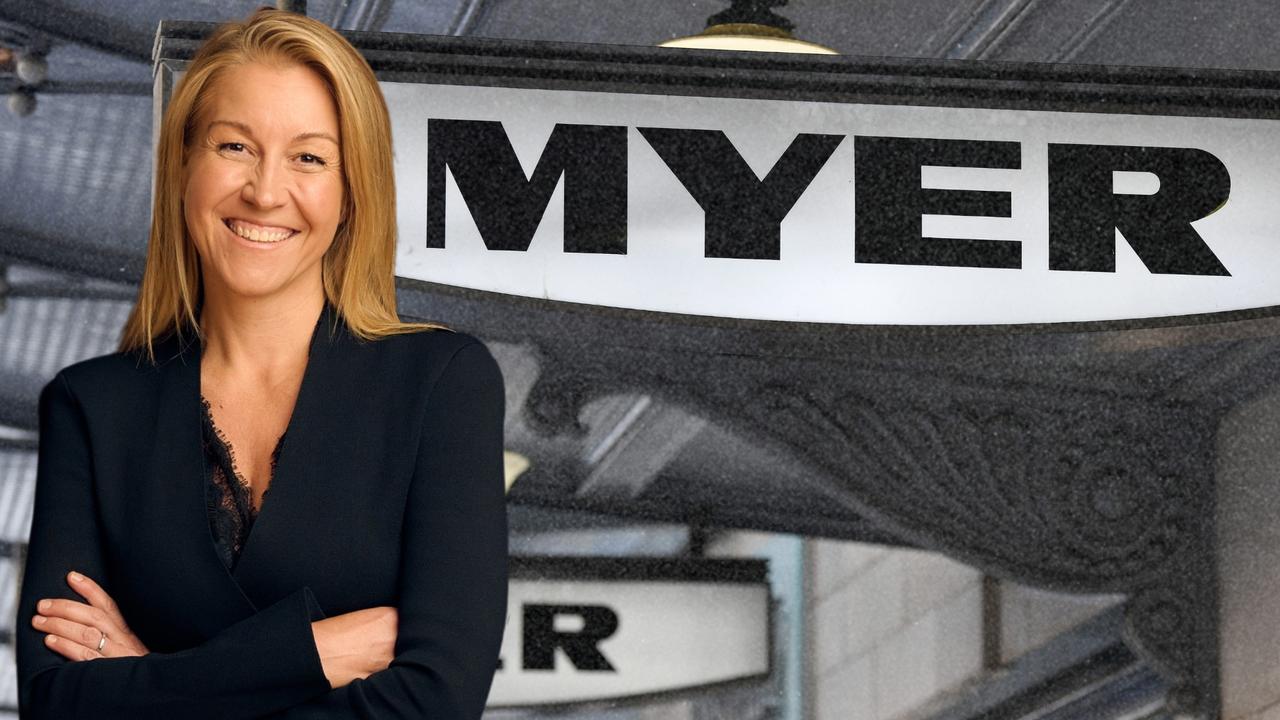

Myer Holdings shares fell by more than 10 per cent on Friday as the company revealed a staggering 28 per cent slide in full-year net profit. The Olivia Wirth-led Myer’s posted a net profit of $43.5 million, and a 26 per cent fall in profit before restructuring and impairments to $52.

6 million for the 12 months to July 27. Statutory net profit after tax of $43.5 million includes $9.

1 million ($12.2 million pre-tax) of a range of impairments and restructuring costs including impairments to its sass & bide, Marcs and David Lawrence brands. Sales for the full-year were down 2.

9 per cent to $3.226 billion. The retailer said comparable sales for fiscal 2024 were up 0.

4 per cent while online sales of $704.3 million were up 2 per cent. Underlying profit margins fell 12 basis points, while operating gross profit fell 2.

5 per cent to $1.194 billion. Myer declared a final dividend of 0.

5c per share, down from 1c, payable on November 21. “Today’s result reflects the challenging macroeconomic environment for Australian retailers,” said Wirth. “Despite the tougher trading conditions, work undertaken by the Myer team in recent years has helped stabilise the business and established a foundation for future growth.

With a highly engaged customer base, a leading loyalty program, positive comparable department store sales growth and high levels of trust in the Myer brand, there are significant opportunities for growth.” Myer was reported to have appointed Boston Consulting Group to conduct a company-wide review of the department store. BCG was tasked with reimagining the department store model and identifying where Myer needs to be positioned in the next five to seven years.

Alongside the latest earnings, Wirth revealed a new roadmap for the brand’s return to growth called ‘Myer Tomorrow’. It includes stronger cost controls, cracking down on in-store theft, better use of promotions and unlocking the full potential of its Myer One loyalty scheme. Myer One currently has 10.

4 million members and grew by 706,000 in fiscal 2024, with more than 50 per cent aged under 35. Wirth’s digital strategy will focus on using data to personalise offers to Myer shoppers and improve its e-commerce platforms. To improve profit, Myer is now expected to be more disciplined on costs, and make its supply chain more efficient too.

Wirth is also overseeing due diligence on buying a range of fashion and apparel brands from Solomon Lew’s Premier Investments, which would see Myer buy brands like Portmans, Just Jeans and Dotti and take on more than 700 stores. In June, the combination of Myer with Premier’s Apparel Brands business was proposed via an all-scrip merger – in effect, Myer would acquire Premier’s Apparel Brands business in exchange for the issue of new shares in Myer to Premier. The deal, effectively a reverse takeover of Myer, would mean that Lew remains Myer’s largest shareholder and be offered a seat on the board.

.