Evidence is mounting that tariffs have curtailed economic activity and will soon push prices higher, even if the effects will take time to be broadly felt. With 14 months remaining before the United States’ 250th birthday on July 4, 2026, Stacy Blake should be placing big orders with the Chinese factories that supply her fireworks company in St Joseph, Missouri. But she’s not.

And she blames President Donald Trump’s tariffs. The same president who’s making plans for a “grand celebration” of this national milestone has imposed sky-high import duties that will make that star-spangled festival tough to pull off. With the trade war causing US orders to dry up, Chinese fireworks factories have begun shutting down.

That threatens to disrupt the industry’s production schedule, leading to serious shortages, said Blake, co-owner of Schneitter Fireworks & Importing. “We’ve got a huge problem ahead of us going into next year,” said Blake, who is also president of the National Fireworks Association. “This season is when Chinese manufacturers would be manufacturing our products right now for 2026, for the 250th.

Very little production is happening. They have halted it.” The fireworks disruption looms even though the president spent much of last week softening his tariff rhetoric .

He said that “a fair deal” with China was possible and insisted that he had spoken with Chinese President Xi Jinping “numerous times”, which the Chinese government denied. Trade talks with dozens of other countries “are going very well”, Trump said, adding that he was “very close to a deal” with Japan. Yet even as Trump signalled a willingness to ease his steepest tariffs, there were signs that his change of tone came too late: the economy has been damaged.

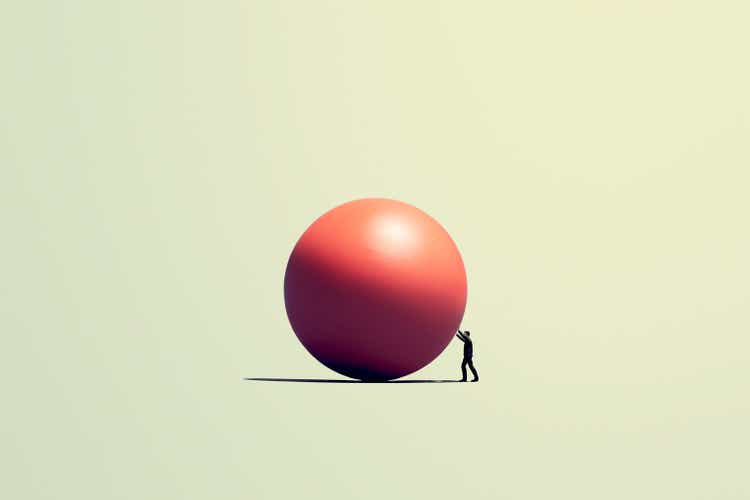

And as the threat to America’s birthday celebration next year shows, it could take some time to learn precisely what effect the experiment with import taxes has had. “You can’t put the toothpaste back into the tube - once you squeeze it, it’s out,” said Constance Hunter, chief economist at the Economist Intelligence Unit, a research firm. The delayed effects of tariffs hang over a US economy that has powered through numerous issues in the past few years.

By many key measures, the economy remains strong. Unemployment is low. Inflation has fallen dramatically from its post-Covid highs and largely remains in check.

Growth has stalled somewhat, but economists say it’s probable that the nation’s gross domestic product increased in the first quarter of this year. These upbeat indicators all have a key shortcoming, though: they predate Trump’s global tariffs and the disruption they’ve caused. Discover more Stocks rally as Trump soothes fears over China trade, Fed 'So much damage': Is the United States headed for a Trump recession? Inside Economics: Donald Trump v the US Fed? Matthew Hooton: Cool heads needed as Trump disaster unfolds And evidence is mounting that tariffs have curtailed economic activity and will soon push prices higher, even if the effects will take time to be broadly felt.

Trump’s tariffs on goods from China have disrupted trans-Pacific supply chains. US officials are alarmed by companies’ dwindling inventories of critical raw-earth metals necessary for a range of economic activity; Beijing restricted the metals this month. In the three weeks since the tariffs took effect, ocean-container bookings from China to the US are down by more than 60%, said Ryan Petersen, founder and CEO of Flexport, a global shipping company.

Cargo carriers that bring Asian goods to the Port of Los Angeles, the nation’s main Pacific gateway, have cancelled 20 port calls next month, more than three times as many as last month, according to port data. The consequence will be “empty shelves in US stores in a few weeks and Covid-like shortages for consumers and for firms using Chinese products as intermediate goods”, said Torsten Slok, chief economist for Apollo Global Management. Fewer goods reaching American shores will mean higher prices on the goods that are in stores - as well as less work for dockworkers and truck drivers.

“Significant” layoffs in trucking, logistics and retail are likely as soon as May, Slok said. “It feels like this slow-motion wave that’s coming toward us, but not here yet,” said Jason Furman, a Harvard University professor who served as a senior economist in the Obama administration. Manufacturers that rely on Chinese imports to make goods domestically are also showing signs of strain.

The Philadelphia Fed’s manufacturing survey showed one of the biggest monthly drops on record, surpassed only by the start of the 2020 pandemic and the 2008 Great Recession. Business investment is also cratering in response to the uncertainty caused by the tariffs, say Furman and other economists. “The US economy is pointed in a dangerous direction.

The further the economy goes down this path, the higher the risk of a recession,” Bill Adams, chief economist for Comerica Bank, wrote in a client note on Friday (Saturday NZT). In the face of these projections, Trump has signalled a desire to reach an agreement with China to remove drastic economic restrictions. He has emphasised that his advisers are negotiating with dozens of other countries, too.

But while Trump sounds newly eager to strike a deal with Xi, the Chinese leader may be in no hurry to reciprocate. The president often claims to have a personal relationship with Xi, whom he has called “a friend”. Treasury Secretary Scott Bessent last week told reporters that it was “both a blessing and a curse that the strongest relationship [between the two nations] is at the very top”.

Indeed, Trump’s top-down negotiating style, which emerged from his personal handling of real estate transactions, does not match Chinese diplomatic practice. Rather than embark on risky mano-a-mano bargaining, Xi may insist that trade talks start with subordinate officials who can lay a foundation for the leaders’ eventual agreement. “They have a different approach,” said Myron Brilliant, a senior counsellor at DGA Group.

“They’re bottom-up. Trump likes to work negotiations top-down.” This stylistic clash may make an early settlement of the US-China trade clash unlikely, he added.

Some progress has been made elsewhere. The US is advancing toward a deal with India, said Eswar Prasad, a Cornell University professor who served in a senior role at the International Monetary Fund. The administration is pushing India to lower its tariffs on American agricultural products - a measure the Indian government appears willing to entertain, Prasad said.

Bessent has projected optimism about reaching deals quickly with partners such as South Korea, which could mitigate the economic harm from the tariffs. Trump’s defenders say this approach reflects his negotiating style of making maximal demands, then gradually coming back to the table from a position of strength. “The Trump technique, if you read his two books on negotiating, is to go way out and then gradually pull back - he never goes small and then pushes out - and he’s done that his whole career,” said Newt Gingrich, a Trump ally who served as speaker of the House from 1995-1999.

But it’s unclear how Trump could pull back from the measures he has imposed before they damage the economy. The biggest impact stems from the tariffs on imports from China, which are far steeper than even the drastic measures he promised during his 2024 presidential campaign. Trump ran on tariffs of 60% on China, but when Beijing retaliated against the president’s first wave of import duties, the US hit back.

Goods from China now face tariffs of 145%, and China has retaliated with its own economic restrictions. The combination threatens to effectively choke off bilateral trade. “They never wanted tariffs that high on China,” said one person briefed on the White House’s thinking, who, like some others quoted in this article, spoke on the condition of anonymity to discuss private deliberations.

“Trump just went tit-for-tat with him. That’s him as a person - he wants to treat them as they treat us.” Even if Trump eventually does roll back duties on Chinese-made goods to 60%, the overall US average tariff rate would sit at 16% - a sharp rise from the pre-trade war figure of around 2.

2%, according to a JPMorganChase analysis. That increase would be more than 10 times what the US experienced during Trump’s first term and would represent a tax hike of nearly $500 billion on American importers, according to the investment bank. There also appear to be no easy solutions to Trump’s tariffs on goods from the European Union and Japan, two of the US’s biggest trading partners.

Japan is expected to resist US requests to limit automobile exports, said two people familiar with the matter, speaking on the condition of anonymity. And EU Commissioner Valdis Dombrovskis told the Wall Street Journal the EU won’t negotiate changes to its value-added tax or agricultural subsidies. Compounding the challenge is the logistical difficulty of simultaneous talks with dozens of governments.

Prasad, citing conversations with economic officials in four countries, said US trading partners are largely in the dark about key elements of a potential deal, such as whom they are supposed to be talking to and the concessions the administration is seeking. One foreign diplomat, speaking on the condition of anonymity, expressed concern that any deal reached with Treasury or Commerce officials could be later undercut by Trump. Some trading partners are also wary of agreeing to the administration’s demands only to see Trump impose additional tariffs on their businesses later this year.

Meanwhile, Schneitter Fireworks is hoping the president reverts to his first-term trade war stance. Almost all of the fireworks that Americans purchase for personal use are made in China; three-quarters of the pyrotechnics featured in more elaborate community celebrations are Chinese. In 2019, recognising the lack of domestic production, Trump exempted the industry from his first China tariffs.

This time, however, he has not granted a similar waiver, leaving scores of small businesses facing crippling extra costs. Importers who cannot afford 145% taxes have told their Chinese suppliers to freeze shipments, which could mean some consumer favourites for celebrating the July Fourth holiday this year will be hard to find, said Blake, Schneitter Fireworks’s co-owner. Without immediate relief from Trump’s tariffs, American importers will miss their turn in the Chinese production line for 2026.

Fireworks factories will soon enter their annual summer shutdown. And when they reopen, they are scheduled to fill European orders before producing what Chinese consumers demand. “It’s very crucial that we start manufacturing in China right now,” Blake said.

Share this article Reminder, this is a Premium article and requires a subscription to read. Copy Link Email Facebook Twitter/X LinkedIn Reddit.

Business

Donald Trump is softening his tariff talk. But the damage may already be done

Evidence is mounting that tariffs have cut economic activity and will soon push prices up.