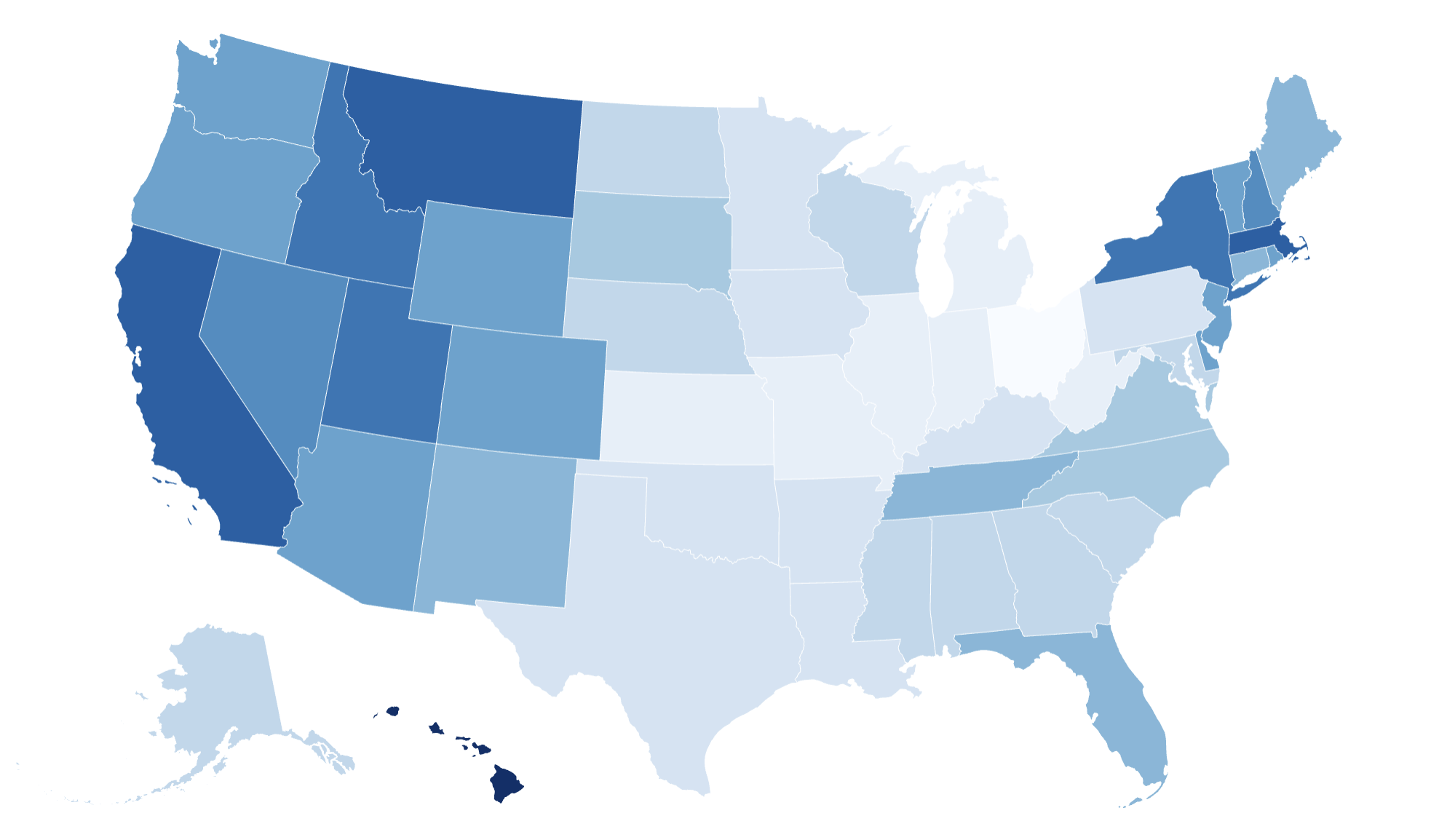

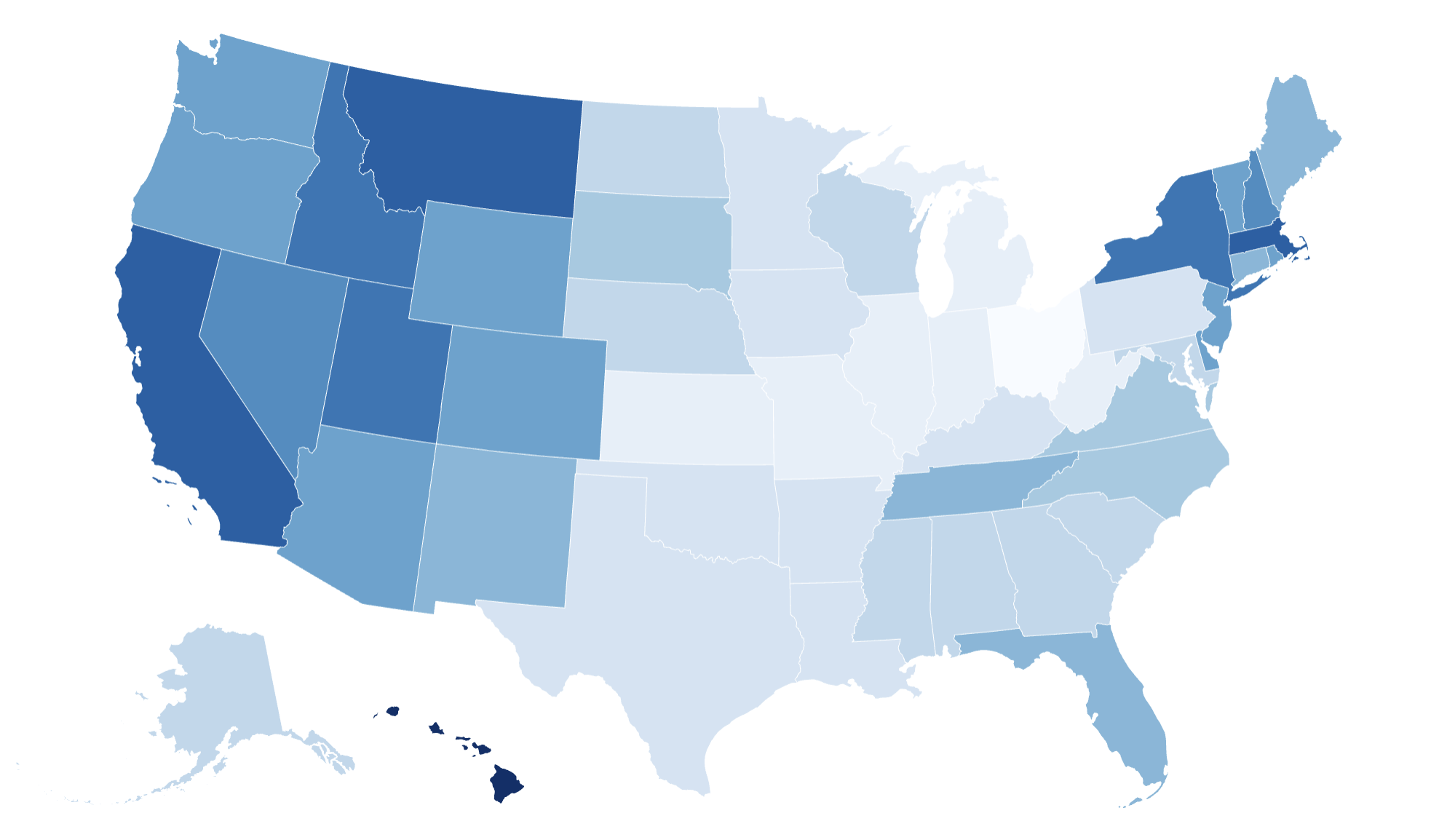

American homeowners need to work an average of 10 days per month just to be able to cover their mortgage payment, according to a new study by Realtor.com. The number of workdays required varies wildly from state to state: in one of the country's most sought-after places to live, Hawaii, it goes up to 17—a whole week more.

Meanwhile, in the Midwest and Southeast, many homeowners work about seven or six days a month to afford their mortgage payments. Why It Matters Skyrocketing home prices, historically low inventory, and stubbornly high mortgage rates are squeezing aspiring homebuyers out of the market and weighing heavily on those who managed to step on the property ladder in recent years. The typical U.

S. homebuyer's monthly housing payment reached an all-time high of $2,807 during the four weeks ending March 23 , according to Redfin data, exacerbating the struggles faced by Americans trying to navigate a difficult housing market. What to Know The states where homeowners need to work the highest number of days to be able to cover their monthly mortgage payments are Hawaii (17), California (15), Massachusetts (15) and Montana (15.

) The states with the lowest number of required workdays were Kansas (7), Missouri (7), Indiana (7), Illinois (7), West Virginia (7), Michigan (7), and Ohio (6). The number of workdays required to afford a home depends on several factors, according to Charlie Lankston, executive editor at Realtor.com.

"First, home prices have risen faster than incomes, widening the gap between earnings and housing costs. Second, elevated mortgage rates have increased borrowing costs, further stretching monthly budgets," he said in a statement. "As a result, prospective buyers must allocate more of their income, and consequently, more work days each month, to afford mortgage payments.

" According to Hannah Jones, senior economic research analyst at Realtor.com, "the most expensive states see the highest housing payments because of the high cost to finance a high-priced home purchase." She told Newsweek : "Homebuyers in states where home prices are disproportionately high relative to income levels see the biggest burden from housing costs.

" The median state price of a home in Hawaii, according to Realtor.com, is $796,947, the highest in the country. Because prices are so high, homeowners in the state need to spend more than half a month's worth of work in covering the average payment of $5,222, including tax and insurance.

Low housing payments, on the other hand, are due to relatively low home prices. "States where home prices are quite low relative to income levels enjoy a relatively low housing-cost burden," Jones said. West Virginia and Ohio, for example, have the lowest median home list price in the country, at $247,000 and $259,450.

Will Mortgage Rates Come Down This Year? Mortgage rates are expected to ease slightly this year, Jones said, "but there is risk to the forecast due to widespread economic uncertainty." Cooling inflation is widely expected to continue to bring down mortgage rates. However, "some of the current administration's proposals are inflationary in nature, which could bring inflation and as a result, interest rates, higher once again," Jones said.

"No one is sure how or if proposed policies, such as widespread tariffs, will be enacted, which makes the mortgage rate path hard to predict." Several experts have expressed concern that Donald Trump 's tariffs on the U.S.

trade partners could drive up the price of everyday goods for American consumers and hurt their confidence. Data released last Friday showed that consumer sentiment dropped to 57 pts in March, its lowest level since 2022. Could A Recession Bring Them Down? An economic downturn this year could bring both good and bad news for homebuyers and homeowners.

Mortgage rates typically fall during a recession, Jones said, as investors lean on bonds for reliable returns versus bigger, riskier investments. "More demand for bonds lowers their return, and mortgage rates mirror the 10-year treasury yield, so mortgage interest rates would move lower in tandem with longer-term bond yields," she explained. "Additionally, the Fed [Federal Reserve] has historically dropped interest rates during recessions in pursuit of low inflation and full employment," Jones added.

"Though the drop in Fed rates most directly impacts short-term yields, the impact moves throughout the bond market and can lower longer-term yields as well." At the same time, not many want to buy a home during a recession, especially if their jobs are at stake. Susan Wachter, professor of real estate at The Wharton School of the University of Pennsylvania, previously told Newsweek that a recession may initially reduce housing demand due to job insecurity, but lower mortgage rates can later encourage buying.

Historically, declines in interest rates and home prices have helped housing markets lead economic recoveries..

Top

How Much You Need To Work To Afford Mortgage Payments in Each State

Homeowners in Hawaii need to work the highest number of days per month to afford their mortgage payments.