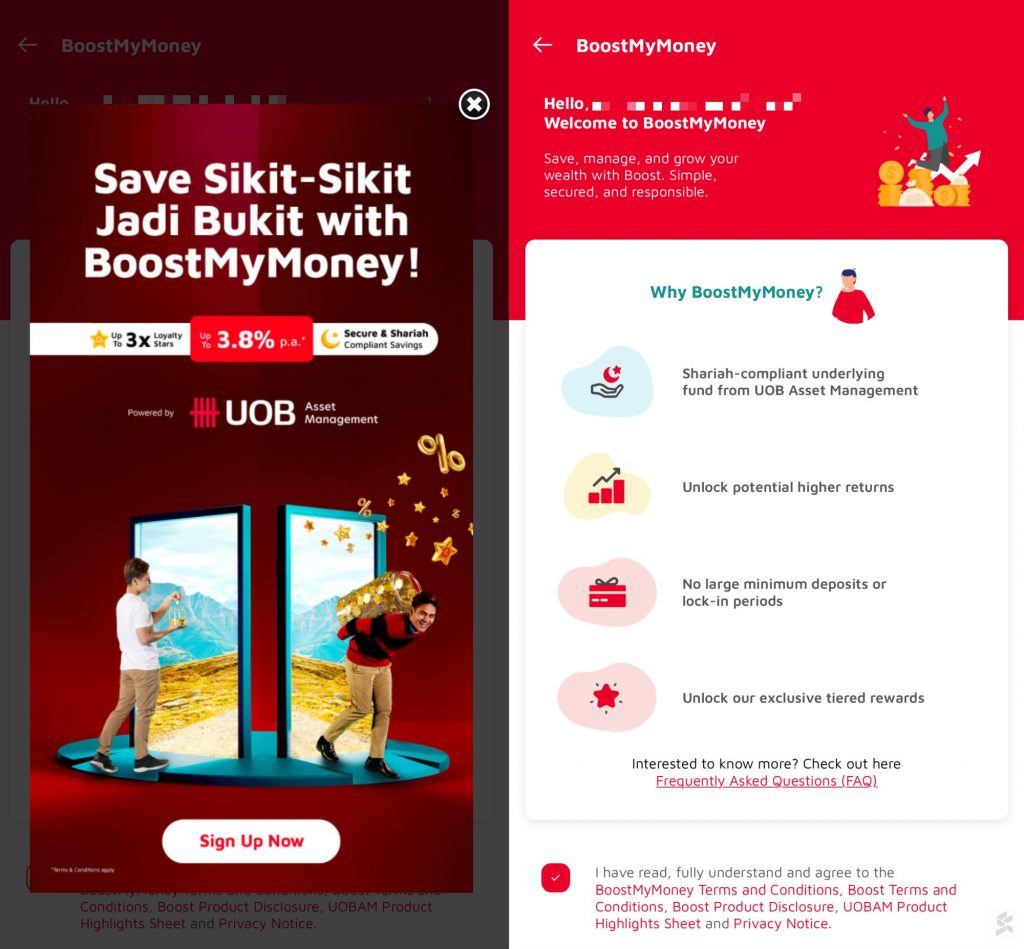

Boost eWallet and UOB Asset Management (UOBAM) have launched BoostMyMoney . This is a Shariah-complaint unit trust product which aims to help Boost eWallet users save and and potentially earn higher returns. On top of that, BoostMyMoney users can earn more rewards for each ringgit saved with a minimum monthly average balance.

According to Boost, the collaboration with UOBAM strives to simplify investments for beginners by offering flexibility and affordability, through the convenience of the Boost eWallet app. The collaboration will also focus on future initiatives that will introduce innovative investment products on the digital app to encourage saving habits among Malaysians Boost added that with BoostMyMoney, the eWallet will leverage on UOBAM’s fund management experience and expertise to encourage tech-savvy Malaysians, especially the young and risk-adverse, to grow their nest eggs with up to 3.82% returns per annum.

It added there’s no lock-in periods and users can start with a minimum deposit of just RM1. To get started, users can launch their Boost eWallet app and tap on the BoostMyMoney banner or icon on the home screen. BoostMyMoney is currently available for Malaysian users aged 18 years old and above who have been upgraded to Boost Premium and completed the eKYC (electronic Know Your Customers) process.

Users can deposit from as little as RM1 via their Boost eWallet balance. Credit card deposits are not accepted as it only accepts funds deposited via debit card or bank account. There’s no mention of a maximum deposit amount for BoostMyMoney and the FAQ states that the maximum limit depends on your Boost eWallet balance.

Any deposits will only be reflected in the next working day if it is made before 4pm. Deposits made after the cut-off period will be reflected on the following working day. After making a deposit, users can view details of their investment by tapping on the Total Value icon on the BoostMyMoney page.

The underlying fund is United Islamic Cash Management Fund, a Shariah-compliant Money market fund managed by UOBAM. It is stated that the funds are not protected by PIDM, but any investment or capital/money market fund is regulated by the Securities Commission Malaysia (SC). According to the FAQ, the earning rate is a projected/estimated gross return rate excluding the management and trustee fee per annum over the next 12 months.

There’s a management fee of 0.5% per annum and trustee fee of 0.025% per annum, so the projected net earning rate/returns is 3.

275% from the advertised 3.8% per annum rate. Users can withdraw up to 95% of their funds instantly to their Boost eWallet.

However, full withdrawals or withdrawals to bank accounts may take up to 4 days. To encourage more savings, Boost says this is the only eWallet-based savings feature that rewards you with Loyalty Points. Users can earn more Boost Stars for every RM1 saved and it the rewards will multiply according to your loyalty while maintaining a Monthly Average Balance (MAB) of at least RM500 .

Users can earn 1x Boost Stars for every RM1 saved in the first 4 months, and it will increase to 2x Boost Stars between month 5 and 8, and eventually to 3x Boost Starts between month 9 and 12, while maintaining a minimum RM500 MAB. As part of their introductory offer, Boost eWallet users can earn a Bonus of 15,000 Boost Stars by making a deposit of RM500 and maintain that savings for at least 5 days. The Boost Stars can be used to provide savings and discounts for bills, groceries, petrol and redeem items from the BoostUp Catalogue.

Boost eWallet’s BoostMyMoney seems to be a direct competitor to TNG eWallet Go+ but there are several notable differences. TNG eWallet Go+ currently displays a rate of 3.49% p.

a. at the time of writing, however users can earn their returns daily which is reflected in the transaction history. On top of that, TNG eWallet offers automatic cash-in and quick pay function which allows TNG eWallet users to instantly move all funds to Go+ to maximise their savings and they could also utilise funds from Go+ for daily spending.

Essentially, BoostMyMoney functions like a traditional unit trust product that functions in an isolated account where deposits and withdrawals are performed manually. Meanwhile, Go+ offers extra flexibility as Go+ functions like an investment-linked eWallet balance with daily returns. The underlying fund for TNG eWallet’s Go+ is Principal e-Cash which is also a Shariah-compliant Money Market Fund.

TNG eWallet has also recently increased the Go+ Wallet limit from RM9,500 to RM20,000. To learn more, you can visit BoostMyMoney’s website ..