Having a nonpartisan discussion about fiscal policy is challenging. Let me assure you that my goal is to make money for both you and me and to safeguard our investment portfolios. There is no room in this job for ideology.

That does not mean I am absent of opinion and interpretation—those must exist to make trading decisions. But those opinions and interpretations are in tribute to capitalism, not politics.It is also challenging to write about fiscal policy nowadays because by the time what I have written passes from my computer to my editor, through compliance review, and to the publisher, the world may have changed.

Although that list of hurdles is long, not much time passes from beginning to end—but today’s whimsical rapidity of fiscal policy is a bug in the system. Policy is not traditionally uncertain, which makes investing in this environment a daunting prospect.President Trump announced wide-sweeping global tariffs on April 2, 2025, at 4 p.

m. (after the stock market closed). He dubbed it Liberation Day.

The next trading day, I made several adjustments to my investment allocations to reduce risk exposure to my portfolios. The reciprocal tariffs were conceptually what I expected but were much harsher in practice.On April 9, under pressure from a collapsing stock market and a severely dislocated Treasury bond market, Trump announced that he would reduce these tariffs to 10 percent for all countries except China to give the White House time to negotiate the Liberation Day rates.

A 104 percent tariff remains for China. Times, they are a-changin’. And quickly.

And, in 90 days, the Liberation Day tariff rates could return. Or sooner, if Trump wants to, for whatever reason. Or for no reason whatsoever.

What’s my next trade? On April 9, Trump triggered a massive rally in the stock market. In normal times, announcing a 10 percent tariff on all of America’s trading partners would crash the stock market. In today’s world, a 10 percent across-the-board tariff somehow felt like a win for investors.

However, Trump appears to want tariffs in place, so it seems as if that 10 percent baseline tariff is the new minimum. As mentioned above, he placed a 104 percent tariff on China, unlike other countries. The risk is that the April 9 baseline rates will go much higher, not lower.

Trump’s love affair with tariffs dates back decades, as evidenced by now-viral old video clips of Trump discussing the economic tool with Larry King and Oprah Winfrey. We are all now learning the extent to which tariffs seem to be a part of the fabric that makes up President Trump. On April 3, 2025, Trump used a medical metaphor on his social media platform, Truth Social, to reassure Americans that everything would be okay.

THE OPERATION IS OVER! THE PATIENT LIVED, AND IS HEALING. THE PROGNOSIS IS THAT THE PATIENT WILL BE FAR STRONGER, BIGGER, BETTER, AND MORE RESILIENT THAN EVER BEFORE. MAKE AMERICA GREAT AGAIN!!!Whether investors love or hate tariffs, it is essential to understand Trump’s intended outcome.

I believe that the medical metaphor fell a bit flat. If a surgeon told me I would feel better after a procedure, I am more inclined to believe it if I understand the desired outcome. Are we removing cancer? Replacing a hip? Transfusing blood? Why are you cutting me open, Doc?! Similarly, nervous investors would like to know the intended result of tariffs that justifies the costs along the way.

What is the payout after we recover?A good rule of thumb is that every percentage increase in the tariff rate results in a 0.1 percent increase in inflation in the subsequent year. According to the Office of the United States Trade Representative (USTR), the United States had a trade-weighted average tariff rate of approximately two percent before Liberation Day.

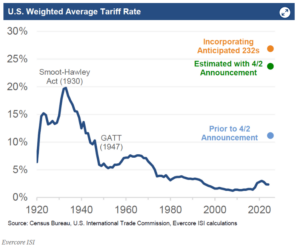

Trump levied a minimum 10 percent tariff on all countries and much higher tariffs on other countries in what the White House called a “kinder” reciprocal tariff. (However, economists generally agree that the mathematics used by the White House were either flawed or, to be generous, unconventional.) Trump’s new policies have increased the effective tariff rate to approximately 24 percent, which is above the 20 percent level set by the 1930s Smoot-Hawley Tariff Act, according to Evercore ISI.

Evercore said the rate could go as high as 27 percent once sector-specific tariffs, called 232s, are implemented.That is a 25 percentage point increase in the tariff rate. So, if that rule of thumb holds, the inflation rate would increase by 2.

5 percent, roughly doubling the current rate to about five percent. There are three factors to consider here. First, if the U.

S. economy enters a recession (which is entirely possible under these new tariffs), the reduced demand is likely to mitigate inflation. Second, the new 90-day 10 percent tariff rate would translate to roughly a 3.

5 percent inflation rate. Thirdly, this heuristic works in a normally functioning economy that follows historical trends. The rule of thumb probably works better if the tariff rate increases by a percentage point or two.

A 13-fold increase in the tariff rate could have a much more profound effect on inflation.Another rule of thumb is that gross domestic product (GDP) growth decreases by 6.5 basis points (or 0.

065 percent) for every 0.1 percent increase in inflation. Therefore, under the Liberation Day rates, the ripple effect of higher tariffs would be a GDP growth rate that is 1.

6 percentage points weaker than it otherwise would have been, or about 0.65 percentage points lower under the 10 percent tariffs implemented on April 9.Again, these heuristics tend to work in normal times.

Both the Liberation Day tariffs and the still-massively high 10 percent rates are outside the scope of history or even most economists’ contemplation. Therefore, inflation could rise significantly, and the economy could contract more deeply than historical trends suggest.If higher inflation and slower economic growth are part of the medicine, what is the ailment Trump is trying to heal with tariffs? He and his cabinet members have mentioned several outcomes.

Let’s explore them in no particular order.Raising tax revenuePeter Navarro, counselor to the president, claims that the Liberation Day tariffs would raise $600 billion to $700 billion annually. For comparison, in fiscal year 2024, the U.

S. Treasury collected approximately $2.4 trillion in individual income taxes, which accounted for about 49 percent of the total federal revenue of $4.

9 trillion. Other sources included payroll, corporate income, and excise taxes. However, Mr.

Navarro’s math is pretty much a straightforward calculation of the increased tariff rate multiplied by the current dollar volume of imports, which is currently about $3.2 trillion (emphasis on “current”).The calculation does not take downstream effects into account.

For example, if the current amount of imports to the U.S. drops, then the estimated revenue amount would not be achieved.

Buy AmericanOne of the president’s goals is to encourage U.S. citizens and companies to purchase from domestic manufacturers.

If that occurs, imports to the U.S. will decrease, and the U.

S. will collect less than Navarro’s $700 billion estimate. Remember that other countries would not pay the money collected through these tariffs, as some people mistakenly believe.

These imports are paid for by U.S. companies buying the foreign goods, which likely pass much of the additional costs onto consumers like you and me.

The tariff tax hike on U.S. companies is the most significant tax increase since the Revenue Act of 1968, which instituted a temporary 10 percent income tax to fund the Vietnam War.

Slower economic growth could develop due to the tax on corporations and also because tariffs are a regressive tax on lower-income households, who must now contend with higher prices. The Yale Budget Lab estimated prior to Liberation Day that a 20 percent broadly applied tariff would cost the average consumer $3,400 to $4,200 per year. A higher share of the budget of low-income households is devoted to low-cost products from foreign nations relative to high-income households.

Move manufacturing to the U.S.These new tariffs are not codified into law.

They were implemented via executive order, based on Trump’s assertion that a national economic emergency exists. Ignoring, for a moment, that the previous tariff situation had been in place for decades and there was no apparent emergency by the strict definition of the word, no reasonable manufacturer is going to relocate its facilities to the U.S.

when these tariffs can be replaced at the President’s whim.Suppose you are the CEO of a company that manufactures cars in Mexico. The current hourly wage for your laborers is $6.

Can you afford to quintuple your average union wage? And even if you did, can any prudent planner count on these tariffs being in place in the long run? Are you going to spend the next two or three years building and retooling plants, hiring and training workers if it is not a long-term investment?Even if Trump keeps the tariffs on throughout his presidency, will the next president keep them?Bring manufacturing jobs back to AmericaAccording to the Job Openings and Labor Turnover (JOLTS) survey, there are approximately 7.6 million job openings at American companies. The U.

S. does not have a jobs problem; it has a labor problem.Manufacturers employ approximately 12.

9 million workers, accounting for about eight percent of U.S. employment.

If manufacturing jobs are brought from overseas to U.S. soil, many of those tasks will be completed by robots, not Americans.

How many jobs would be created through these tariffs? Tens of thousands? I don’t think it would be 100,000.The term “American exceptionalism” exists, in part, because the United States is an outlier in innovation, technological advancement, entrepreneurial culture, and access to capital. Do we want to allocate U.

S. workers and other resources to replace the offshore manufacturing of shoes, cheap clothes, mattresses, and textiles?FairnessThere are instances when the U.S.

is mistreated, but those could be addressed with precision rather than broad strokes. Although the current administration appears to hold this view on principle, there is nothing inherently wrong with a trade deficit.When I go to a restaurant that serves me a plate of risotto and a mocktail, I do not get upset with them because they take my money.

They produced something I wanted and I took it.The U.S.

is positioned in the middle range of tariff rates compared to other countries. The actual score changes from year to year because the composition of imports and exports, as well as prices, fluctuates. Nonetheless, half of all other countries charge the U.

S. a lower-weighted average tariff than the U.S.

charges them. However, Trump levied a minimum 10 percent tariff on all countries. If we wanted to be fair, shouldn’t we have lowered our tariffs on those countries?Give tax cuts to AmericansThe possibility of tax cuts germinating from tariffs is a bonus reason that many people have opined, but I have not heard directly from the White House—and with good reason.

Tax cuts must be codified into law, but those cuts must be offset by other revenue or spending reductions. The Congressional Budget Office (CBO) will not score any revenue from these tariffs as revenue because they are not legislated by Congress; instead, they are the result of an executive order.A tool to negotiateSome presume that if Trump wanted to negotiate something, it would be for zero tariffs across the board.

But what are other countries negotiating against? The Liberation Day math is all messed up on what the White House calls the “kinder” reciprocal rates. As the bipartisan Tax Foundation explains, “Trump’s reciprocal tariff calculations draw its estimates from bilateral trade deficits in goods, a fundamentally flawed method.”As an example, The Wall Street Journal explains that the White House divided the U.

S.’s 2024 goods-traded deficit with China—$295 billion—by the amount of goods the U.S.

imported from China, resulting in the White House’s calculation of 67 percent.As a result, Trump levied a 34 percent tariff on China (approximately half of China’s perceived rate) on top of other existing levies. China’s weighted average tariff rate on imports from the U.

S. was approximately 21 percent before April 2025. (Since then, and as of this writing, China has retaliated with its own 34 percent tariff rate.

)Israel eliminated all tariffs on U.S. goods on April 1, before Liberation Day, in an attempt to strengthen economic ties and preempt potential trade disputes.

Despite this, the White House imposed a 17 percent tariff rate on Israel. Israeli officials expressed surprise and concern, noting the administration’s “flawed” calculation based on a perceived 33 percent tariff rate previously imposed by Israel on U.S.

goods.It seems that Trump scrapped these Liberation Day plans because the stock market crashed, and the Treasury market became dislocated. The master politician that he is, he then spun the move as if they were part of his master plan all along.

But, and I ask this as politically neutral as possible, should we believe the plan was to wipe out $6 trillion of U.S. stock market capitalization to fill a $1 trillion deficit that no reasonable economist saw as a significant issue?I am glad to see Trump acting on what he perceives as unfair trade practices that are hurting Americans.

This is a commendable notion, in theory. However, even the staunchest Trump supporters are feeling the pain of the tactics used—even at these “lower” 10 percent rates, which is still dangerously high. I am glad Trump is starting his operation.

I am glad he wants America to heal. But what ailment is he trying to fix? Corporations, households, and investors are left on the sidelines, frozen in uncertainty, as we await clarity from the White House.After Liberation Day, I said I expected Trump to relax those tariffs considerably, whether they are part of a larger negotiation strategy or because he relents from the pressure of other countries forming their own trade blocks that exclude the U.

S. That is why I made some investment portfolio tweaks, but I did not go to all cash or short the market. However, I remain cautious, with my eye on economic deterioration that could trend to a recession in the U.

S.In an address to the nation, President Ronald Reagan explained the dangers of excessive protectionism in the form of tariffs. Some of his comments on tariffs included:Over the long run, such trade barriers hurt every American worker and consumer.

..Today, many economic analysts and historians argue that high tariff legislation passed back in that period, called the Smoot-Hawley Tariff Act, greatly deepened the depression and prevented economic recovery.

You see, at first, when someone says, ‘Let’s impose tariffs on foreign imports,’ it looks like they’re doing the patriotic thing by protecting American products and jobs.And, sometimes, for a short while, it works. But only for a short time.

What eventually occurs is, first, homegrown industries start relying on government protection in the form of high tariffs. They stop competing and stop making the innovative management and technological changes they need to succeed in world markets. And then, while all this is going on, something even worse occurs.

High tariffs inevitably lead to retaliation by foreign countries and the triggering of fierce trade wars. The result is more and more tariffs, higher and higher trade barriers, and less and less competition. So, soon, because of the prices made artificially high by tariffs that subsidize inefficiency and poor management, people stop buying.

Then the worst happens. Markets shrink and collapse. Businesses and industries shut down, and millions of people lose their jobs.

History provides a harsh lesson with the infamous Smoot-Hawley Tariff Act of 1930. That sweeping protectionist measure deepened and prolonged the Great Depression by igniting trade wars that decimated American exports. Trump’s tariffs risk triggering a similar spiral, inviting retaliation from major trade partners.

Most urgently, Trump’s tariffs could significantly fuel inflation, directly contradicting his own pledge to bring down consumer prices and stabilize the economy. High inflation rates erode purchasing power, diminish consumer confidence, and lead to higher interest rates—crippling small businesses and hampering economic growth.Trump’s proposed global tariffs are risky.

Instead of strengthening America’s economy, these protectionist measures threaten to plunge the country into recession.Allen Harris is an owner of Berkshire Money Management in Great Barrington and Dalton, managing more than $700 million of investments. Unless specifically identified as original research or data gathering, some or all of the data cited is attributable to third-party sources.

Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Advisor’s clients may or may not hold the securities discussed in their portfolios. Advisor makes no representations that any of the securities discussed have been or will be profitable.

Full disclosures here. Direct inquiries to Allen at [email protected].

.

Business

CAPITAL IDEAS: Why does President Trump love tariffs?

I am glad Trump is starting his operation. I am glad he wants America to heal. But what ailment is he trying to fix?