China is pushing its tech companies to prioritise domestically produced artificial intelligence (AI) chips over those from foreign suppliers like NVIDIA and AMD, in an effort to boost the country’s self-reliance in semiconductor technology. While no official ban has been placed on NVIDIA’s China-tailored H20 graphics processing unit (GPU), sources indicate that Chinese companies have been informally advised to favour homegrown solutions, such as those developed by Huawei Technologies. Shifting to domestic semicon Although NVIDIA’s H20 GPUs remain popular in China, the government’s subtle guidance to move towards local alternatives reflects its broader strategy to reduce dependence on foreign technology.

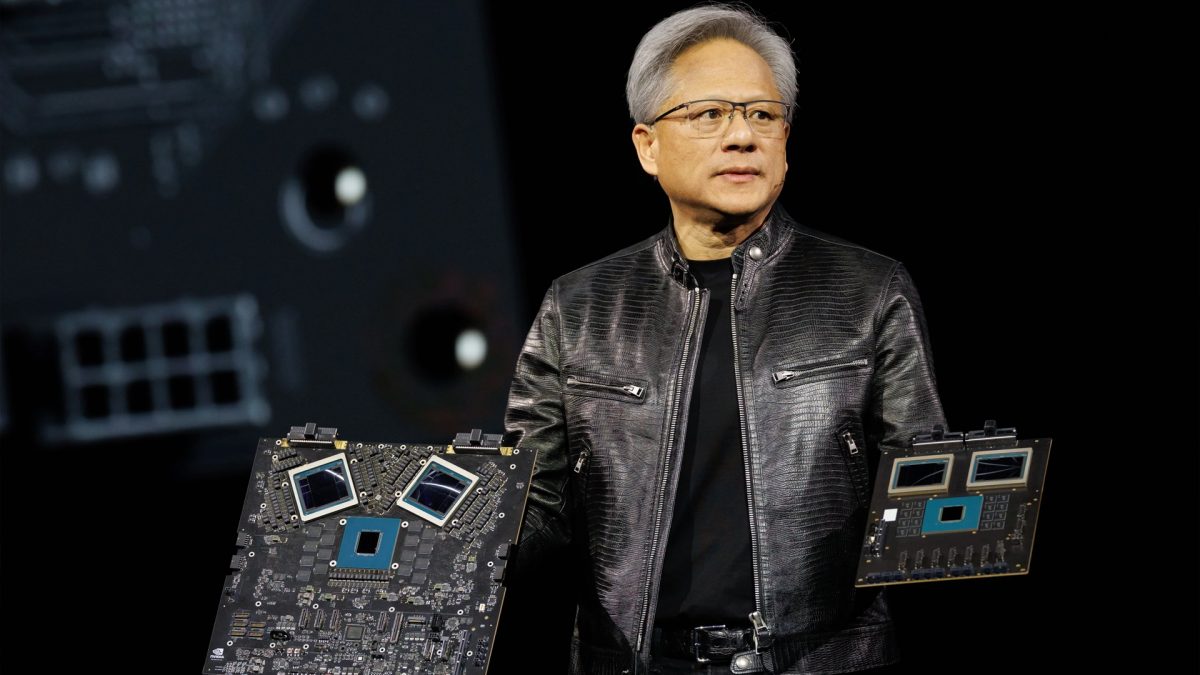

NVIDIA has long dominated the AI chip market with its powerful GPUs, essential for training and running AI models. However, since May 2024, reports have surfaced that Chinese regulators have been urging domestic companies to scale back on NVIDIA chip purchases, instead turning to local suppliers like Huawei. This push comes at a time when the global AI chip market is experiencing rapid growth.

Taiwan Semiconductor Manufacturing Co’s CEO has projected that the AI chip sector will expand much faster than the overall semiconductor industry, highlighting the critical importance of these components for future technological advancements. NVIDIA’s role amid US sanctions NVIDIA has adapted to several rounds of US-imposed export restrictions, which initially barred its A100 and H100 chips from being sold to Chinese clients in 2022. To comply with these sanctions, NVIDIA introduced modified versions like the A800 and H800 chips.

However, with further restrictions imposed last October, NVIDIA developed the H20, L20, and L2 chips specifically for the Chinese market, helping the company maintain its presence despite regulatory hurdles. NVIDIA’s H20 chips, although restricted in performance compared to its high-end counterparts, have seen strong demand from large Chinese cloud service providers. Despite the reduced capacity, NVIDIA’s technical support and maintenance services continue to make its products appealing.

The company expects to deliver over 1 million H20 GPUs in China this year, generating an estimated $12 billion in sales. Rising adoption of Chinese AI chips While NVIDIA remains a significant player in the Chinese market, the use of locally made AI chips is on the rise. State-owned carrier China Telecom recently announced the development of two large language models (LLMs), which were trained entirely on Chinese-made AI chips.

While the company did not disclose the specific supplier, its history of collaborating with Huawei suggests that Huawei’s Ascend processors were likely used. China’s push to develop its domestic AI chip industry highlights its desire to reduce reliance on foreign technology in critical areas. As the AI chip market continues to grow, driven by demand for AI applications, China is positioning itself to become a key player in this space.

While NVIDIA remains dominant for now, the shift towards local solutions could reshape the country’s AI chip landscape in the coming years, particularly as geopolitical tensions persist in the tech sector..