The secondary bond market started off last week on a dull note, but quickly picked up momentum and saw rates decline steadily on the back of strong buying interest. In particular, the 2026-2028 duration saw notable demand, resulting in rates dropping considerably lower at the close of the week. This was supported by a considerable increase in total market liquidity.

Accordingly, the 01.02.26 maturity saw yields decline from an intraweek high of 10.

20% to a low of 10.10%. The 01.

05.27, 15.09.

27, and 15.12.27 maturities were seen trading down from 11.

50% to 11.15%, 11.52% to 11.

30%, and 11.50% to 11.35%, respectively.

The 15.02.28/15.

03.28, 01.07.

28, 15.10.28, and 15.

12.28 maturities saw trade at the rates of 11.765%-11.

58%, 11.86%-11.75, 11.

84%-11.75%, and 11.90%-11.

78%, respectively. In conclusion, at the close of the week the T-bond section of the yield curve was seen shifting downwards, mainly on the 2026-2028 tenors. This comes ahead of the upcoming Treasury bond auction due this Tuesday (12 November), which will have on offer Rs.

85 billion from a 01.05.2028 maturity bearing a coupon of 9.

00% and Rs. 47.50 billion from a 01.

10.2032 maturity bearing a coupon rate of 9.00%.

For context, the previous Rs. 32.50 billion Treasury bond auction, conducted on 28 October, recorded a bullish outcome.

A 15.10.28 maturity (bearing a 11.

00% coupon) was issued at a weighted average yield of 11.84%, with the entire Rs. 20 billion offered raised at the first phase of subscription.

In addition, a 01.06.33 maturity (bearing a 9.

00% coupon) was issued at a weighted average rate of 12.36%. However, the bond failed to raise the entire offered amount of Rs.

12.50 billion at the first phase, leading to the opening of the second phase. Subsequently, the maturity was fully subscribed across both phases.

In conclusion, the auction overall saw total bids received exceed the offered amount by 3.82 times and the entire Rs. 32.

50 billion successfully raised across both phases. In addition, Rs. 2 billion, being the maximum amount offered, was raised out of the total market subscription of Rs.

4 billion via the Direct Issuance Window on the 2028 tenor. Meanwhile, at the weekly Treasury bill auction conducted last Wednesday (6 November), weighted average rates were seen edging up on the shorter tenors for the second consecutive week. Accordingly, the weighted average rate on the 91-day tenor increased by two basis points to 9.

37%, while the 182-day tenor also rose by two basis points to 9.70%. However, the weighted average rate on the 364-day tenor remained unchanged at 9.

95%. The bulk or 86.35% of the funds raised were on the 91-day and 182-day maturities.

Total bids received exceeded the offered amount by 1.72 times, and the entire Rs. 175.

00 billion on offer was successfully raised at its first phase. An additional amount of Rs. 3.

10 billion was raised in the second phase. As a result, the T-bill section of the yield curve was seen creeping upwards. Due to this, the overall yield curve was seen flattening.

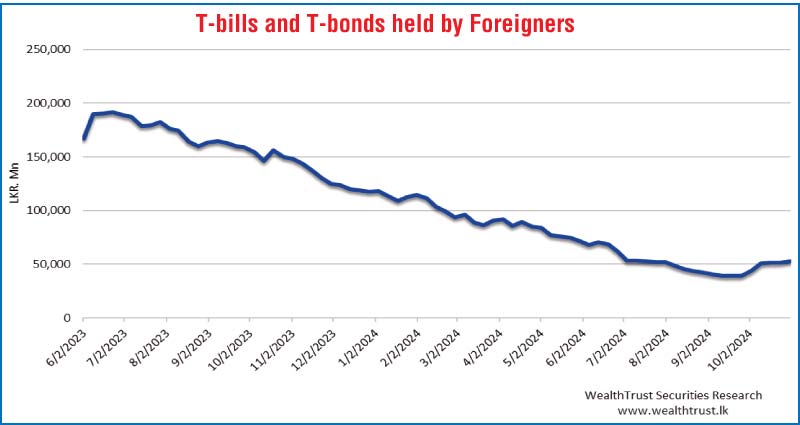

For the week ending 7 November 2024, foreign holdings in Rupee treasuries saw a net inflow of Rs. 1.90 billion.

This marked the eighth consecutive week of positive inflows. As a result, total foreign holdings reached Rs. 54.

81 billion. The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 35.

51 billion. In money markets, total outstanding liquidity increased sharply to Rs. 123.

37 billion by the end of the week ending 8 November, up from Rs. 80.05 billion recorded the previous week, reaching the highest level since mid-June this year.

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka (CBSL) injected liquidity during the week by way of overnight reverse repo auctions and a seven-day term reverse repo auction at weighted average rates of 8.47% to 8.65%, respectively.

The weighted average interest rate on call money and repo ranged between 8.55% to 8.57% and 8.

68% to 8.77%, respectively. The CBSL’s holding of Government Securities was registered at Rs.

2,515.62 billion as at 8 November 2024, unchanged from the previous week’s level. In the Forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs.

292.50/292.65 as against its previous week’s closing level of Rs.

292.95/293.05, and subsequent to trading at a high of Rs.

292.55 and a low of Rs. 293.

20. The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 65.17 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies).