Overview of the Recent Transaction On September 18, 2024, ( , ) made a significant addition to its investment portfolio by acquiring 4,130,000 shares of Codexis Inc. ( ), a prominent player in the enzyme optimization sector. This transaction not only increased the firm's total holdings in Codexis to 7,585,000 shares but also elevated its portfolio position to 5.

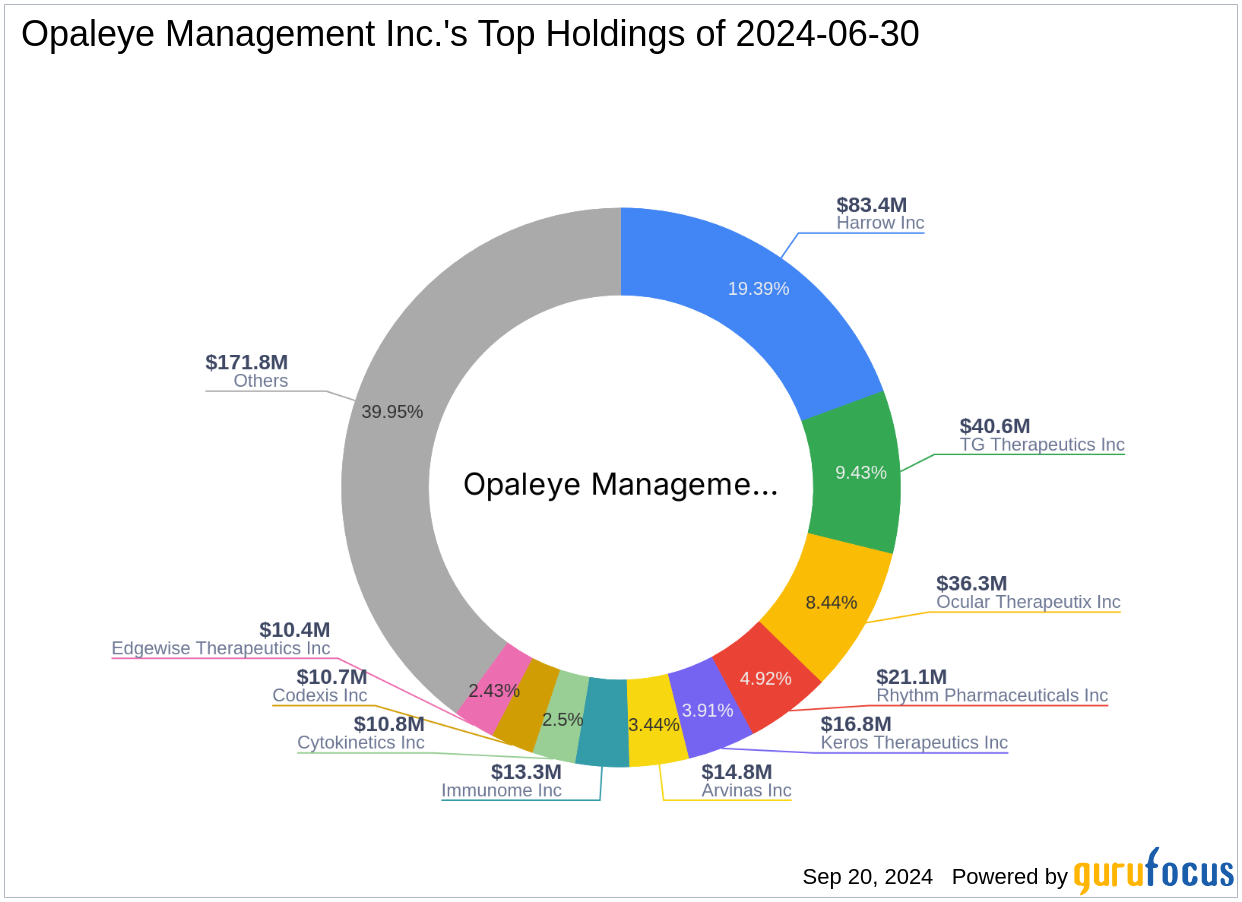

41%, reflecting a substantial commitment to this biotechnology entity. Insight into ( , ) Based in Cambridge, MA, ( , ) is a focused investment firm with a keen interest in the healthcare sector, particularly biotechnology and pharmaceuticals. The firm manages an equity portfolio valued at approximately $430 million, with top holdings that include Harrow Inc ( ) and Ocular Therapeutix Inc ( ).

Opaleye's investment strategy emphasizes identifying companies with potential for significant scientific advancements and market impact. Detailed Analysis of the Trade The recent acquisition was executed at a price of $3.16 per share, marking a strategic enhancement of Opaleye's position in Codexis.

Post-transaction, the firm now commands a 10.69% stake in the biotech company, underscoring a robust confidence in its future prospects. This move has a notable impact of 2.

95% on the firm's portfolio, indicating a significant bet on Codexis's market performance and technological offerings. Introduction to Codexis Inc. Codexis Inc.

, headquartered in the USA, specializes in the development of advanced biocatalysts through its proprietary CodeEvolver technology. The company serves a diverse range of industries, including pharmaceuticals and biotechnology, focusing on enzyme optimization and protein commercialization. With a market capitalization of $227.

677 million, Codexis continues to expand its influence across various global markets, including the United States, Ireland, and China. Financial and Market Analysis of Codexis Inc. Currently, Codexis's stock is trading at $3.

21, slightly above its GF Value of $2.69, categorizing it as modestly overvalued. The company's market performance has been underwhelming with a year-to-date stock price increase of only 2.

88%, and a significant decline of 75.31% since its IPO. Despite these challenges, Codexis maintains a GF Score of 61/100, indicating potential for future performance improvements.

Strategic Implications of the Trade The decision by ( , ) to increase its stake in Codexis might be driven by the firm's confidence in Codexis's innovative enzyme technologies and its potential to secure lucrative partnerships and licensing deals. This move could be seen as a strategic play to leverage Codexis's capabilities in enhancing pharmaceutical manufacturing processes and drug development, sectors that are core to Opaleye's investment philosophy. Conclusion This transaction between ( , ) and Codexis Inc.

highlights a significant endorsement of the biotech company's future potential. Investors and market watchers will undoubtedly keep a close eye on Codexis's operational advancements and market performance, as these factors will play crucial roles in determining the success of Opaleye's investment strategy. The ongoing developments could provide valuable insights into the biotechnology sector's dynamics and investment opportunities.

This article first appeared on ..