without naming any company, Starlink, in its latest submissions to Trai, said India's operators do not attempt to provide any explanation of how their satellite systems use spectrum differently from next-generation systems that can serve users all across India. "Instead, they try to thread the difficult needle of arguing for reasonable spectrum pricing for their own satellite systems, but artificially heightened and anti-competitive pricing for others," Starlink said in its counter comments.

Bharti Airtel chairman Sunil Mittal had earlier called for auction of spectrum in case satcom firms offer services in urban areas, but has batted for administrative allocation, in case the services are restricted to remote areas. Advt Bharti Airtel and satcom company Eutelsat Oneweb, both backed by the Bharti group, telco Vodafone Idea and the Cellular Operators Association of India (COAI) had proposed a differentiated spectrum pricing strategy to ensure a level-playing field between satcom and terrestrial operators. As per the players, only for particular use cases, satcom spectrum should be given administratively, otherwise it should be priced at market rates.

Reliance Jio, though, has been asking for auction of the entire satcom spectrum. "These operators are attempting to reframe their limited capabilities as a conscious system design and business choice. However, it is difficult to see this as anything other than transparently self-serving at the cost of underserved users," Starlink said.

It said it doubts that any underserved user anywhere in India would prefer having to pay higher prices just so these satellite operators can serve their preferred "traditional and conventional" markets more cheaply instead. Airtel and Oneweb have not provided any counter comments on the issue, but both Jio and Vodafone Idea have reiterated that spectrum should be priced at market rates. On Starlink and Amazon's comments, Vodafone Idea said satcom players will be extending their broadband services to all areas, including urban and semi-urban areas, and will directly compete with terrestrial communication service providers.

"Therefore, no spectrum policy (including assignment methodology and pricing) should get influenced by the fallacy being pushed by satellite players for their commercial business interest," Vodafone Idea said. "It is important that Trai ensures a level playing field in between the various players providing competing and same services." Reliance Jio said that with substantial capacities, satcom players would be competing directly with terrestrial operators in both urban and rural markets.

Sharing some examples, Jio said the capacities generated by SpaceX's Starlink and Amazon's Kuiper constellations would be massive and would directly rival those of terrestrial operators and would also indeed exceed some of the terrestrial operators. "For instance, each Starlink V1 satellite has the capacity of 20 Gbps, followed by V2 mini having 80 Gbps capacity and the upcoming V2 would have 10 times the capacity of V1. The Kuiper satellites will also provide significant capacities, with each satellite expected to handle up to 1 terabit per second (Tbps) of traffic," Jio said.

By Kiran Rathee , ET Bureau Published On Nov 6, 2024 at 07:37 AM IST Telegram Facebook Copy Link Be the first one to comment. Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button. This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis.

Download ETTelecom App Get Realtime updates Save your favourite articles Scan to download App Starlink elon musk indian telecom operators Satellite Spectrum Pricing bharti airtel satcom Industry Starlink internet.