Thiruvananthapuram: In a major administrative move, the state govt has decided to convert 566 tribal forest settlements into revenue villages by invoking a long-ignored provision of the Forest Rights Act . The decision brings recognition to these settlements, but there is no clarity on what rights the affected families will gain. In its Feb 2025 order (accessed by TOI), the revenue department cites Section 3(1)(h) of the Act, which recognises the right of settlement and conversion of all forest villages, old habitations, un-surveyed villages and other forest-dwelling settlements—whether included in govt records or not—into revenue villages.

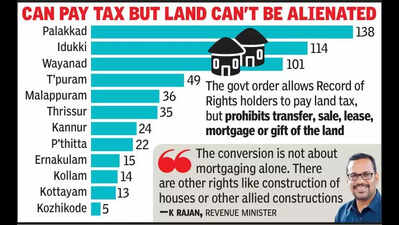

The move is based on a report submitted by the land revenue commissioner that identified these villages/habitations across the state, and 29,139 tribal families are granted Record of Rights (RoR) under the Act. These families occupy 38,581.509 acres of forest land, while the highest number of conversions are in Palakkad (138 villages), followed by Idukki (114) and Wayanad (101).

No such villages are identified for conversion in Alappuzha and Kasaragod. Once a forest village is converted into a revenue village, RoR holders are permitted to pay land tax under the Kerala Land Tax Act, 1961. However, the order says Section 4(4) of the Forest Rights Act — which prohibits transfer, sale, lease, mortgage or gift of the land — still applies.

It means the land can only be inherited, not alienated. This brings up a question as to what exactly the families are paying the land tax for. "You're giving an impression of ownership without providing actual rights.

It's a neat political win, but the functional benefits to tribals are limited," a senior forest department official said. Revenue minister K Rajan defended the move, saying the benefits go beyond just banking or land ownership. "The conversion of forest villages to revenue villages is not just about mortgaging the land.

There are other revenue rights like the construction of houses or other allied constructions like sheds, etc. When it is forest land, there are limitations—forest department's consent is required for everything. It can even revoke the RoR.

There is no bar in approaching banks for mortgage, but they may not entertain it as the land cannot be alienated or ownership taken under any circumstances," he told TOI. The govt has also issued a list of conditions to be followed for the conversion. The RoR details of the converted land must be entered in a supplementary Basic Tax Register (BTR) and can be incorporated into the main BTR only during the state's digital resurvey.

The converted plots will be assigned survey and thandaper numbers, but they must carry the prefix ‘FR' (Forest Rights) to differentiate them from regular revenue land. It has been alleged that the forest department—the primary stakeholder in forest land—had not been consulted before the order was issued. Sources said the revenue department had only sought its remarks after finalising and dispatching the order to district collectors.

Despite repeated attempts, the official dealing with the subject chose not to respond. The minister, meanwhile, said: "We have consulted the forest department though they need not be consulted." The Union ministry of tribal affairs had issued detailed guidelines for such conversions as early as Nov 8, 2013, and the state's decision came 12 years later.

.