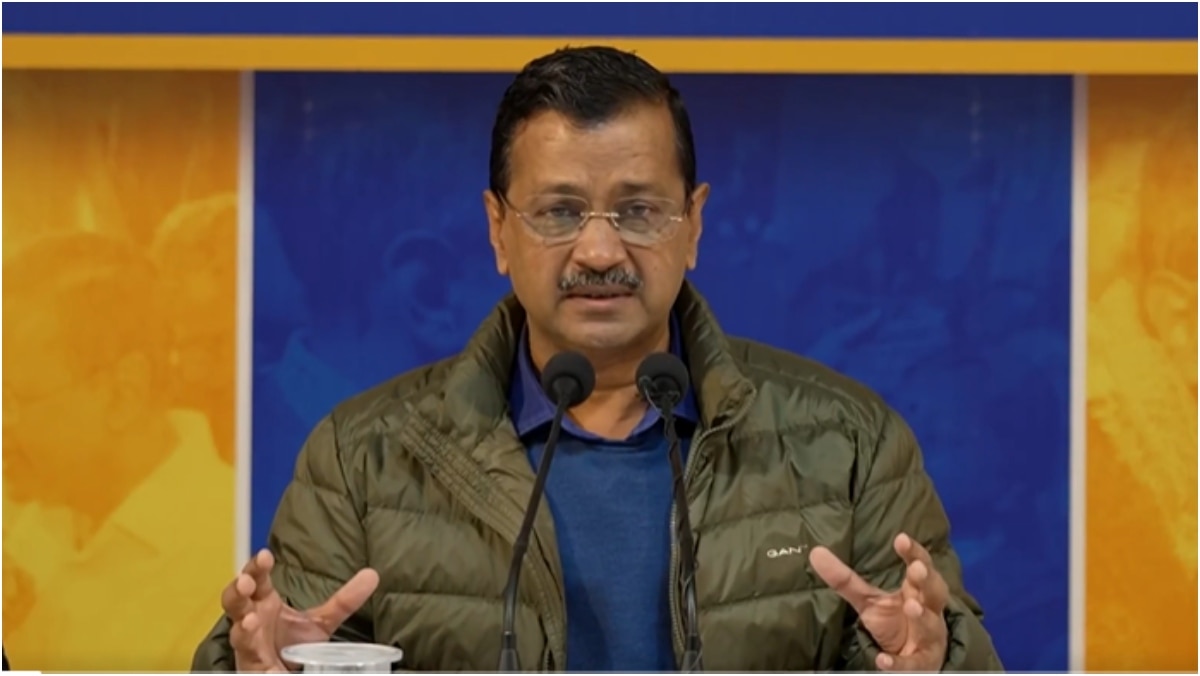

Soon after Union Finance Minister Nirmala Sitharaman announced on Saturday that the tax slabs will be increased in the next financial year, benefiting the middle class, the Aam Aadmi Party sought to claim credit for the same. The party said that the Budget reflected AAP convener and former Delhi Chief Minister Arvind Kejriwal's demands. Kejriwal on January 22 had sought the raising of the tax slab to Rs 10 lakh for the salaried class.

And on Saturday, February 1, Sitharaman announced that up to Rs 12 lakh would be tax-free. Raising the tax slab was among Kejriwal's seven demands in the party's "middle-class manifesto". The party in an X post said: "Kejriwal fought for the middle class.

The central government must also accept Kejriwal's other 6 demands for the middle class." Arvind Kejriwal reacted to the Income Tax slab announcement saying: "A large part of the country's treasury is spent on waiving off the loans of a few rich billionaires. I had demanded that the loans of any billionaire should not be waived henceforth.

With the money saved from this, middle-class home and vehicle loans, and loans of farmers should be waived." He also said that Income Tax and GST rates should be halved, but these were not done. What Were Kejriwal's Seven Demands For Middle Class? The Aam Aadmi Party went back to its core voter base — the middle class — on January 22 with the nation's first "middle-class manifesto".

However, more than any specific promises, it only highlighted what the AAP government had done in the past few years and put forth the party's demands for the Union Budget. Here are the demands that Arvind Kejriwal placed before the Centre before the Budget. Education Budget must be increased from 2% to 10% of the GDP and private school fees are capped.

Subsidies and scholarships are granted for higher education. Health Budget must be increased to 10% of the GDP and health insurance must be freed from taxes Income Tax exemption slab mustbe increased from Rs 7 lakh to 10 lakh. Essential commodities must be made GST-free.

Senior citizens must get the benefits of strong pension and retirement plans. Railway concessions for senior citizens must be reintroduced..