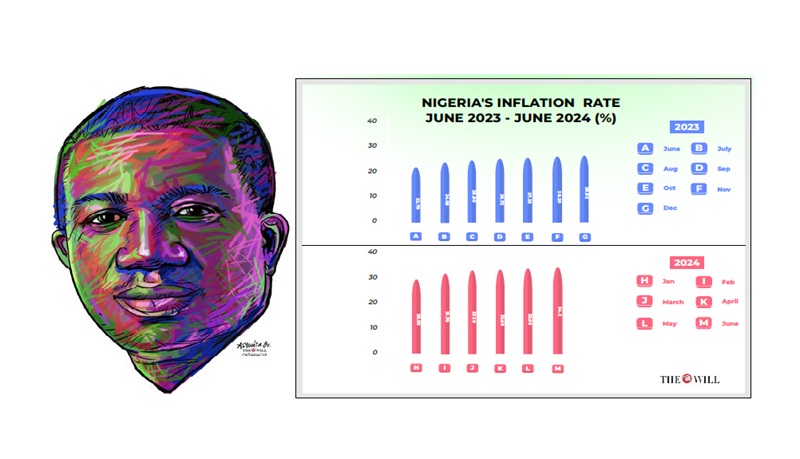

September 08, (THEWILL) – The recent increase in the pump price of Premium Motor Spirit (PMS), generally known as petrol, will worsen the prevailing energy crisis and spark severe challenges in the economy, with micro, small and medium enterprises (MSMEs) the worst affected. The Nigerian National Petroleum Company (NNPC) Limited, on September 3, 2024, announced a 45 percent basic increase on the price of PMS from N617 per litre to N897 per litre. Although this is referred to as the “official” price, motorists pay up to N1, 300 per litre across the states.

As a result, the cost of transportation has increased remarkably, leading to a high cost of living and inflation that continues to impact daily life for many Nigerians. Already, businesses have been struggling to survive the wave of inflation triggered by the removal of fuel subsidy and the devaluation of the naira in the second quarter of 2023, with many firms shutting down before the recent fuel price increase. According to Segun Ajayi-Kadir, Director-General of the umbrella body of major manufacturers in Nigeria, the Manufacturers Association of Nigeria (MAN), 767 manufacturing companies shut down and 335 others became distressed in 2023 as CBN’s tight monetary policy, aimed at reining in inflation, bites harder.

In the same vein, the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture, NACCIMA, Lagos Chamber of Commerce and Industry, LCCI, and Nigerian Employers Consultative Association, NECA, among others, express worry over the impact of the new pump price of petrol on struggling small businesses. Also, Dr Muda Yusuf, Chief Executive Officer, Centre for the Promotion of Private Enterprise, CPPE, noted that strategic efforts must be made to support the MSMEs and halt the calamity that has befallen them as a result of the high cost of living and weak consumer spending. MSMEs are, collectively, the largest employers in many low-income countries including Nigeria.

In Nigeria, there are over 37 million MSMEs contributing to over 50 per cent of Nigeria’s GDP. However, less than five per cent of these businesses have access to credit in the financial system. This necessitated the creation of the Development Bank of Nigeria (DBN) to provide a sustainable lifeline to the sector.

The DBN was conceived by the Federal Government of Nigeria (FGN) in collaboration with global development partners to address the major financing challenges facing Nigeria’s MSMEs The objective is to alleviate financing constraints faced by MSMEs and small Corporates in Nigeria through the provision of financing and partial credit guarantees to eligible financial intermediaries on a market-conforming and fully financially sustainable basis. In an earlier interview with THEWILL, Dr Yusuf said the government should endeavour to recapitalize DBN if it lacks the necessary firepower to play its statutory role because MSMEs as the engine of the economy are the powerhouse in terms of job creation and GDP growth. Since its establishment, the DBN has been consistent in providing the necessary financial support to the MSMEs towards attaining its mandate as a wholesale financial services institution.

Among the latest cases was the N25 million secured from KFW Development Bank of Germany in November 2023 to support the nation’s MSMEs and boost the renewable energy sectors towards revitalizing Nigeria’s economy. Speaking on the deal, Tony Okpanachi, the Managing Director/CEO of DBN, hailed KFW’s consistent support for Nigeria’s economy across various sectors; he emphasised KFW’s keen interest in witnessing the resurgence of Nigeria’s MSMEs and the energy sector. “We’ve just concluded an agreement for a credit line of N25m provided by KFW to DBN for MSME financing.

As a wholesale Development Finance Institution (DFI), DBN is geared to provide credit access to MSMEs through wholesale lending to financial institutions and microfinance banks,” Okpanachi explained. Highlighting DBN’s ongoing focus on green and renewable energy initiatives, Okpanachi mentioned the bank’s collaboration with 65 financial institutions specifically to support small businesses involved in these sectors. During the year also, DBN empowered over 4,000 MSMEs across the country through a combination of digital and physical training initiatives.

Building on the success of the scheme, the bank announced the official launch of the 2024 DBN Entrepreneurship Training Programme (DBNETP) — their flagship annual programme designed to equip MSMEs with the tools they need to thrive. This year marks the 6th cycle of the DBNETP, as a core element of the DBN’s commitment to supporting the growth of Nigeria’s entrepreneurial ecosystem “This is the time to appreciate the role of DBN in the economic development of this country. The bank should step up its intervention role at this troubling time to salvage the small businesses battling for survival.

This is the most trying time for the MSMEs,” said Kennedy Agim, an industrialist specializing in agro-allied processing. Agim noted that the government should extend the necessary support to DBN to ensure it, in turn, plays its role of rescuing the MSMEs which are being carried away by the terrific flood of economic challenges piercing the body and soul of the sector’s operators. “We monitor the utilisation of funds by partnering financial institutions and, more importantly, its impact on their businesses.

Our focus extends beyond disbursing funds; we remain actively engaged throughout the process to ensure a tangible impact on both the beneficiaries and the economy,” Dr Okpanachi had said. This is the way to go. A notice on its website indicates that the bank plans a capacity building forum with the theme, “Empowering Nigerian MSMEs in a challenging global landscape” taking place on September 25, at Transcorp Hilton Hotel, Abuja.

The bank emphasised that while its mandate fully supports the stimulation of diversified and inclusive growth, it will contribute to alleviating specific financing constraints that hamper the growth of domestic production and commerce by providing targeted wholesale funding to fill identified enterprise financing gaps in the MSME segment. The current economic hardship in Nigeria places on the bank a double responsibility towards the realization of this goal. Sam Diala is a Bloomberg Certified Financial Journalist with over a decade of experience in reporting Business and Economy.

He is Business Editor at THEWILL Newspaper, and believes that work, not wishes, creates wealth..