Mumbai: A wave of new entrants is seeking a foothold in India’s Rs 55,000-crore telecom tower industry by offering competitive pricing through innovative solutions ranging from cost-efficient small cell deployments to energy-efficient designs, challenging large incumbents despite high entry barriers. Backed by public and private capital, companies like SAR Televentures , Suyog Telematics and Signotox Towers have erected a few thousand towers in deeper geographies for accelerated 5G rollouts and densification of high-quality coverage. And they are hoping to leverage the expected expansion of Vodafone Idea and state-run Bharat Sanchar Nigam Ltd.

( BSNL ) for future growth. Advt “The entry of new startups in the tower segment is a welcome shift that promises to invigorate competition, drive innovation, and support India’s ambitious digital infrastructure goals,” said Manoj Kumar Singh, director general of industry body Digital Infrastructure Providers Association (DIPA). But they are up against two of the world’s largest tower companies – Indus Towers and Brookfield-backed Data Infrastructure Trust.

In addition, they face challenges around erecting new towers in densely populated metros, right of way (RoW) issues and high associated costs, industry insiders said. Still, investors are betting on long-term prospects of the new entrants. SAR Televentures recently concluded a successful equity fundraise of Rs 450 crore from the likes of BoFA Securities, Intuitive Alpha Investment Fund and Negen Undiscovered Value Fund.

It aims to erect 1,000 new towers to add tenancies from Vi, the country’s third largest telco, and state-owned BSNL. Its stock has surged 215% since listing on the NSE last November. Its shares closed at Rs 320, down 0.

93% from the previous close, on Thursday. The markets were closed on Friday. Suyog Telematics has been on upswing since it announced a 15-year mega deal with BSNL in May this year to roll out telecom sites pan-India, including in the coveted Mumbai and Delhi circles.

Its shares touched an all-time high of Rs 1,913 on the BSE on November 8. They closed at Rs1,742 on Thursday, up 2.02% from a day earlier.

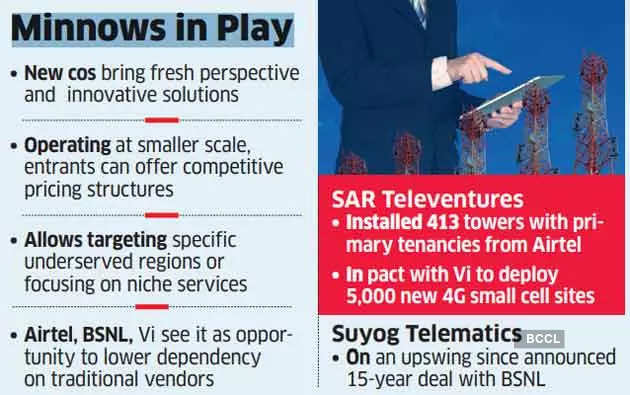

Advt “New players bring fresh perspectives and innovative solutions, from cost-efficient small cell deployments to energy-efficient designs, that can help bridge infrastructure gaps, especially in underserved and rural areas,” Singh of DIPA said. “By operating at a smaller scale, these companies can offer competitive pricing structures, targeting specific underserved regions or focusing on niche services such as small cell deployment on urban structures like streetlights and bus shelters,” he said. Industry executives familiar with the matter said telcos like Bharti Airtel, BSNL and Vi view this as an opportunity to diversify dependency from traditional vendors and expand networks in strategic locations, at a lower cost.

Partnering with larger players come at a higher cost and, sometimes, with slower timelines due to their large-scale operations. Airtel, Vi and BSNL did not respond to emails seeking comment till press time Sunday. The new ventures have only a 1-2% market share so far.

Out of about 800,000 telecom towers in India – the second largest in the world after China – some 250,000 are run by Indus Towers , majority owned by the country’s second-largest telco Airtel, and 275,000 by Brookfield-backed Altius Telecom Infrastructure Trust (formerly Data Infrastructure Trust), which counts telecom market leader Reliance Jio as its largest tenant. Other major tower companies are GTL Infrastructure with 26,000 towers and Ascend Telecom with around 18,600 towers. SAR Televentures has installed 413 towers with primary tenancies from Bharti Airtel.

It recently signed a pact with Vi to deploy 5,000 new 4G small cell sites. The company plans to invest Rs 42.5 crore for erecting 1,000 new towers with an aim to add tenancies from Vi and BSNL as both network providers are undergoing major network expansions.

Its recently concluded fundraise included a rights issue of Rs 300 crore and a public offer of Rs 150 crore. SAR Televentures managing director Rahul Sahdev said micro sites are a relatively greenfield opportunity in India as large tower companies such as Indus Towers and Altius deploy macro sites for coverage up to 10 kilometres. “Small cells are a low-investment business which gives coverage up to nine metres and starts giving return on investment within 24 months even with single tenancy,” he said.

The range of small cells, which are about the size of a pizza box, can be anywhere between up to nine metres to up to a few kilometres. Suyog Telematics is an IP-1 licence holder, which has erected 4,300 telecom towers and over 5,100 tenancies. IP-1 licence allows businesses to operate passive telecom infrastructure assets like dark fibre, ducts, towers and right of way.

“We started as an EPC (engineering, procurement and construction) contractor to BSNL in 1995,” said Shivshankar Lature, managing director of Suyog Telematics. “Under the BSNL order, we are aiming to roll out 2,000 tenancies and adding Rs 50 crore additional revenue for upcoming two fiscals.” But Balaji Subramanian, vice president at equity research firm IIFL Securities, said three-four large tower infrastructure providers are enough to service a telecom market like India with four telcos.

“Erecting new towers in densely populated metros, with RoW (right of way) challenges and high associated costs would be extremely difficult for newer players,” he said. Still, the smaller players could strategically target niche areas to densify infrastructure within 70-80 meters of existing towers, Subramanian said. “The larger worry is whether financially unstable telecom operators will be able to clear pending dues to tower companies and think of new deployments,” he said.

By Himanshi Lohchab , ET Bureau Published On Nov 18, 2024 at 07:51 AM IST Telegram Facebook Copy Link Be the first one to comment. Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button. This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis.

Download ETTelecom App Get Realtime updates Save your favourite articles Scan to download App BSNL indus towers suyog telematics telecom tower industry 5G rollout Vodafone Idea Indus Towers telecom infrastructure gtl infrastructure digital infrastructure providers association SAR Televentures Suyog Telematics telecom news.