The nation’s taxpayers face an ocean of red ink after Treasurer Jim Chalmers used his mid-year fiscal update to reveal a $21.8 billion blowout in budget deficits and commonwealth debt crashing through $1 trillion in the coming year. The update reveals a lift in government spending, much of it in areas such as childcare and aged care, but also confirms ongoing revenue pressures with collections of one key tax expected to slump by a quarter.

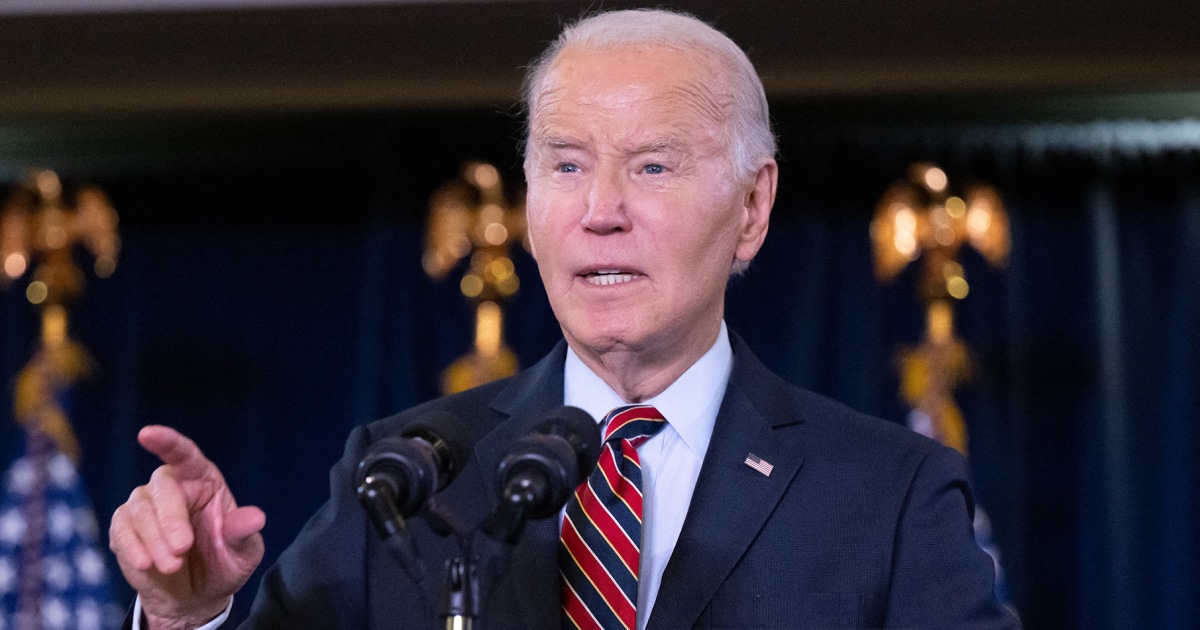

Treasurer Jim Chalmers said the government had “much less debt” than when it came to office. Credit: Alex Ellinghausen It also shows that the economic outlook for the Albanese government headed to an election by May of next year remained tough, with household spending likely to grow slower than the population even as inflation remains steady and real wages lift. Chalmers, who in May forecast a deficit of $28.

3 billion for the current financial year, now expected it to ease slightly to $26.9 billion. But beyond 2024-25, the situation is much worse.

From the current financial year until 2027-28, Chalmers had forecast cumulative deficits of $122.1 billion. He is now forecasting $143.

9 billion in red ink. The deficit in the coming financial year is now tipped to reach $46.9 billion, a deterioration of $4.

1 billion over the May forecasts. It would be the sixth-largest deficit in cash terms on record. The 2026-27 deficit is tipped to be $11.

7 billion worse at $38.4 billion, while in 2027-28 the deficit is expected to be $31.7 billion, a $7.

4 billion blowout on what had been forecast. The bigger deficits mean more debt. Gross debt, currently $911 billion, is expected to finish the financial year at $940 billion.

It is forecast to climb to $1 trillion next year, $1.1 trillion the year after that and hit $1.16 trillion by 2027-28.

Chalmers focused on the improvement to the budget bottom line this year, noting that the economy was also growing. “Despite the pressures coming at us, we’re on track for a soft landing and our budget strategy is helping,” he said. “Our economy is growing, inflation is moderating, real wages are growing, unemployment is low, more than one million new jobs have been created, we’re rolling out tax cuts and cost-of-living help to help people doing it tough, and there’s now much less debt than when we came to office.

” The single largest blowout in cost has been the GST, including the bipartisan deal to offer ongoing support to the nation’s most fiscally secure state, Western Australia. This will cost the budget an extra $6.7 billion by 2027-28.

Higher interest rates on more debt means the government’s interest bill will cost it an extra $3.2 billion. Payments connected to annual indexation will also climb sharply, led by a $3.

6 billion increase in aged pensions, a similar amount on disability pensions and $2.1 billion on JobSeeker. Clearing a backlog in payments due to veterans left by the Morrison government will cost an additional $1.

8 billion, on top of $6.5 billion revealed in the May budget, while natural disasters such as last year’s Tropical Cyclone Jasper will cost an extra $1.8 billion.

Chalmers said average real spending growth will be 1.5 per cent over the six years to 2027-28, half the 30-year average. But this year alone, spending is forecast to lift by 5.

7 per cent after a 2.9 per cent rise in 2023-24. By 2026-27, spending growth is tipped to ease to just 0.

9 per cent. Spending as a proportion of the economy will grow to 26.5 per cent this year, before edging up to 27.

2 per cent in 2025-26. Policy decisions since the budget have pushed up the government’s total payments by $2.5 billion in 2024-25 and by $19.

1 billion for the four years to 2027-28. Improved access to early childhood education and care (ECEC) will cost $840 million in payments over four years from 2024-25, while higher pay for workers in those areas will stack up to $3.6 billion over the same period.

Health is also in focus, with new and amended listings on health schemes including the Pharmaceutical Benefits Scheme costing $2.5 billion over five years from 2023-24. Changes to the NDIS, aimed at bringing down its costs over the longer term, will be a drag on the government’s finances, with measures including 1000 additional staff and a crackdown on NDIS fraud costing $940 million in the four years from 2024-25.

The government is also pumping $250 million over two years to prepare for a possible avian flu outbreak. The update also reveals a collapse in tobacco excise which had been one of the government’s largest sources of revenue. Including 2024-25, the Treasury has wiped a cumulative $10.

7 billion from tobacco excise over the forward estimates with the government now expecting to collect $34.2 billion compared to $44.9 billion by 2027-28.

The government now expects a net 340,000 overseas migrants to move into the country this financial year, a 30 per cent increase on the 260,000 forecast in May. The government is expecting the economy to grow by just 1.75 per cent this financial year, a quarter percentage point lower than what it had predicted in May.

The downgrade is largely due to softer household spending which is tipped to expand by just one per cent this year, after previously being forecast to grow by 2 per cent. Treasury has maintained its inflation forecast for 2.75 per cent this year and next, lower than what is expected by the Reserve Bank.

Wage growth has been downgraded slightly, but will still out-pace inflation over the next two years. Unemployment is also expected to climb to 4.5 per cent by the middle of next year and remain there until to 2026.

Cut through the noise of federal politics with news, views and expert analysis. Subscribers can sign up to our weekly Inside Politics newsletter ..