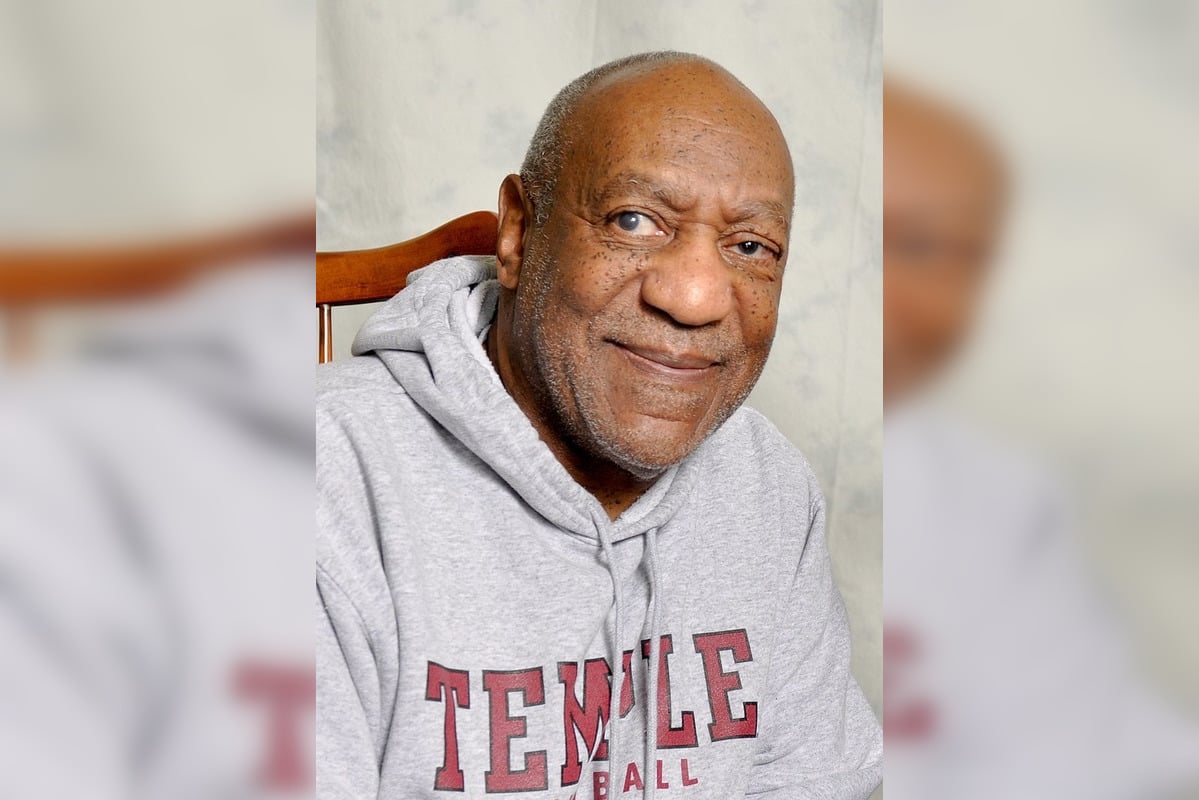

Bill Cosby, the embattled entertainer once heralded as "America's Dad," is confronted with foreclosure proceedings on two upscale Manhattan properties. In a lawsuit filed in Manhattan Supreme Court, First Foundation Bank alleges that Cosby and his wife, Camille, have defaulted on a substantial $17.5 million loan tied to their six-story townhouse located on East 71st Street, as reported by Crain's New York .

Acquired in 1987 for $6.2 million, the property served as a primary residence for the Cosbys. On an unrelated front, CitiMortgage has instigated a separate legal action over a townhome on East 61st Street, 10 blocks away from the previously mentioned address.

The loan in question amounts to $4.2 million, with Cosby allegedly owing $3.7 million of that sum, according to the New York Post .

The property, which spans approximately 5,000 square feet, was reportedly serving as a secondary residence. Documents from First Foundation Bank's lawsuit reveal the Cosbys have not made payments since June 1, 2024. In a communication from November of the preceding year, an attorney for First Foundation warned that they owed "$791,500 in principal, interest and late fees, plus attorney's fees.

" Prior to these recent legal troubles, Cosby had encountered loan default issues with the same property in 2023 but managed to settle part of the debt with a payment surpassing $500,000. Bill Cosby's financial and legal quandaries escalated following allegations and a conviction for sexual misconduct, which was later overturned by Pennsylvania’s highest court. In attempts to manage legal costs, it was reported by Crain's New York in 2017 that Cosby was seeking a $30 million loan against the 71st Street townhouse.

As public records indicate, the beleaguered comedian and his wife are yet to designate legal representation for their current foreclosure cases..