The secondary bond market saw some volatility last week. This was driven by uncertainty surrounding the upcoming Presidential election, amidst pressure from Sri Lanka’s International Sovereign Bondholders to implement the Joint Working Framework for restructuring by mid-September, and the upcoming Rs. 290 billion Treasury bond auction – one of the largest in the country’s history – scheduled for this week.

Rates were observed increasing throughout the week, despite a brief recovery driven by renewed buying interest at elevated levels. The rebound proved to be a ‘dead cat bounce,’ as rates continued to climb, closing the week marginally higher. Market activity was sporadic, as trading saw sessions of heightened activity interspersed between prolonged lull periods.

Shorter duration bonds initially bucked the trend and saw yields decline as market participants were seen gravitating towards tenors of 2026 and below amidst the prevailing uncertainty. However, at the end of the week shorter tenors also saw two-way quotes increasing. For example, the 15.

12.26 maturity was seen increasing from an intraweek low of 10.85% to 11.

30%. The 2027 tenors (01.05.

27-15.12.27) were seen trading from intraweek lows of 12.

00% to highs of 12.38%, collectively. The 01.

07.28 and 15.12.

28 tenors were seen increasing 12.85% to 12.95% and 12.

90% to 13.05%, respectively. The 2029 tenors of 15.

06.29 and 15.09.

29 saw yields increase from 12.95% to 13.15% collectively.

Additionally, trades were seen on the medium tenor 15.05.30 and 01.

12.31 maturities at the rates of 13.15% to 13.

20% and 13.27% to 13.3750% respectively.

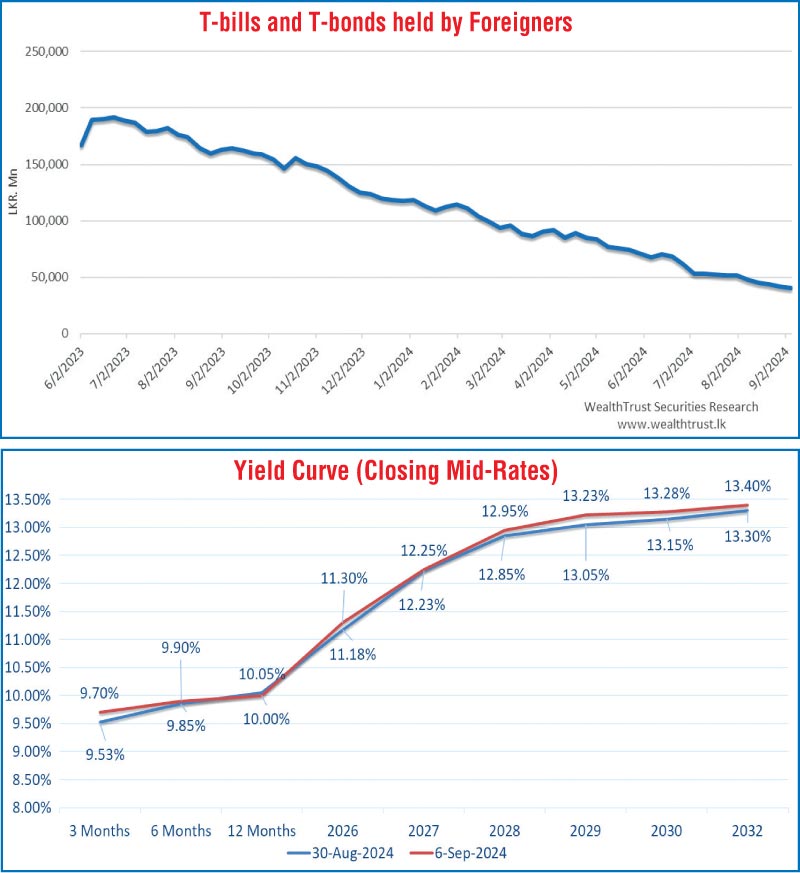

As a result, at the close of the week, the yield curve was observed shifting slightly upwards, showcasing significant resilience against the backdrop of considerable headwinds. Meanwhile, at the weekly Treasury bill auction conducted last Wednesday, weighted average yields on shorter-tenor securities rose for the fifth consecutive week. The 91-day yield increased by 12 basis points to 9.

61%, while the 182-day yield climbed 10 basis points to 9.94%. The 364-day yield edged up by 2 basis points to 10.

03%, marking its first increase in four weeks. The entire Rs. 152 billion on offer was raised in the first phase, with bids exceeding the offer by 1.

62 times. This week will see Rs. 180 billion on offer, incidentally making it one of the largest T-Bill auctions of the year.

This week the CBSL is also scheduled to conduct a round of Treasury bond auctions totalling a colossal Rs. 290 billion, on the 12 September (Thursday). The auction will be comprised of 3-year, 5-year and 10-year tenors.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 25.78 billion.

The foreign holding in rupee Treasuries continued to steadily decline, recording a net outflow for the eighth straight week, amounting to Rs 1.69 billion for the week ending 05 September 2024. As a result, the overall holding stood at Rs.

42.07 billion. In money markets, the total outstanding liquidity surplus decreased to Rs.

48.08 billion by the week ending 06 September as compared to a surplus of Rs. 71.

04 billion from the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auction at weighted average rates of 8.50% and 9.

08% respectively. The weighted average interest rate on call money and repo ranged between 8.50% to 8.

57% and 8.64% to 8.72% respectively.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was seen declining during the week ending 06 September to Rs. 2,535.62 billion as against the previous week’s level of Rs.

2,555.62 billion. Despite some volatility during the week, the USD/LKR rate closed at Rs.

298.80/298.90, subsequent to trading at a high of Rs.

298.35 and a low of Rs. 299.

50, appreciating in comparison to its previous week’s closing level of Rs. 299.20/299.

60. The daily USD/LKR average traded volume for the first four trading days of the week stood at a healthy US $ 62.99 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies).