China is upping tariffs on US imports to 125 percent, branding the Trump administration's tax policies a "joke." The retaliatory action comes days after the US government elevated levies against its arch enemy to 145 percent, claiming Beijing had shown "little respect" by hiking its tariffs to 84 percent, which was itself in response to earlier action taken by America at the start of this month. The Chinese Ministry of Finance confirmed today the increase will take effect from tomorrow, April 12.

It's the last such action China will take, per the Finance Ministry, with the Commerce Ministry adding that China considers the current tariff levels to be economically meaningless. By that, it means China doesn't rely on imports from the US to anywhere near the same degree as America relies on imports from China, and thus the matching tariffs on American gear coming into China has achieved its end goal: Cutting off shipments with super-high fees. China's saying it isn't fazed by that.

Meanwhile, folks in the States, who rely heavily on the Middle Kingdom, face an effective trade embargo on goods coming in from China due to President Donald Trump's ultra-tariffs. The US's repeated imposition of abnormally high tariffs on China has become a numbers game, which has no practical economic significance "The US's repeated imposition of abnormally high tariffs on China has become a numbers game, which has no practical economic significance," the Commerce Ministry said in a statement. "It will only further expose the US's use of tariffs as an instrument and weapon to bully and coerce, and become a joke.

" The Finance Ministry described the current tariff level as leading to "no market acceptance for US goods exported to China." The US's exports to China are led by electronics, mineral fuels and oil, oil seed and grains, machinery and aircraft. Those exports to China were valued at $143.

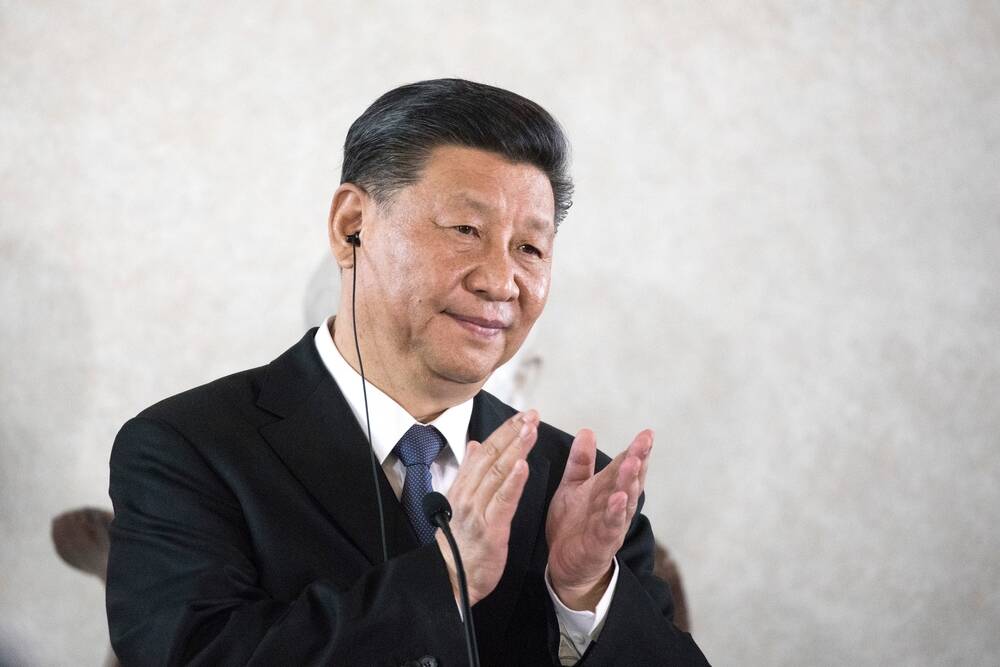

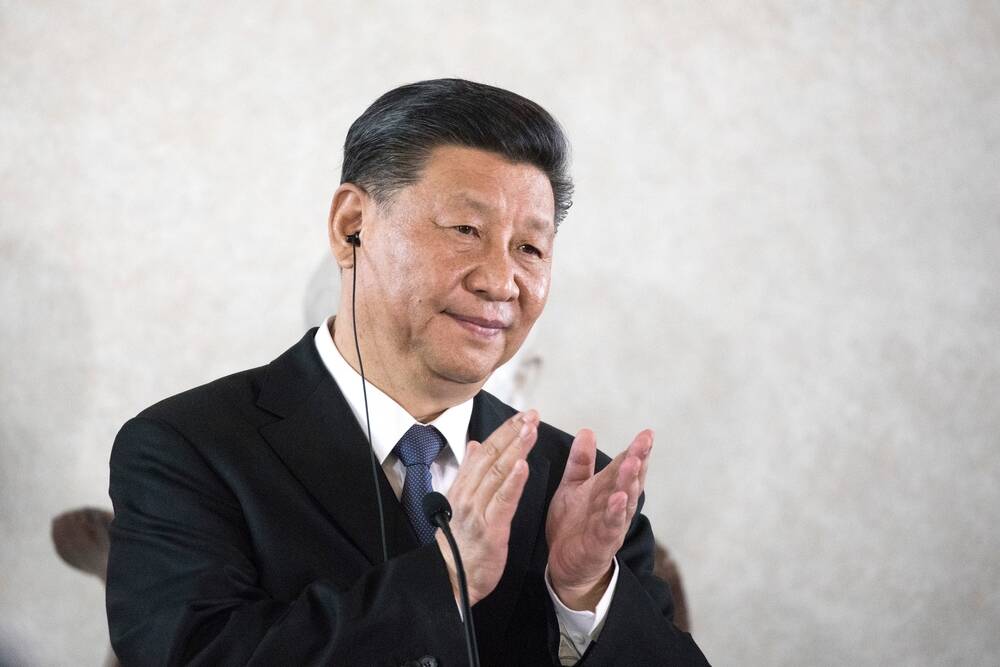

5 billion in 2024. The US meanwhile imported $440 billion of stuff from China. Chinese President Xi Jinping also took the opportunity, amid growing US-China economic chaos, to weigh in on the matter, stating during a meeting with Spain's Prime Minister Pedro Sánchez that there are no winners in a tariff war, according to Chinese state media.

Xi further warned - again, without mentioning the US - that going against the world would only isolate a nation that does so, and talked up his love for the European Union and desire to strengthen Chinese ties with the trading bloc. "The United States' wanton imposition of unilateral tariffs has seriously violated international trade rules and basic economic laws and common sense, causing severe shocks and turbulence to the current world economy, global markets and multilateral trading system," the Commerce Ministry said, while implying that Trump's temporary suspension of broad tariffs on practically every country in the world last week was prompted by pressure from China and others. A bond market catastrophe was a big driver for making Trump blink, to be honest.

US tariffs on Chinese imports initially rose to 34 percent in April under Trump's directive, climbed to 104 percent at the start of this month, and now to 125 percent. It'll take a few quarters for the ripple effects to be felt, yet Forrester VP and research director Mark Moccia said there's definitely going to be a wider impact in the IT world. IT infrastructure will likely see significant price increases as major manufacturing nations face high tariff rates "Tariffs will make mass capital expenditures for PCs more expensive.

IT infrastructure will likely see significant price increases as major manufacturing nations face high tariff rates," Moccia said in a statement. "More concerning would be if other countries retaliate by directly targeting US services where there is a surplus to many countries." The knock-on effect of those increased costs could force CIOs to delay some IT projects as they are forced to prioritize only the most necessary spending, and manage budgets as effectively as possible.

PC prices, for example, are forecast to jump by as much as 68 percent . Anticipating the impact, vendors ramped up shipments ahead of the hikes, driving a surge in channel inventory in Q1. "CIOs and other tech leaders will need to proactively analyse costs, diversify sourcing, optimize inventory, and prioritize the projects that don't sacrifice critical AI ambitions," Moccia added.

In the datacenter industry, Schneider Electric and Digital Realty told The Register this week they have teams of people analyzing the rapidly evolving situation. Pablo Ruiz Escribano, senior VP for Schneider's Secure Power and Datacenter Business, agreed it has introduced uncertainty into the economy and entire industry. "This is a very volatile subject that we are, for sure, monitoring," he said.

As with Russia's invasion of Ukraine and the COVID-19 pandemic, the global supply chain unit is evaluating the impact, he added. Schneider has created factories in the US which produce tech for the local market so has built some diversification into his manufacturing model. Fabrice Coquio, senior VP at Digital Realty, said: "We source equipment from throughout the world.

Our customers do as well. It's not good, obviously." One group that won't be affected by those increased Chinese tariffs? US chip companies that outsource fabrication to plants outside America.

According to a recent announcement by the Chinese Semiconductor Industry Association, as reported by local media, the Chinese government will consider the wafer assembly location as the country of origin. In other words, good news for companies like AMD, Qualcomm, and Nvidia, which have their chips manufactured in places like Taiwan. ®.

Technology

China ups tariffs on US goods to 125%, calls Trump's war a 'joke'

Middle Kingdom retaliates against White House's 'instrument and weapon to bully and coerce' China is upping tariffs on US imports to 125 percent, branding the Trump administration's tax policies a "joke."...