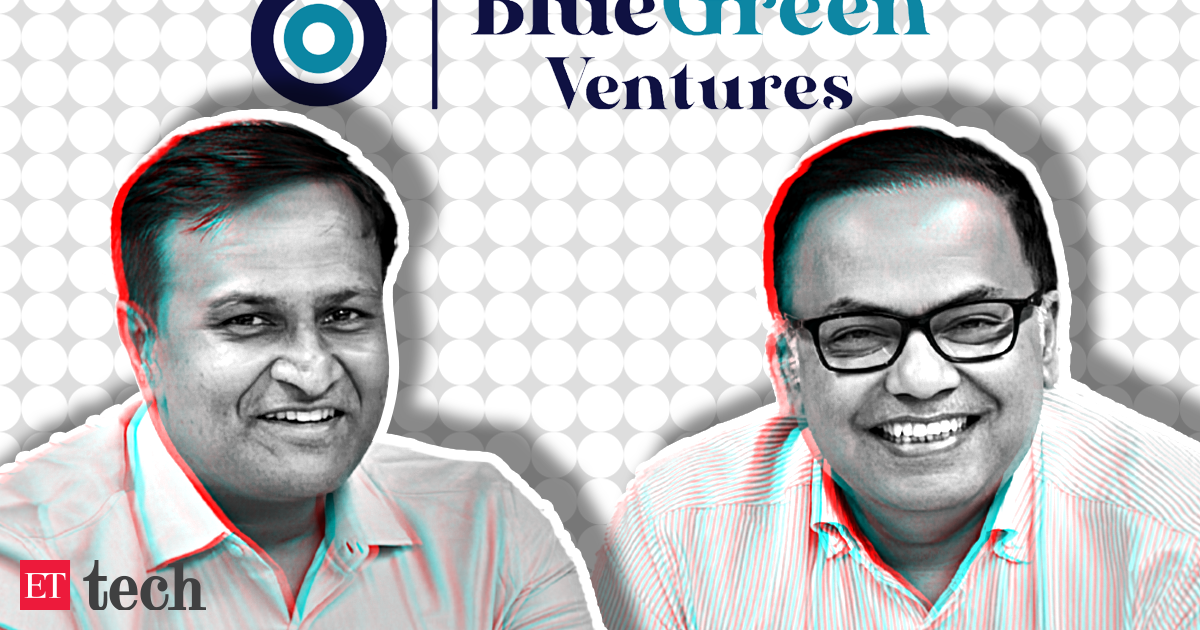

Anup Jain and Rajeev Suri , who left early-stage venture firm Orios Venture Partners as managing partners in September 2023, have floated a new investment firm – BlueGreen Ventures , the duo told ET in an interaction. The firm is looking to raise $75 million along with a greenshoe option of another $25-30 million, they said. “We are looking at maybe the next couple of months or so for the first close, and maybe another two-three quarters after that for the final close,” Suri said.

The fund will back startups in the early stage and pick stakes in pre-IPO companies through secondary transactions. It will focus on sectors such as climate and sustainability, fintech and consumer businesses. Marketing Modern Marketing Masterclass by Seth Godin By - Seth Godin, Former dot com Business Executive and Best Selling Author View Program Office Productivity Mastering Google Sheets: Unleash the Power of Excel and Advance Analysis By - Metla Sudha Sekhar, IT Specialist and Developer View Program Artificial Intelligence(AI) Generative AI for Dynamic Java Web Applications with ChatGPT By - Metla Sudha Sekhar, IT Specialist and Developer View Program Web Development C++ Fundamentals for Absolute Beginners By - Metla Sudha Sekhar, IT Specialist and Developer View Program Marketing Future of Marketing & Branding Masterclass By - Dr.

David Aaker, Professor Emeritus at the Haas School of Business, UC Berkeley, Author | Speaker | Thought Leader | Branding Consultant View Program Strategy Succession Planning Masterclass By - Nigel Penny, Global Strategy Advisor: NSP Strategy Facilitation Ltd. View Program Artificial Intelligence(AI) Tabnine AI Masterclass: Optimize Your Coding Efficiency By - Metla Sudha Sekhar, IT Specialist and Developer View Program Artificial Intelligence(AI) Basics of Generative AI: Unveiling Tomorrow's Innovations By - Metla Sudha Sekhar, IT Specialist and Developer View Program Finance A2Z Of Finance: Finance Beginner Course By - elearnmarkets, Financial Education by StockEdge View Program Finance AI and Generative AI for Finance By - Hariom Tatsat, Vice President- Quantitative Analytics at Barclays View Program Web Development Intermediate C++ Skills: Master Pointers, Structures and File Stream By - Metla Sudha Sekhar, IT Specialist and Developer View Program Office Productivity Mastering Microsoft Office: Word, Excel, PowerPoint, and 365 By - Metla Sudha Sekhar, IT Specialist and Developer View Program Finance Crypto & NFT Mastery: From Basics to Advanced By - CA Raj K Agrawal, Chartered Accountant View Program Artificial Intelligence(AI) AI-Powered Python Mastery with Tabnine: Boost Your Coding Skills By - Metla Sudha Sekhar, IT Specialist and Developer View Program Artificial Intelligence(AI) AI and Analytics based Business Strategy By - Tanusree De, Managing Director- Accenture Technology Lead, Trustworthy AI Center of Excellence: ATCI View Program Office Productivity Zero to Hero in Microsoft Excel: Complete Excel guide 2024 By - Metla Sudha Sekhar, IT Specialist and Developer View Program Web Development Advanced C++ Mastery: OOPs and Template Techniques By - Metla Sudha Sekhar, IT Specialist and Developer View Program Web Development Intermediate Java Mastery: Method, Collections, and Beyond By - Metla Sudha Sekhar, IT Specialist and Developer View Program Artificial Intelligence(AI) Master in Python Language Quickly Using the ChatGPT Open AI By - Metla Sudha Sekhar, IT Specialist and Developer View Program Web Development Java 21 Essentials for Beginners: Build Strong Programming Foundations By - Metla Sudha Sekhar, IT Specialist and Developer View Program Marketing Performance Marketing for eCommerce Brands By - Zafer Mukeri, Founder- Inara Marketers View Program For early-stage investments , the fund will lead the round with an average cheque size ranging from Rs 7 crore to Rs 12 crore, while for late-stage companies, the amount will range between Rs 20 crore and Rs 30 crore, the partners said. Discover the stories of your interest Blockchain 5 Stories Cyber-safety 7 Stories Fintech 9 Stories E-comm 9 Stories ML 8 Stories Edtech 6 Stories In the early-stage bets, BlueGreen Ventures plans to lead the funding rounds.

Jain said the firm will primarily target startups building localised solutions for Indian problems within BlueGreen Ventures’ focus sectors. “We want to build on our success on climate and sustainability models addressing India-specific climate goals and problems with Indian entrepreneurs and Indian solutions at scale. And that’s what drives our passion to make this and, sure enough, our confidence is extremely high because we’ve experienced success as fund managers in those two,” he said.

The firm has already raised commitments from some chief executives of global companies, Jain and Suri said. They did not disclose the names of the sponsors. “For fund managers, it’s always about where the returns can be found.

And these are risky returns, which means that these are new business models which don’t exist today. Entrepreneurs bring that model to life. We bet on them, and we support their journey, and they’re able to create a business model out of it,” Jain said.

At Orios Venture Partners, Jain was a part of the investment team while Suri led the firm’s investor relations. Their combined portfolio of investments includes BatterySmart, Zupee, CarDekho, Ixigo, Mobikwik, Bimaplan and Werize. Before his time with Orios VP, Jain spent over two years building Redback Advisory services, which mentored startups.

Prior to that, he was senior vice president of retail at Bata and senior director of strategic projects at Pizza Hut. Suri, who joined Orios VP in 2019, was previously senior vice president and new business incubator at Viu, a Hong Kong-based over-the-top video streaming provider. Among other roles in the past, he was chief marketing officer and senior vice president at Reliance Jio and head of global marketing at Infosys.

.