China increased its tariff on U.S. goods to 125% on Friday, matching President Trump's levy, but said it won't go higher.

Why it matters: The tit-for-tat move extends a trade war impacting hundreds of billions of dollars' worth of goods — though the intention to cap the tariff may be a small opening to moderate tensions.Catch up quick: The new Chinese levy goes into effect April 12 on about $144 billion of U.S.

exports, primarily agricultural products like soybeans.It mostly matches U.S.

tariffs, which the Chinese government dismissed as a "joke." The U.S.

now charges 145% on Chinese goods — the 125% reciprocal rate plus an earlier 20% tariff in a dispute over the flow of fentanyl. What they're saying: "Given that American goods are no longer marketable in China under the current tariff rates, if the U.S.

further raises tariffs on Chinese exports, China will disregard such measures," the Chinese Ministry of Finance said in a statement, per Bloomberg. CNBC reported the same sentiment, though with a different translation.By the numbers: The latest Chinese move weighed on financial markets.

European stocks were up in early trade but turned negative after the Chinese announcement.U.S.

stock futures were slightly lower as well in thin early morning trade. Yields on U.S.

Treasury bonds, under enough pressure of late to force the White House's hand, were about 1.5 basis points higher at 4.407%, well off their highs overnight.

Go deeper...

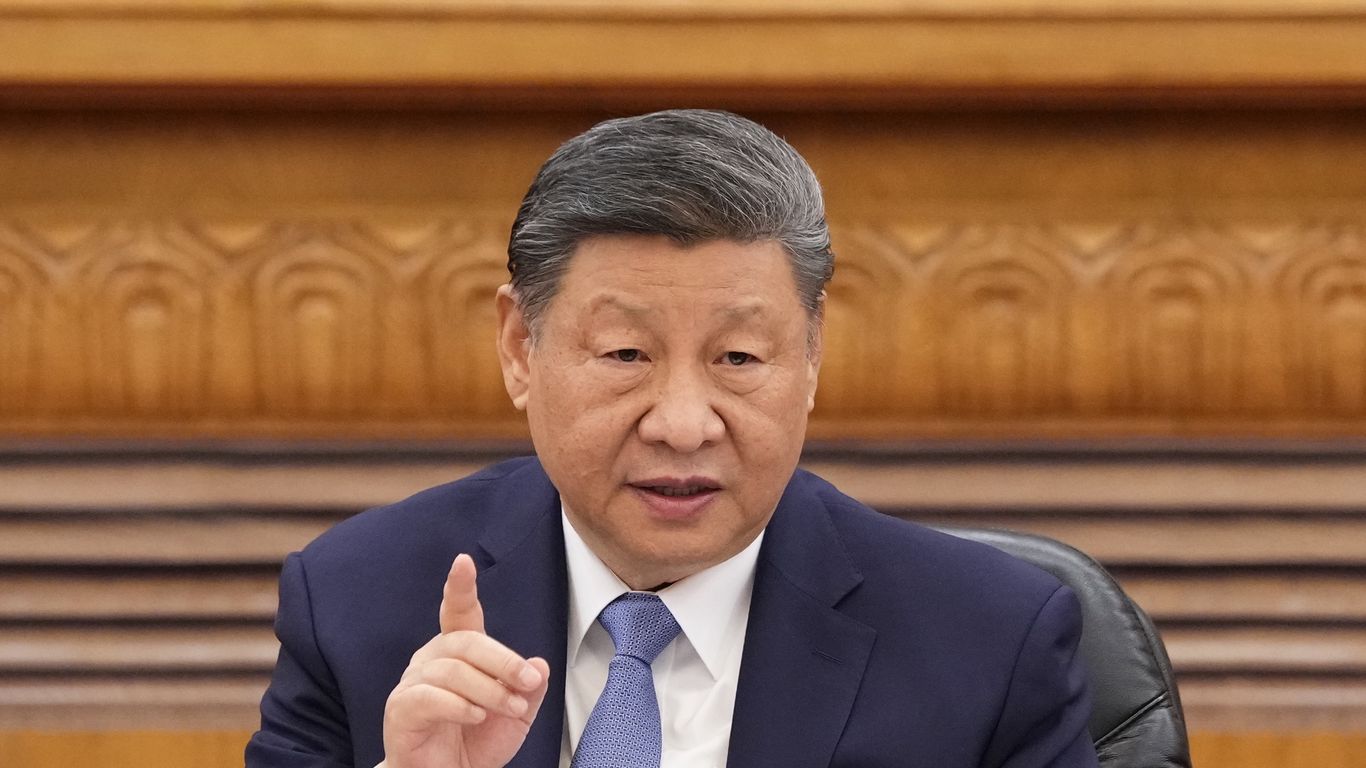

Xi's counterpunch: How China will ensure the trade war hurts the U.S..

China raises U.S. tariff to 125%, won't go higher

China increased its tariff on U.S. goods to 125% on Friday, matching President Trump's levy, but said it won't go higher.Why it matters: The tit-for-tat move extends a trade war impacting hundreds of billions of dollars' worth of goods — though the intention to cap the tariff may be a small opening to moderate tensions.Catch up quick: The new Chinese levy goes into effect April 12 on about $144 billion of U.S. exports, primarily agricultural products like soybeans.It mostly matches U.S. tariffs, which the Chinese government dismissed as a "joke." The U.S. now charges 145% on Chinese goods — the 125% reciprocal rate plus an earlier 20% tariff in a dispute over the flow of fentanyl. What they're saying: "Given that American goods are no longer marketable in China under the current tariff rates, if the U.S. further raises tariffs on Chinese exports, China will disregard such measures," the Chinese Ministry of Finance said in a statement, per Bloomberg. CNBC reported the same sentiment, though with a different translation.By the numbers: The latest Chinese move weighed on financial markets. European stocks were up in early trade but turned negative after the Chinese announcement.U.S. stock futures were slightly lower as well in thin early morning trade. Yields on U.S. Treasury bonds, under enough pressure of late to force the White House's hand, were about 1.5 basis points higher at 4.407%, well off their highs overnight. Go deeper... Xi's counterpunch: How China will ensure the trade war hurts the U.S.