The latest round of US-China tariff war is fanning a flight to quality and Citigroup’s wealth bankers are telling its clients to resist buying the dip after a global sell-off that wiped out US$2.73 trillion in stock market value this week. “Our team does not expect a rapid de-escalation,” Andy Sieg, Citigroup’s global head of wealth, said in an interview in Hong Kong on Monday.

“It is very hard right now to have precise estimates of the economic impact of tariff changes. We are not advising [them] to buy the dip. This is a time for caution.

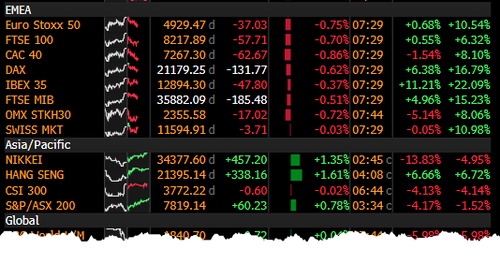

” Citigroup was more confident about recommending the safety of short-maturity bonds, hedge funds, gold and non-correlated assets, he said, adding that some structured notes that have some downside protection would also be appropriate to own. His team hosted a webcast for 1,200 clients across Asia before the market tumble on Monday. The MSCI World All-Country Index, the broadest gauge of global stocks, slumped 2.

5 per cent on Monday, erasing US$2.73 trillion of capitalisation. Benchmark stock indices in mainland China and Hong Kong sank by at least 7 per cent in the worst rout in decades, prompting Beijing to intervene in the market.

.

Business

Don’t buy the dip amid global market sell-off, Citigroup wealth bankers say

While a bear market rally can occur, it will not last and it is too early to buy the dip, according to strategists at BCA Research.