The debt troubles of Gensol Engineering Ltd, whose loans were downgraded to default by two rating agencies this week, are more pronounced than initially thought. has learnt that Ahmedabad-based solar plant construction company has delayed repayments to one of its largest lenders, the (Ireda), by up to two months. A spokesperson for state-run Ireda said the delay has been up to 30 days in some accounts, while in others, it's up to 60 days from the due date.

That contradicts Gensol’s claims on the severity of the delay. On 4 March, a spokesperson for the company said it would like to clarify that “this was a one-time disruption, resulting in a minor delay in debt repayment, which has since been promptly settled". The Ireda spokesperson, however, clarified that loans to Gensol have not turned non-performing.

“As on date, there is no proposal for restructuring the dues." A Gensol spokesperson said on Thursday, “We have already addressed the concerns related to downgrade and minor which occurred due to short-term liquidity mismatch and is now improving by way of customer payments." The company denies any involvement in falsification claims and would be setting up a committee to comprehensively review the matter, the spokesperson said.

Debt defaults Gensol’s financial crunch surfaced in public on 3 March, when Care Ratings Ltd downgraded its 716 crore bank loan to default, citing delays in “servicing of term loan obligations". The following day, Icra Ltd downgraded the loans to default, stating the company "apparently falsified" information about its debt servicing. The company's share price tanked 20% on Wednesday, followed by another 10% drop on Thursday.

The stock has plunged 37% since last Friday (28 February). According to Icra, as of 22 November, some of Gensol's prominent creditors include Power Finance Corp. Ltd, with loans of 334.

8 crore; HDFC Bank Ltd ( 26.4 crore); Tata Motors Finance Ltd ( 18.3 crore); and Axis Bank Ltd ( 15 crore).

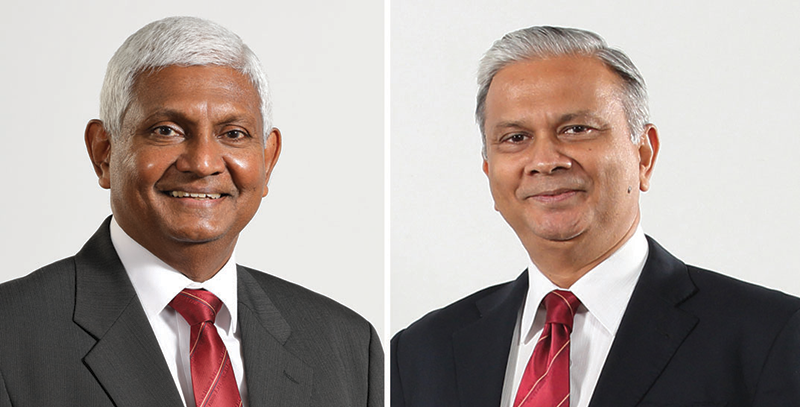

But Anmol Singh Jaggi, chairman and managing director, had not just borrowed from these large financial institutions. As of December quarter, he had pledged 81.70% of his 62.

6% ownership in Gensol. In February, Jaggi turned to over a dozen financial companies and stock broking firms to pledge more shares. By the end of the month, show exchange filings, the stock offered as collateral against loans jumped to 85.

5%, A falling share price could lead some of these creditors to either take control of the shares or sell them in case Jaggi is not able to provide adequate security for the money he has borrowed. On Tuesday, the same day Care Ratings released the report, Badjate Stock Broking Pvt Ltd, a Nagpur-based stockbroking company, took control of 0.37% of Jaggi's shares.

Anuj Badjate, the managing director of the firm, declined to comment. “We would like to state that all the share pledged data has been filed and uploaded on the exchanges," said the Gensol spokesperson cited earlier. How it came to this Jaggi started Gensol in 2012 as a strategic advisory firm.

By 2017, he started a solar engineering and procurement business. In 2019, months before he took the company public, he started an electric-can hailing business under BluSmart Mobility. When Gensol listed in October 2019, its stock opened at 21 a share.

Investors were hardly excited for the next two years as the shares remained under 25. Things started changing in January 2022, the year he announced plans to manufacture electric vehicles in Chakan, Pune. Shares jumped from 30 apiece to over 350 by the end of the year.

By March 2024, the stock had peaked at 1,200 a share. During this rally, Jaggi started to borrow more money by pledging shares. The promoter pledge jumped to 85.

5% as of February from 27% as of June 2022. could not independently ascertain where this money was being deployed. But investors have started raising questions.

“[T]he execution has been really below the expectations. In the last 12 months, the share price has almost halved. Every time in last 2 quarters, if I remember correctly, results come out, and the stock falls another 10% to 15% immediately after the result," an individual investor, Kapil Banga, said the post-earnings interaction on 13 February.

“So that's the execution without a good order book (although) presence across renewable energy, battery energy storage, solar, EVs...

I'm a small investor, earning a salary and investing here. The return so far has been really underwhelming." Jaggi said the company has zero control over falling share prices and attributed the decline to .

“It is beyond our scope. What we know is how to build solar power plants, what we know is how to build EV cars, and we continue to focus on that," said Jaggi, who was quizzed about high debt ( 1,250 crore) by three other investors. Surviving on hope Gensol says it has signed a non-binding agreement to sell the US-based solar tracking subsidiary Scorpius Trackers to an unnamed American company for 350 crore.

The management said the transaction should be completed by the end of March 2026. "Gensol bought Scorpius Trackers for about 140 crore last year. Trying to sell part of the business for twice the enterprise value will be great if they can do it," said an investor who claims to have been approached at least three times in the last six months by the management of Blu-Smart mobility to invest in the company.

Gensol is also discussing selling 2,997 electric vehicles worth 315 crore to Refex Green Mobility, a Chennai-based firm. The company told investors last month that it remains hopeful that the deal will be completed by the first quarter of the next fiscal at the latest. Till then, Jaggi's plans to get his company out of this financial crunch rests more on hope.

.