Bank Zero has seen “robust” 40% year-on-year customer growth over the last two years, and the digital-only player is expecting to break even in the next two years. The branchless bank has set a target to gain 100 000 new customers by 2027, to meet its vision of breaking even within this time frame. The bank received its licence one year after competitors TymeBank and Discovery Bank, and launched to the public in August 2021.

It is co-founded by seven investors, including former First National Bank CEO Michael Jordaan and banking innovator Yatin Narsai. Narsai, CEO of Bank Zero, tells ITWeb the bank is accelerating its growth strategy through new partnerships and new offerings. “We are seeing robust customer growth of 40%.

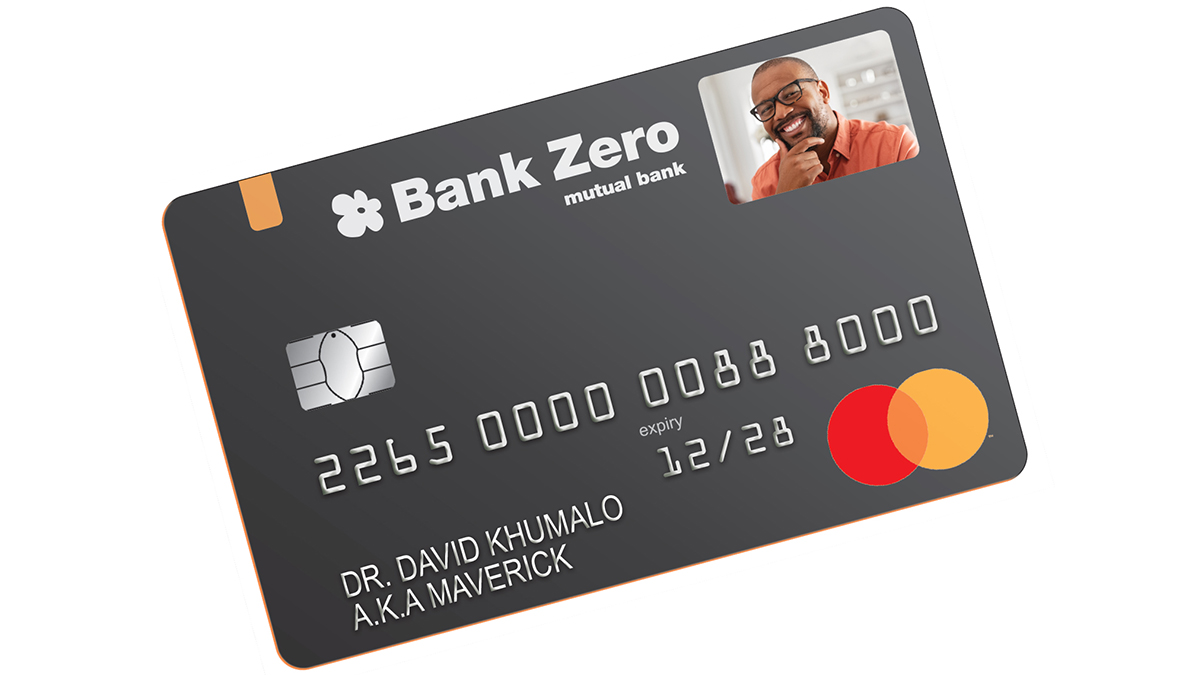

Our growth in business customers is much higher than even we expected – even though we did forecast good business segment growth. “This translates into just 100 000 customers needed to achieve break-even. Other new banks are burdened with expensive IT systems (priced in USD, EUR or GBP) and require over two million customers to reach break-even.

Bank Zero uses its own IT systems with built-in innovations like our card patent.” The number of digital banks has grown tremendously globally over the last two years, but only a few are profitable, according to a report from consulting firm Simon-Kucher. Of those that are in the black, most have taken a lot longer to become profitable, such as Latin America’s Nubank and London-based Monzo, which took eight and seven years, respectively.

Last March, Discovery Bank reached its monthly operational break-even ahead of the group’s target date – four years since its launch in 2020. TymeBank became the first digital bank to make a profit in South Africa and on the continent, after reaching its first month of profitability in December 2023. The milestone came less than five years since it launched to the public in February 2019.

Since its launch, Bank Zero has been targeting high-value customers, which includes businesses. According to Narsai, business customer growth is faster than individual customer growth. Customer growth in general is strong, yet it is positively outstripped by the growth in card turnover and accounts – a sign of strong customer quality.

This growth is boosted by business-focused banking services and capabilities, such as bulk file pays, the ability to pay multiple recipients at once, flexible and secure mandate management, Xero accounting integration, Excel integration and relationship banking,Narsai points out. “We have a larger share of businesses on our base than what we were expecting. Our business case worked on 10% of accounts belonging to businesses, but we’re seeing closer to 15%.

This is in the early stages, and we expect even further growth. “We bank almost all business types, from something as basic as a sole trader (which is often the only zero-fee business account offered by other banks), to something as large as a PTY and something as complex as an NPO.” Despite growing competition in SA’s digital-only banking market, Narsai says South Africans are increasingly recognising the convenience, efficiency and low fees offered by new digital players, in comparison to traditional incumbents.

This trend is resulting in more consumers ditching their traditional financial institutions in favour of new, agile players, he adds. As part of its ongoing efforts to add services, Bank Zero is looking to introduce international EFTs and phone tap payments, he notes. This, after the bank last year introduced the ‘pay many’ functionality and immediate payments on its app.

“We expect to rollout international EFTs by 2026. Phone taps is being rolled out and is eagerly embraced by our customers. Google Pay has been live for a while.

Apple Pay is in beta testing.Immediate payments have also been actively used since it went live last October. “Introducing app-jacking prevention features is also in the pipeline.

It’s an incremental journey that builds upon a stable and robust banking platform. This creates steady traction without burning huge amounts of capital, allowing us to keep costs low for customers.” Discussing challenges faced by digital banks in the local landscape, Narsai states that a capital-intensive business model does come with setbacks.

“Key challenges facing SA’s digital-only banking sector includes capital efficiency – or lack thereof. Also, some market segments are extremely difficult to break into. Creating ‘me-too’ banking solutions, and then just adding ‘cute’ app screens to that is not always the answer,” he concludes.

.

Business

Bank Zero charts path to break-even in two years

After 40% year-on-year customer growth, the digital-only financial player aims to gain 100 000 new clients and expects to break even by 2027.