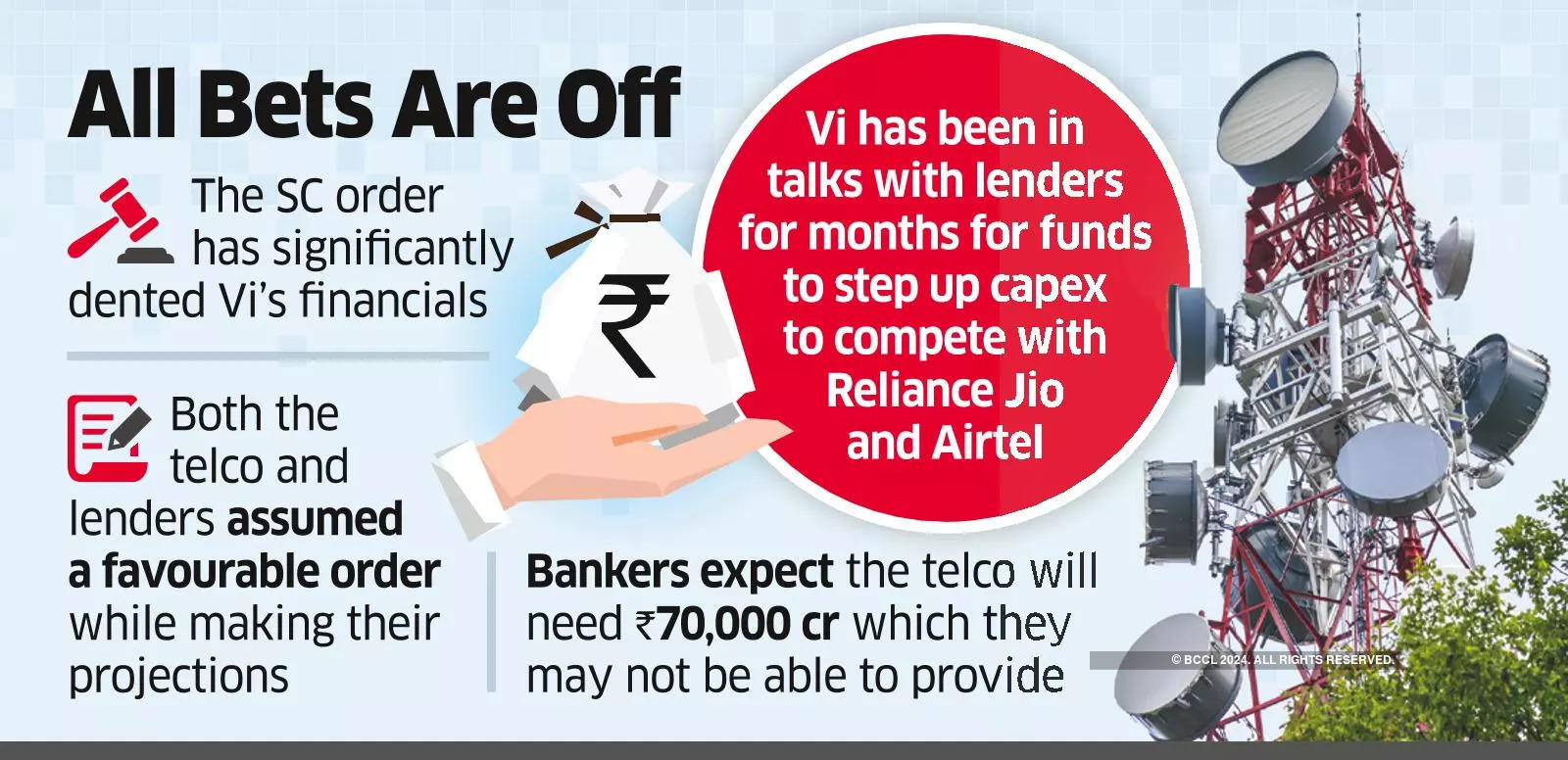

The apex court's rejection of Vodafone-Idea (Vi)'s curative petition seeking a review of its 2019 judgment on the re-computation of adjusted gross revenues (AGR) payable by telecom firms has made banks wary of lending to the company. Bankers said the court's order significantly dented Vi's financials because both lenders and the company had assumed a favourable order while making business projections. "No decision has been made by lenders on the loans but the SC order has definitely changed calculations.

Government dues owed by the company were always the bone of contention because the numbers we are talking about are huge. Banks will have to reassess what they want to do in light of the latest development," said a person aware of the negotiations. Advt Vi has been in talks with lenders for months as it seeks funding to step up the capital expenditure necessary to compete effectively with bigger rivals Reliance Jio and Airtel .

In June ET had reported that Vi had sought Rs 23,000 crore from banks in term loans and another Rs 10,000 crore in bank guarantees. Banks have already initiated a techno-economic viability (TEV) report from a top consultancy firm to assess Vi's creditworthiness before taking a call on sanctioning the loan. A TEV study, typically, makes a critical assessment of the technological, market, financial and regulatory risks facing a company.

It helps banks take into account possible risks before lending large sums to a company. "The draft TEV report is still being deliberated on by banks but with this SC order the company's liabilities have substantially increased. Taking those liabilities into account the company could need at least Rs 70,000 crore of loans which the banking system may not be in a position to give," said a second person aware of the negotiations.

As of March 31, the company owed more than Rs 2 lakh crore to the government, including Rs 1.33 lakh crore in deferred spectrum payments and Rs 70,320 crore in AGR dues . With the SC denying relief on AGR dues, bankers will seek a concrete proposal from the company on how they plan to meet these liabilities.

Advt "Private sector banks have indicated that they will prefer to sit out any new funding for Vi, which leaves the ball in the court of PSU lenders led by SBI . Even SBI has indicated that it will only be game to fund the company if there are other lenders joining it in a consortium. Other options are public sector NBFCs like Power Finance Corp (PFC) and Rural Electrification Corp (REC)," said the first person cited above.

SBI did not reply to an email seeking comment. Earlier this month, ET reported that Vi had approached PFC and REC for loans to meet medium-term funding requirements. Banks in informal discussions with Vi have suggested a corporate guarantee from the Aditya Birla Group to make the loan more palatable.

But there has been no response from the group as yet. "Only a strong guarantee by the group can salvage the situation to make bank lending possible. As things stand now everything is in limbo.

The signal from Vodafone is also not good since it sold its entire take in Indus Towers a few months ago. So it's all about what the Birla group wants to do now," said the second person cited above. In June Vodafone announced that it had sold an 18% stake - out of its 21.

05% holding - in Indus Towers for Rs 15,300 crore via an accelerated book-building offering. The stake sale proceeds will be used to clear the bulk of the UK company's existing lender dues relating to Rs 1.8 billion of borrowings secured against its Indian assets, the company had said.

By Joel Rebello , ET Bureau Published On Sep 24, 2024 at 07:33 AM IST Telegram Facebook Copy Link Be the first one to comment. Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button. This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis.

Download ETTelecom App Get Realtime updates Save your favourite articles Scan to download App Vodafone Idea news sbi indus towers AGR Dues vodafone loans Indus Towers airtel telecom news AGR dues case Vodafone Idea.