NEW DELHI: Razorpay, PayU, Easebuzz and Paytm are among eight payment gateways that have come under investigation with the Enforcement Directorate (ED) freezing around Rs 500 crore in their virtual accounts over the last two years in connection with 10 Chinese nationals running one of the biggest cryptocurrency scams, HPZ Token, from India. The accused allegedly collected over Rs 2,200 crore from people across 20 states and remitted the 'proceeds of crime' out of the country, a part of which was frozen with the payment gateways before they were remitted to beneficiaries. While making bulk payments, the amount remained with the gateways for a day or two, during which ED had frozen around Rs 500 crore.

The agency is investigating the money trail and also checking if the payment gateways had generated suspicious transaction reports (STR), and alerted the RBI and the Financial Intelligence Unit (FIU). All financial institutions have to generate STRs and report them to the RBI periodically, which forwards them to the FIU for enforcement agencies to investigate further. Of the total Rs 497 crore frozen in the virtual accounts of payment gateways, PayU had highest at Rs 130 crore of the alleged 'proceeds of crime' related to the HPZ Token scam, followed by Rs 33.

4 crore with Easebuzz, Rs 18 crore with Razorpay, Rs 10.6 crore with CashFree and Rs 2.8 crore with Paytm, a senior official said.

The other payment gateways where ED has frozen the alleged scam money, include WunderBaked, AgreePay and SpeedPay. The accused ran a pan-India operation with companies incorporated in at least 20 states, where people were given the option to invest in the mining of cryptocurrencies, including Bitcoins, through mobile app HPZ Token. More than 50 companies were registered in Delhi having 84 bank accounts, 26 firms in Karnataka with 37 bank accounts, 19 in Haryana and 11 in UP, besides Maharashtra, Gujarat, Andhra Pradesh, Telangana, Tamil Nadu and West Bengal.

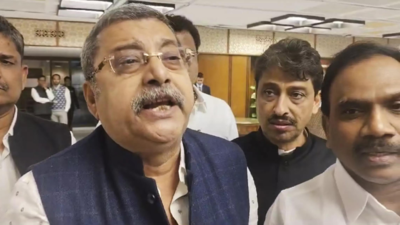

In this case, a PMLA court in Nagaland on Jan 22 declared a Delhi resident, Bhupesh Arora, as a fugitive economic offender as he refused to appear before the agency despite a non-bailable warrant against him. ED said Arora fled to Dubai in 2022 after it began investigations. ED has filed a chargesheet alleging the involvement of 298 people in the scam.

.