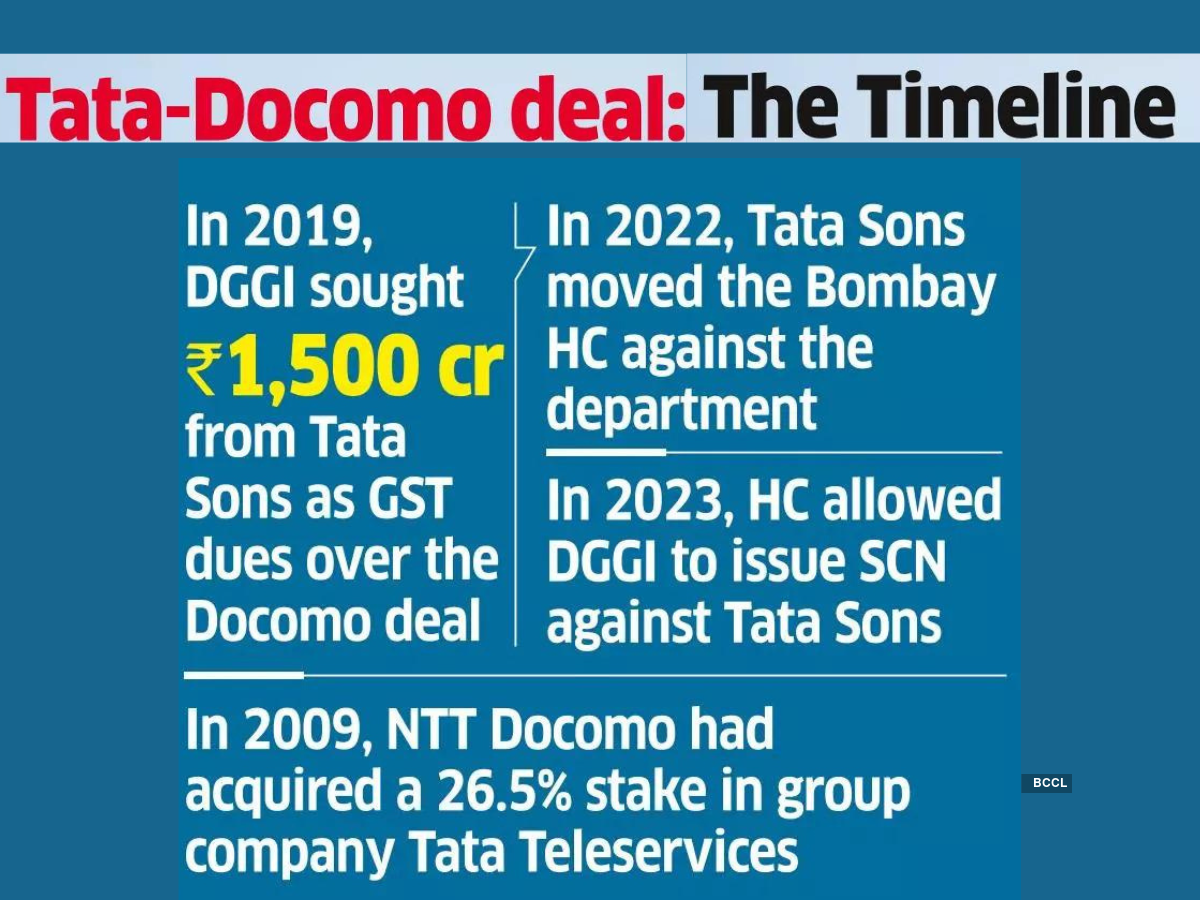

Mumbai: In a significant relief for Tata Sons , the Adjudicating Authority (AA) of the Goods and Services Tax ( GST ) department has dismissed a GST demand of over Rs 1,500 crore on the company over a settlement deal with Docomo . The AA order will act as a precedent for companies engaged in arbitration, officials close to the matter told ET. "The department has the option of contesting it before the High Court," one of the officials said.

In 2019, the Directorate General of GST Intelligence (DGGI) claimed 18% GST on the $1.27 billion that the Tata Group holding company paid to the Japanese telecommunications company in 2017 to settle a dispute with Tata Teleservices. Advt It argued that since the payment was made on behalf of Tata Teleservices, it should be treated as a loan from Tata Sons to the group firm and hence liable for 18% GST.

Tata Sons challenged the claim, arguing that the payment was the outcome of arbitration proceedings in a London court and therefore GST was not applicable. Subsequently, in November 2022, the salt-to-software conglomerate filed a writ petition before the Bombay High Court where it cited a circular issued by the Central Board of Indirect Taxes and Customs (CBIC) on August 3, 2022, and another issued on February 28, 2023, for claiming that no GST could be levied on liquidated damages. "The amount was the due paid on behalf of Tata Teleservices by Tata Sons and not for any services rendered by Docomo.

It is an arbitration case that was paid and closed...

DGGI is looking at it in a very technical manner," the company had pleaded before the HC. However, in 2023, the HC allowed the department to issue a show-cause notice (SCN) to the company which was further challenged by the company before the AA. "The AA has relied upon the arguments made by the company while ruling in its favour," the official quoted above said.

"Since this is the order of the AA, it would act as a precedent for other companies facing similar litigations," the person added. Advt Tata Sons did not comment on the AA order. The DGGI levied the GST under Schedule 2 of the CGST Act , which treats the payment of loans as a service rendered.

"Since Tata Sons is the holding company, it is liable to pay 18% GST on behalf of Tata Teleservices," a senior official told ET. Advait M Sethna, counsel specialising in indirect tax and arbitration, said the Telangana Advance Ruling Authority in a recent ruling had held that GST is not payable on out-of-court settlements. "In my view liquidated damages arising in arbitration are ordinarily exempt from GST," he said.

"However, it appears that if the award is attributable to claims arising out of goods and/or services as defined under GST Act, then to that extent, GST would be leviable. The said definition under GST Act specifically excludes money security and actionable claims," Sethna said. NTT Docomo had acquired a 26.

5% stake in Tata Teleservices in 2009. The two sides had agreed at the time that the Japanese company could exit the venture at a pre-determined minimum price-at least half of what it paid to acquire the stake. The Japanese firm sought to exercise that option in 2015 due to Tata Teleservices' financial struggles.

The Reserve Bank of India (RBI), however, was of the view that such an exit could only take place at fair market value, in tune with a rule amended in 2013. Tata Sons, then led by the late Cyrus Mistry, cited this and declined to pay the agreed amount. Docomo filed for international arbitration and in 2017 it stated that it received from Tata Sons $1.

27 billion awarded by an international arbitration court for its stake in Tata Teleservices Ltd (TTSL). By Rashmi Rajput & Kala Vijayraghavan , ET Bureau Published On Sep 23, 2024 at 07:22 AM IST Telegram Facebook Copy Link Be the first one to comment. Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button.

This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis. Download ETTelecom App Get Realtime updates Save your favourite articles Scan to download App Docomo Tata Sons GST Authority GST CGST Act Bombay High Court tata group telecom news.