Across the broader market, gainers outnumbered losers 297 to 214, with 1.3 billion securities worth $1.4 billion traded.

Ranamita Chakraborty SINGAPORE - Stocks in Singapore rose on Nov 19 as Asian indexes closed higher and lower US yields boosted emerging markets and commodities. The Straits Times Index (STI) rose 0.7 per cent or 25.

42 points to 3,757.97. Across the broader market, gainers outnumbered losers 297 to 214, with 1.

3 billion securities worth $1.4 billion traded. Key regional indexes also ended higher.

Japan’s Nikkei 225 ended 0.5 per cent higher, and South Korea’s Kospi Composite Index was up 0.1 per cent; Hong Kong’s Hang Seng Index closed 0.

4 per cent higher. On the STI, CapitaLand Ascendas Reit fell the most, losing 1.2 per cent or three cents to end at $2.

56. The top performer among the constituents was Seatrium, which gained 3.8 per cent or seven cents to finish at $1.

91. SPI Asset Management managing partner Stephen Innes said the Asian markets “bounced in tandem” with US and European futures as easing Treasury yields breathed new life into equities worldwide. He noted that the softening rates have amplified talk of a potential December Federal Reserve rate cut, fuelling cautious optimism among traders and offering a reprieve for risk assets.

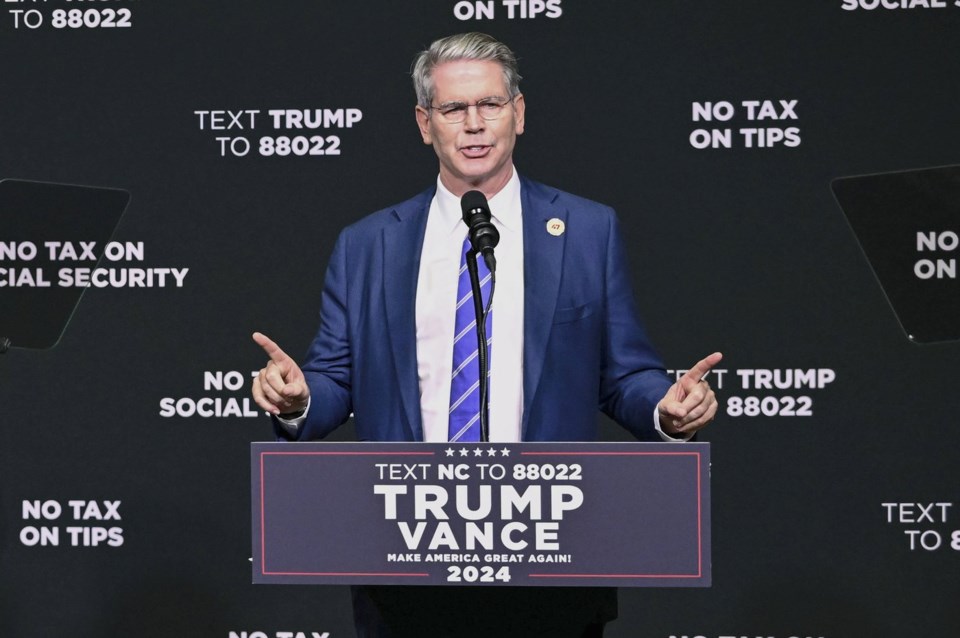

“Lower US yields and a potentially more dovish Fed outlook have also alleviated pressure on the dollar, creating a more favourable environment for emerging market assets and commodities to regain their footing,” he said. Mr Innes added: “However, these near-term tailwinds come with an undercurrent of uncertainty. The looming impact of President-elect Donald Trump’s fiscal policies casts a long inflationary shadow over the global economic landscape.

” He added that investors are currently deciphering how these bold potential fiscal moves will align with the ambitions of Trump’s newly unveiled Department of Government Efficiency (Doge), which is tasked with tackling inefficiencies in federal operations. Doge, under the leadership of billionaire Elon Musk and entrepreneur Vivek Ramaswamy, is drawing attention as a potential game-changer. Innes said the department’s success or failure is expected to profoundly influence market sentiment and policy trajectories well into 2025.

THE BUSINESS TIMES Join ST's Telegram channel and get the latest breaking news delivered to you. Read 3 articles and stand to win rewards Spin the wheel now.