Every Wednesday and Friday, TechNode’s Briefing newsletter delivers a roundup of the most important news in China tech, straight to your inbox. Sign up Deeproute.ai, a Chinese startup using an autonomous driving approach similar to Tesla and Softbank-backed Wayve, is providing assisted driving technology to a dozen new models from big automakers.

The company believes its tech will help these car companies compete with the Elon Musk-helmed electric vehicle giant in China and globally next year, founder and chief executive Maxwell Zhou said on Tuesday, while announcing a significant fundraise of $100 million. Zhou believes China’s vast data pool has given it a boost in competing with Tesla in the race to develop self-driving cars. Five-year-old Deeproute makes a data-driven, self-learning artificial intelligence system like Tesla and British startup Wayve, rather than a handcrafted, rule-based set of algorithms, It is one of the first few companies in the world using NVIDIA’s latest centralized computer, Drive Thor.

Zhou, who holds a Ph.D from the University of Texas at Dallas, predicted that it will take time for Tesla to bring its Full Self-Driving (FSD) system, the most autonomous version of its Autopilot advanced driver assistance system (ADAS), to its China-made vehicles. “We’ve been training our system using Chinese traffic data for a long time,” Zhou said (our translation).

Tesla is waiting for final approval to introduce its FSD in China early next year. A big endorsement: Zhou’s comments were made as Deeproute has secured $100 million in its Series C1 funding from Great Wall Motor, two people with direct knowledge of the matter told TechNode. Great Wall Motor has declined to comment officially.

Deeproute has made Baoding Xunqi Technology Co., Ltd. one of its shareholders, with the latter holding a 7% stake in the startup’s registered capital totaling RMB 2.

7 million ($377,177), according to information posted by the Shenzhen Municipal Administration for Market Regulation on Monday. Chinese tech giant Alibaba remains its top shareholder with 17.2%.

The parent company of Baoding Xunqi manages collective assets for a local county in the Lianchi district of the northern Chinese city of Baoding, where Great Wall Motor is headquartered, according to Chinese corporate data site Tianyancha. It also has stakes in several firms affiliated with the automaker. Deeproute did not reveal the identity of the investor, calling it a “prestigious” Chinese car manufacturer.

READ MORE: Great Wall Motor reveals more about its in-car OS, self-driving, and GPT Great Wall Motor said it sold 6,180 refeshed Blue Mountain sports utility vehicles (SUVs) at a starting price of RMB 299,800 ($41,792) in October, marking a 204% increase from a year ago. Credit: Great Wall Motor A mass adoption incoming: Deeproute’s upcoming end-to-end artificial intelligence technology would require human intervention at least every 100 kilometers (62 miles) and introduce coherent, human-like reasoning that can take up to dozens of seconds (rather than the six to seven seconds of existing offerings), in a complex Chinese city environment, Zhou told reporters. The Deeproute IO 2.

0 is scheduled for deployment next year and its first-generation system is being used in 20,000 cars already. These include the Smart #5, an electric crossover launched by Mercedes-Benz and China’s Geely on Oct. 27, as well as Great Wall Motor’s refreshed Blue Mountain flagship SUV that went on sale in August.

More than 10 new models could use the technology next year. Deeproute has benefited from a great deal of high-quality “critical state data” collected in China where road participants usually interact with autonomous vehicles in a more unruly way, Zhou told the audience at NVIDIA’s annual developer conference GTC in March. “The quality of the [traffic] data in China is much better than that collected in the US,” Zhou said at the time.

An AI-driven vision: Having distanced itself from the conventional, rule-based approach to vehicle autonomy, which often relies on high-definition maps and expensive lidar sensors , Deeproute said it would be relatively easy to scale up its technology and comply with data security rules for both China and overseas markets. The cost of a self-driving hardware and software package could range from $1,000 to $2,000 per vehicle, according to Zhou. Despite growing demand from Chinese EV buyers, assisted driving functions available to the market are still enabled by early versions of the end-to-end AI solution, which ultimately takes raw sensor data from cameras and trains them in a single gigantic neural network.

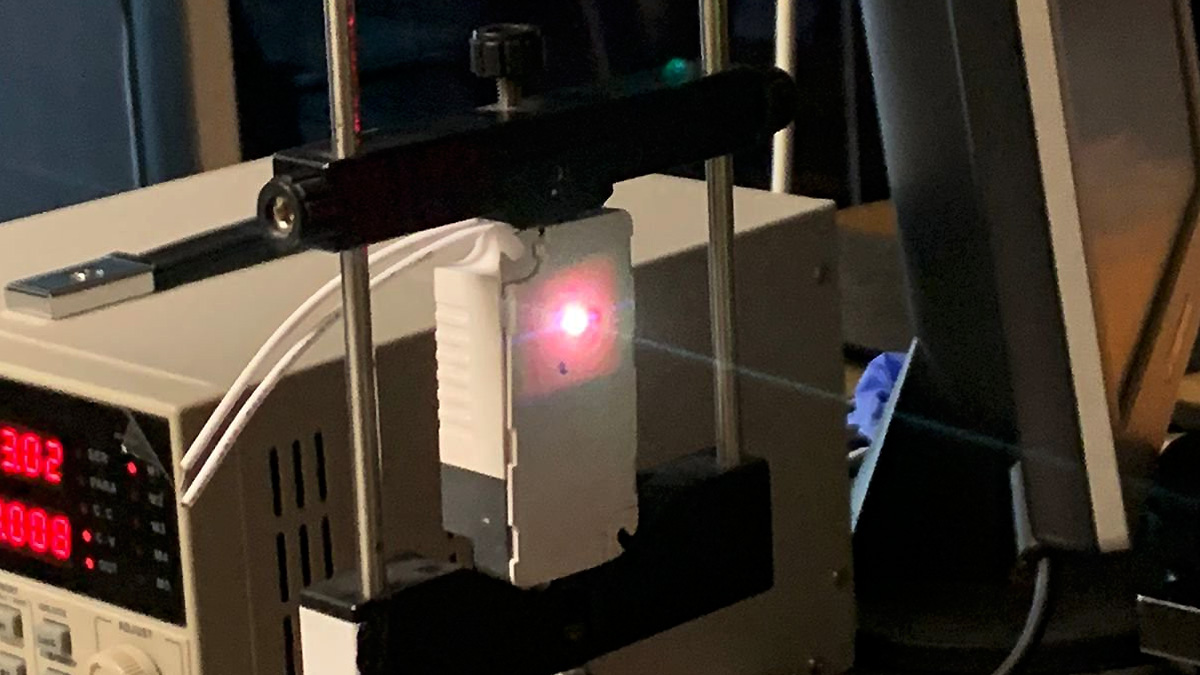

These ADAS functions do not function “well enough” for many users, Zhou added. Zhou expects ADAS to become a killer feature for the majority of users next year, as more companies are building their future ADAS based on NVIDIA’s next-generation automotive-grade computer chips – DRIVE Thor – which allow more computing power than the existing DRIVE Orin chip to process data. “Deeproute can be the one that makes the most use of Thor’s power next year,” said Zhou (our translation).

READ MORE: Chinese companies take on Tesla’s Full Self-Driving with non-lidar approach, end-to-end AI Support TechNode With a small team, TechNode provides timely news and thoughtfully researched articles for worldwide readers interested in learning more about the Chinese tech industry. One-time Monthly Annually One-time $60 $120 $365 Other Donation amount $ Monthly $10 $20 $30 Other Donation amount $ Annually $60 $120 $365 Other Donation amount $ Your contribution is appreciated. Donate Now Related.