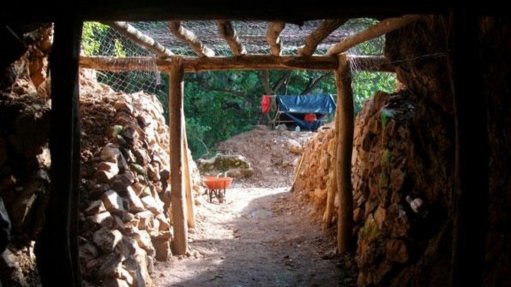

Canadian exploration and development company Condor Gold has confirmed it has received two nonbinding acquisition offers, one from Calibre Mining and the other from Metals Exploration, potentially paving the way for a future offer to acquire the company. Condor, listed on both the TSX and Aim, has focused its efforts on the exploration and development of gold assets in Nicaragua, with its flagship project being the La India gold asset. The company has been exploring strategic options for this asset for the past two years, following the initiation of a formal sale process.

In response to Condor’s announcement, Calibre clarified its position, noting that while it had previously engaged in discussions regarding the potential acquisition of the La India gold asset, it was not currently in talks and did not have an active offer on the table. "At this time, unless Condor is willing to reengage in meaningful discussions, Calibre does not envision completing an acquisition," stated the TSX-listed company in a release. Metals Exploration – a UK-listed company focused on gold projects in the Philippines – appears to be further along in its negotiations, according to a report by SkyNews.

The report indicated that Metals Exploration is nearing a cash-and-stock deal to acquire Condor Gold. The company, which owns the Runruno gold project in the Philippines, is backed by financier Nick Candy , a prominent shareholder. SkyNews reports that a deal could be announced as soon as this week.

.