Alberta’s taxpayers deserve ironclad protection against reckless spending — and that is why Premier Danielle Smith should be leading the country by bringing in a provincial fiscal constitution. For too long, politicians in Edmonton have passed laws designed to protect taxpayers, only to toss them aside when they become inconvenient. Consider lessons from our past.

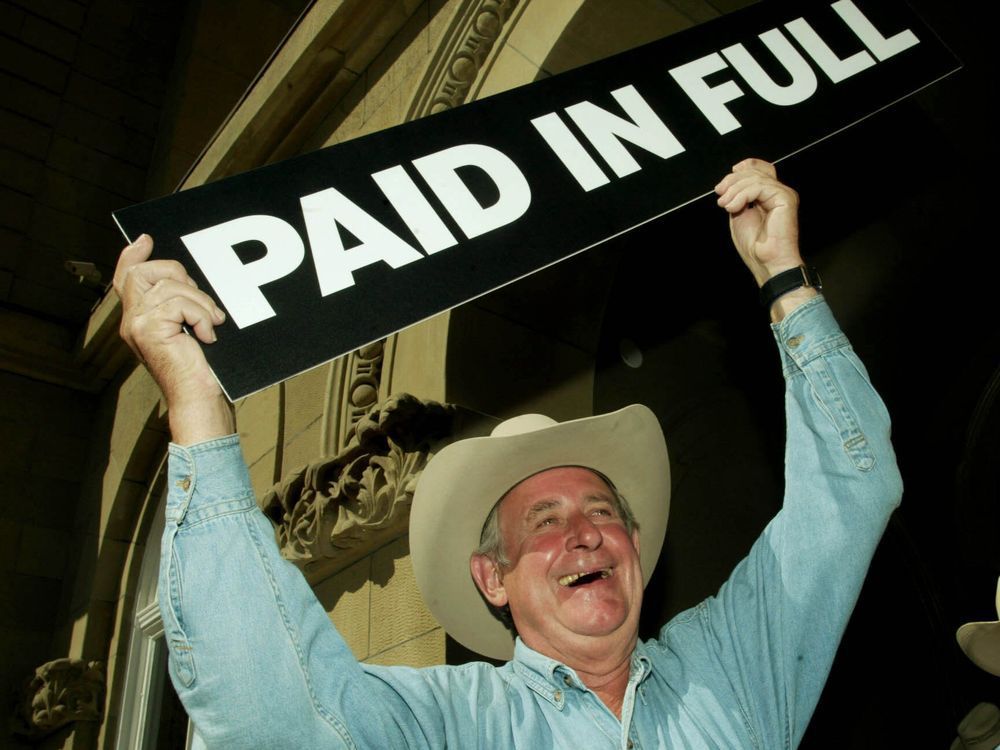

In 2005, Alberta became debt-free under former-premier Ralph Klein. At the time, Klein promised, “Never again will this government or the people of this province have to set aside another tax dollar on debt.” But in 2009, that promise evaporated when the government repealed the balanced budget law.

Alberta’s hard-won financial discipline was undone with a single vote. And, of course, this led Alberta back into a cycle of deficits and debt. Although Alberta has returned to balanced budgets in recent years and brought back some protections for taxpayers, these measures are still only as strong as the current government’s willingness to uphold them.

It is time to build something stronger. Alberta should adopt a fiscal constitution — a binding set of financial rules that can’t be repealed by a simple majority vote. Former Alberta finance minister and University of Calgary professor Ted Morton has championed this idea, suggesting Alberta needs a “made-in-Alberta constitution” to enshrine fiscal discipline.

Alberta is already at the forefront of standing up to Ottawa on issues of energy and firearms rights. So why stop there? Just as the province has defended its jurisdiction, it should repatriate the Alberta Act from Ottawa, as Morton suggests, and take full control of our fiscal future. Right now, Alberta’s foundational legal framework — the Alberta Act — is embedded in Canada’s federal constitution.

Originally passed by the Canadian Parliament in 1905 to establish the province, it sets out the province’s structure, powers and relationship with the federal government. However, because the Act is a federal statute, any amendments must be approved by the federal Parliament, meaning Alberta doesn’t have full control over it. Repatriating the Alberta Act would give Alberta the unilateral ability to amend its own foundational legislation without needing approval from Ottawa.

This would be like what Canada did in 1982 with the Constitution Act, when Canada repatriated its constitution from Great Britain. By bringing it home, Alberta would gain the authority to amend the Alberta Act and establish additional constitutional protections. Alberta could constitutionally lock in key elements of Alberta’s fiscal framework: balanced budgets, limits on government spending growth, and protections for the Heritage Fund to prevent political raids.

Instead of depending on politicians’ whims, we’d have a fiscal constitution to ensure Alberta’s finances remain stable, regardless of what government is in charge. This would also require that future changes to these protections receive supermajority approval or a public referendum, making it far harder for politicians to chip away at Alberta’s financial safeguards. Imagine the financial stability Alberta could enjoy today if these measures had been in place decades ago.

If Alberta had enacted constitutional protections previously, and enacted budget rules earlier, the province could have saved roughly $300 billion over the years. These are funds that could have gone toward building Alberta’s Heritage Fund and reducing the tax burden on Albertans. Instead of pouring money into interest payments, Alberta could have leveraged its wealth to create an unparalleled advantage for future generations.

Alberta stands at a crossroads. It can continue to rely on temporary laws, always vulnerable to the next political whim. Or the province can take a bold step to protect taxpayers permanently.

It’s a way of protecting the Taxpayer Protection Act. A fiscal constitution would make it clear Alberta’s financial health is non-negotiable and that reckless spending, unchecked deficits and casual tax hikes won’t be tolerated. It’s time for Alberta to seize control of its own future and enshrine fiscal responsibility in a way that can’t be undone.

This is the Alberta Advantage: A province that respects its taxpayers, prioritizes its financial health, and safeguards its prosperity for generations to come. Kris Sims is the CTF Alberta Director and Devin Drover is the CTF General Counsel..