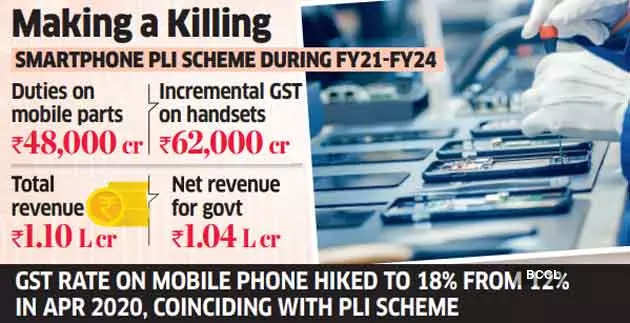

New Delhi: The smartphone production-linked incentive (PLI) scheme has turned into a revenue bonanza for the government, generating 19 times the value of its incentive disbursements under the scheme in the last four fiscal years. The industry contributed Rs 1.10 lakh crore to the government exchequer and produced goods worth Rs 12.

55 lakh crore between FY21 and FY24, during which the government disbursed Rs 5,800 crore in incentives, according to industry body India Cellular and Electronics Association ’s (ICEA) assessment of the PLI scheme . This implies that the government earned revenue of Rs 1,04,200 crore after the PLI disbursements, ICEA said in the report submitted to the finance ministry and the Ministry of Electronics and IT (MeitY) last week. Advt The industry paid duty of Rs 48,000 crore on mobile parts and components during the four years while another Rs 62,000 crore was generated from incremental goods and services tax (GST), it said.

The government had increased GST on mobile phones from 12% to 18% coinciding with the announcement of the PLI scheme in April 2020. Ten companies — five global and five local — were selected to receive sops under the smartphone PLI scheme with an overall financial outlay of Rs 40,951 crore, which was later reduced to Rs 38,601 crore. But the success of the scheme in terms of investments, production, exports and job creation has been driven mostly by Apple’s contract manufacturers Foxconn, the Tatas (Wistron) and Pegatron, followed by Korean major Samsung.

They have been meeting targets and getting incentives. Among the Indian companies, only Dixon Technologies has been meeting targets and getting sops. The scheme commenced from FY21 but was amended after most beneficiaries, barring Samsung, failed to meet the targets in the first year.

Its tenure was extended to six years, with the condition that companies can claim benefits for five years of their choice. The scheme ends in FY26 for every firm, barring Samsung, for which FY25 is the last year. The incentives will be cleared by FY27.

Among foreign manufacturers, Foxconn unit Rising Star (Bharat FIH) — a smartphone contract manufacturer for China’s Xiaomi — has failed to meet the targets since the scheme was rolled out. Advt Similarly, local companies such as Lava International, Optiemus Electronics, Padget (Micromax) and UTL Neolync have not managed to meet targets to get incentives. Overall, though, the PLI scheme has been a success in meeting all policy objectives and targets, ICEA said.

The scheme was aimed at expanding production. “We have exceeded all policy objectives — jobs, revenue, exports, FDI and value addition. We are hopeful that the upcoming budget will drive greater competitiveness, consistent with PM’s $500-billion production target by 2030,” said Pankaj Mohindroo, chairman of ICEA.

The mobile phone industry has generated nearly 300,000 direct jobs and 600,000 indirect jobs in the smartphone ecosystem following the launch of the scheme, it said. The industry has also become the largest employment generator and skilling source for women in mid-skilled, blue-collared jobs. Further, cumulative exports of smartphones during the PLI period of four years added up to Rs 2,87,000 crore.

This has propelled smartphone exports from its 23rd rank in FY19 to becoming the third-largest individual commodity at the end of the last fiscal. Smartphones are also India’s largest exported product to the US. ICEA has also informed the government that value addition for smartphones in India has risen from an average of 12% five years ago to nearly 20% now.

The increase in value addition in India is faster than China or Vietnam when they were at India’s stage of expansion in electronics manufacturing, according to the industry. By Kiran Rathee , ET Bureau Published On Nov 18, 2024 at 07:56 AM IST Telegram Facebook Copy Link Be the first one to comment. Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button.

This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis. Download ETTelecom App Get Realtime updates Save your favourite articles Scan to download App PLI scheme smartphone production-linked incentive scheme PLI scheme revenue generation India Cellular and Electronics Association smartphone manufacturing incentives GST on mobile phones Smartphone PLI revenue dixon technologies PLI for handsets.