Retail and distribution profit growth coupled with supply chain stability will be among the first casualties of President Trump’s tariffs, with several CE and appliance brands currently struggling to work out where their future lies with most CE and appliance Companies unable to plan ahead due to uncertainty in the market. According to McKinsey Chief Financial Officer Yuval Atsmon “There’s a real likelihood that we’re going to see a lot of short-term tremors for company profits and supply chains, and I think in the short-term it’s mostly headwinds,” he said in an interview at McKinsey’s World Trade Centre office in New York. Companies who have been hardest hit are consumer electronics manufacturers with Netgear down 17.

2%, Sonos 18.76%, Logitech 20.39%, Dell 19.

76% while appliance Companies appear to have not been hit as hard with Haier down only 6.63%, Delonghi 12.67%, V-VUG 7.

74% Arcelik the owner of Beko and Hitachi down 6.42%, Electrolux 11.11%, Shark Ninja 14.

45%, while local appliance manufacturer Breville was among the hardest hit appliance Companies falling 15.09%. Atsmon claims that “The one clear thing is that this is impacting people’s ability to plan ahead is uncertainty” of how consumers and retailers are going to be affected.

During an interview with the WSJ, he said “There has been a tailwind over the last couple of months, from people trying to build up inventory where they’ve expected tariffs. Now, first of all, they’re not going to need anything for a while, and then they’re going to play “wait-and-see” what happens. He claimed that people understood that the tariffs were coming and that the issue became more serious when the first statements were made about Canada and Mexico, and then followed by an announcement that there will be tariffs on Europe.

In the smartphone market Apple shares are down 13.2% while Samsung shares are only down 5.71% with analysts confident that Samsung could gain share from the roll out of tariffs.

Both Samsung Electronics and Apple face sweeping tariffs of over 40% however Samsung is seen as the Company that could gain a comparative advantage over its US archrival Apple who was facing problems even before tariffs were introduced by Trump. Observers believe that Samsung who manufacture in Vietnam and India face relatively lower tariffs than China — where Apple produces the majority of its products. Currently, Samsung produces over 100 million smartphones annually — more than 50 percent of its total output — at its factories in Bac Ninh and Thai Nguyen, Vietnam, which are subject to a 43 percent tariff under Trump’s measures.

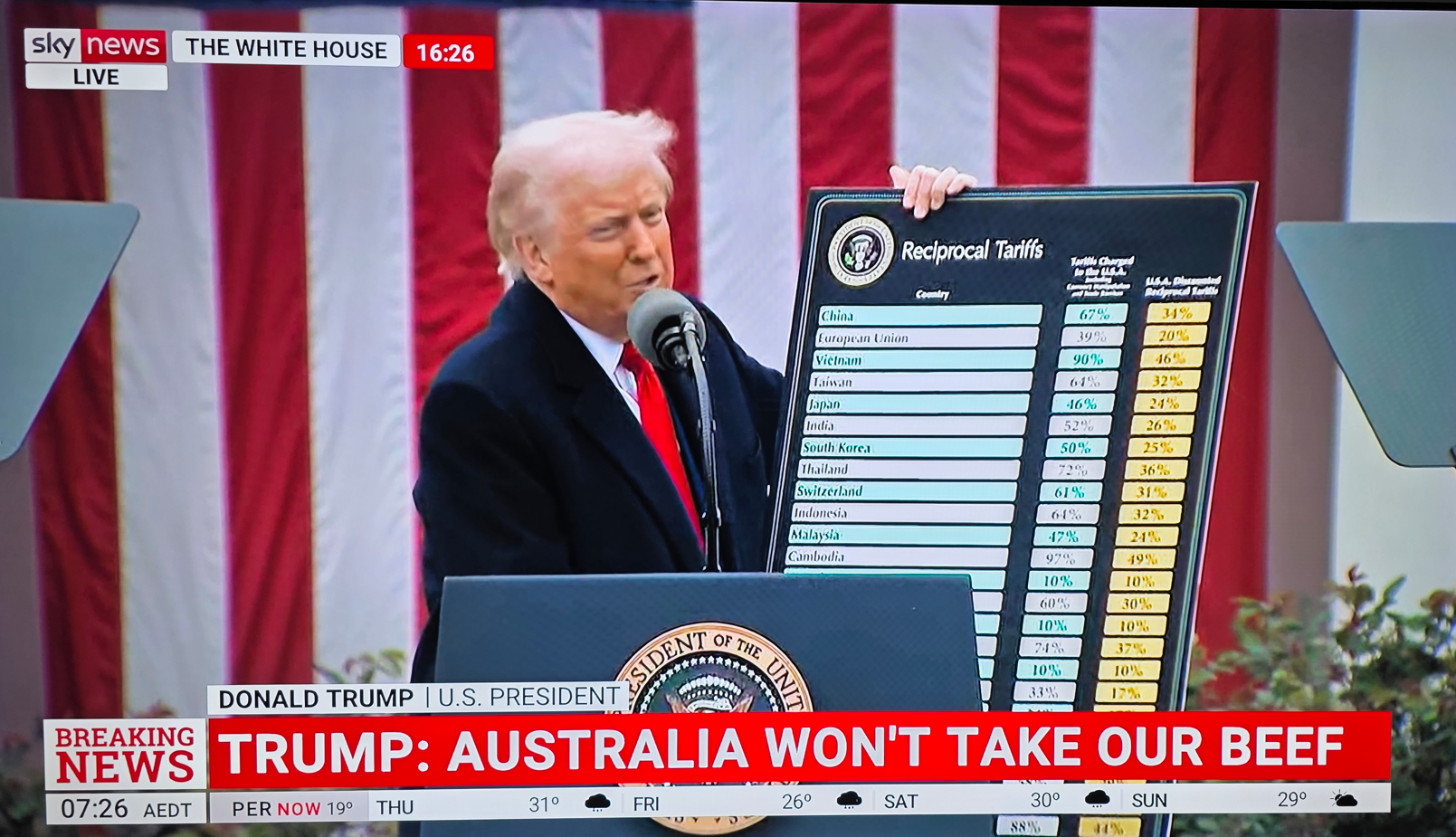

About 30 percent of Samsung’s smartphones are made in India, which faces a 26 percent tariff. Apple, in contrast, manufactures roughly 90 percent of its iPhones in China, which faces a 54 percent effective tariff — combining Trump’s new 34 percent “reciprocal” tariff and the existing 20 percent tariff. The issue for Australian retailers is whether brands will lift the cost of goods to balance out lost profits due to tariffs in markets such as the USA.

Should Apple choose to pass the additional costs on to consumers, analysts predict that the price of the iPhone 16 series could rise by 30% to 40% in the USA with the US phone maker edging against these rises by lifting the price of goods in markets such as Australia. According to projections by Rosenblatt Securities, the high-end iPhone 16 Pro Max model, featuring a 6.9-inch display and 1 terabyte of storage, could be priced at nearly A3,829 in the US — an increase of 43%.

For Samsung, which ships most of its US-bound smartphones from its Vietnamese factories, experts suggest shifting production to countries with lower tariff burdens, such as Brazil and South Korea. Trump’s latest social media post that tariffs against Vietnam could be reduced which could benefit Samsung . On his Truth Social platform Trump wrote, “Just had a very productive call with To Lam, General Secretary of the Communist Party of Vietnam, who told me that Vietnam wants to cut their tariffs down to ZERO if they are able to make an agreement with the US.

” During the past month both Apple and Samsung have been stock piling goods in the USA especially their popular Galaxy S25 Series. The big problem could be their new foldable Galaxy Z Fold and Galaxy Z Flip models which are due to be released shortly. On Friday, US Federal Reserve chair Jay Powell warned that the tariffs being set by Trump risked delivering both higher inflation and slower growth to the world’s largest economy, revealing concern at the US central bank.

China’s move to retaliate against the latest round of US tariffs with its own levies on American goods further raised fears about the fallout. At a local level JB Hi Fi shares fell 2.14% Harvey Norman 3.

78% over the past five days while Wesfarmers who own Bunnings, Officeworks, Kmart and Target rose 0.6%, also up was Big W owner Woolworths whose shares rose 5.20%.

As for the impact on the US economy Former Obama economic advisor and now president and CEO of the Federal Reserve Bank of Chicago Austan Goolsbee told Fox News before the White House tariff announcement “If you had a one-time tariff that increased the costs and stopped increasing them, and there is no retaliation, I think it would be, in theory, a transitory increase in inflation,” he said, adding that “Tariffs could be transitory, as opposed to inflation.” Consumers have a fear that the tariffs mean the economy is headed back to the overheated inflation rates of 2021 and 2022. However, Goolsbee stated that imports are only about 11% of the economy.

“So, tariffs on just a small sliver of the economy might not have a material impact in the macro sense,” he asserted. “And in 2018, we had tariffs. Inflation didn’t go up.

”.

Technology

Samsung Tipped To Be Potential Winner As Tariff Uncertainity Rattle CE & Appliance Brands

Retail and distribution profit growth coupled with supply chain stability will be among the first casualties of President Trump’s tariffs, with several CE and appliance brands currently struggling to work out where their future lies with most CE and appliance Companies unable to plan ahead due to uncertainty in the market. According to McKinsey Chief... Read More