Sri Lanka’s country rating was upgraded from ‘Restricted Default’ to ‘CCC’ following the successful exchange for the new International Sovereign Bonds (SL ISBs) during December 2024. The three types of exciting new sovereign bonds have restored foreign investor confidence. The Central Bank of Sri Lanka (CBSL) has performed a remarkable role in guiding the economy out of default status and restored economic stability, and gained Sri Lanka a non-default country rating of ‘CCC’.

Among the key achievements of the CBSL are the reduction of treasury interest rates under 9% and the stabilisation of currency while rebuilding foreign reserves to $ 6 billion. Sri Lanka offers four Macro Linked Bonds (MLBs) linked to GDP growth, a Governance Linked Bond (GLB), and a short-term Fixed Coupon Bond for unpaid Past Due Interest (PDI). The MLBs offer variable returns depending on Sri Lanka’s GDP growth from 2024 to 2027, (e.

g. haircuts can vary between 16% and 39%). The GLB interest can vary depending on meeting 15.

3% and 15.4% of total revenue/GDP thresholds in 2026 and 2027, respectively. The PDI bond offers a fixed coupon of 4% until 2028 and trades at around $ 94.

This combination of unique, variable returns offers global investors an exciting opportunity to capitalise on Sri Lanka’s economic revival and US interest rate movements. Sri Lanka’s economic resurgence in 2024 was promising, with a 5% GDP growth rate. With improving investor confidence, SL ISB daily turnover now exceeds $ 10 million.

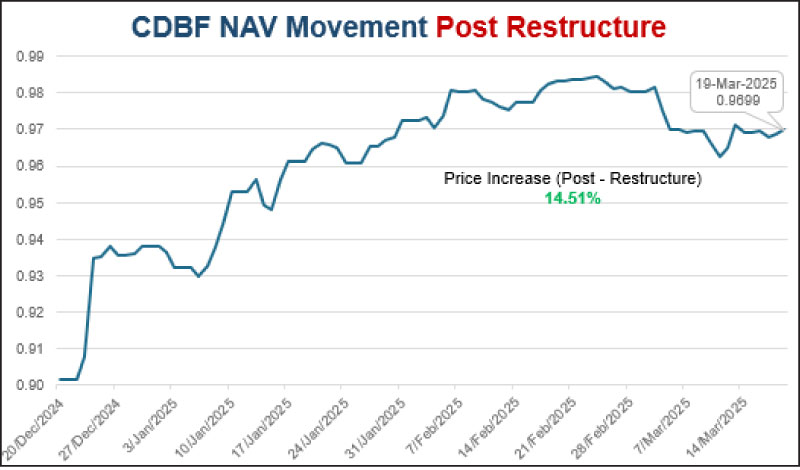

The Ceylon Dollar Bond Fund (CDBF) is the only USD sovereign bond fund that is exclusively invested in SL ISBs, with Deutsche Bank acting as the trustee and custodian bank. The Fund reported returns of 53% in 2023 and 39% in 2024. Foreign investors are invited to enter the CDBF while Sri Lanka is rated at ‘CCC’ and consider realising their investment upon Sri Lanka reaching a country rating of ‘B-.

’ Other advantages of the CDBF are the ability to withdraw anytime and being tax exempted. Ceylon Asset Management (CAM), the Fund manager, has commenced an advertising campaign to promote the CDBF to the Sri Lankan diaspora, South Asian, Middle Eastern, and Australian investors. CAM is an associate company of Sri Lanka Insurance Corporation (SLIC) and is licenced under the Securities and Exchange Commission of Sri Lanka Act, No.

19 of 2021. Meanwhile, the Ceylon Financial Sector Fund managed by CAM emerged as the top-performing rupee fund in Sri Lanka during 2024, with a return of 64%. Past performance is not an indicator of future performance.

Investors are advised to read and understand the contents of the KIID on www.ceylonam.com before investing.

Among others, investors shall consider the fees and charges involved..