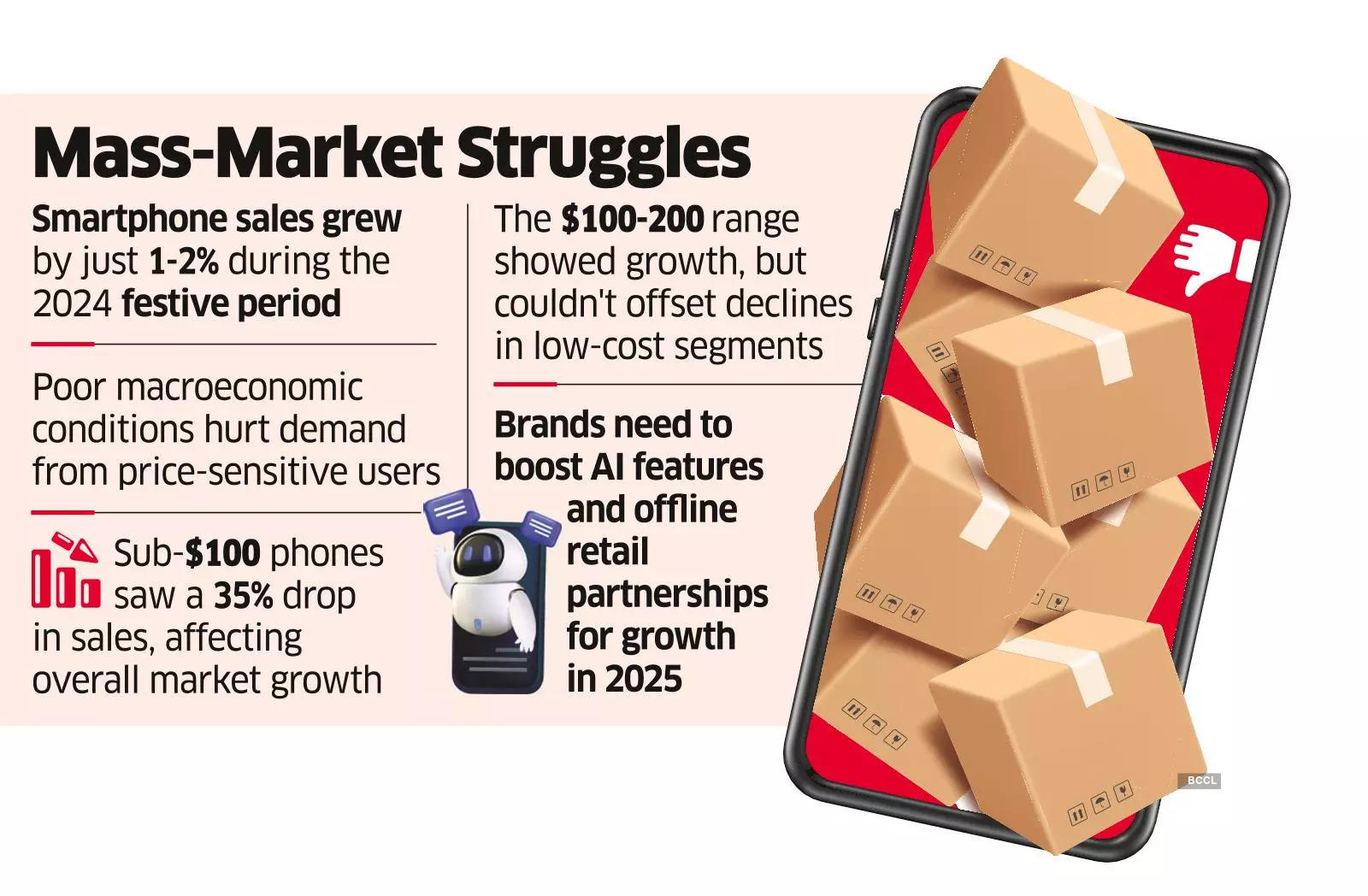

New Delhi: After a tepid festive season for smartphone sales with low single-digit increase in volume, market trackers estimate shipments to be flat for the second year in a row in 2024. Analysts expect 2025 to also witness low single-digit growth, which will hinge on whether brands are able to revive demand in the mass-segment and make generative AI features more attractive to users. Brands need to revamp partnerships with offline retail channels and increase marketing spending around generative AI features in smartphones, they added.

According to Counterpoint Research , the 30-day festive period, which this year started late-September and lasted till end-October, saw volumes grow only 1-2% compared with the previous season. Advt Compared with last year, which saw double-digit volume growth, sales in the 2024 festive season were dragged by low demand for mass-market devices that used to be the biggest volume drivers for the industry, Counterpoint said. "The festive season was slightly better than last year, but not as impactful as it used to be in the pre-pandemic years.

Volume drivers like the sub-$100 phones are not seeing high demand because of poor macroeconomic conditions with the bottom-of-the-pyramid users under stress," said Prachir Singh, senior analyst, Counterpoint Research. The research firm said this mass-segment's share of overall volume was around 30% in the third quarter of 2023. By Q3 2024, this share had come down to under 20%, marking a significant decline.

IDC data also revealed a similar trend, with the sub-$100 segment going down from 21% in Q3 of last year to 13% in Q3 this year, marking a 35% on-year fall in volumes, amid low demand. The sharp decline in this segment offset the growth the market saw in the $100-200 segment and beyond, resulting in flat growth for the year, they said. The smartphone industry shipped 146 million units in 2023, growing by just 1%, according to IDC.

Counterpoint said the market remained flat in 2023 at 152 million units, dragged by a slow first half with better-than-expected sales in the second half keeping the market from declining. Advt In 2024, there was volume growth in all three quarters, but a sharp decline is expected in the fourth quarter as demand tapered off after the festive season. According to IDC, shipments grew 12% on-year in Q1, 3% in Q2 and 6% in Q3, clocking 115 million till end-September.

"Q4 2024 estimates look anywhere between 35 million to 37 million with moderate inventory. There are multiple launches lined up for December, the sell-in for which should be reflecting early in Q1 2025. Consumer demand after festive season tapers down," said Upasana Joshi, senior manager, IDC.

She expects 2024 shipments to be 151-152 million units. Counterpoint Research estimates the market to end 2024 also with 152 million units. For 2025, Joshi is predicting low single-digit growth.

"It needs strong growth especially in the $100-400 segment and affordable offerings, and marketing around GenAI features on smartphones," she said. By Subhrojit Mallick , ET Bureau Published On Dec 19, 2024 at 07:58 AM IST Telegram Facebook Copy Link Be the first one to comment. Comment Now COMMENTS Comment Now Read Comment (1) All Comments By commenting, you agree to the Prohibited Content Policy Post By commenting, you agree to the Prohibited Content Policy Post Find this Comment Offensive? Choose your reason below and click on the submit button.

This will alert our moderators to take actions REASONS FOR REPORTING Foul Language Defamatory Inciting hatred against a certain community Out of Context / Spam Others Report Join the community of 2M+ industry professionals Subscribe to our newsletter to get latest insights & analysis. Download ETTelecom App Get Realtime updates Save your favourite articles Scan to download App smartphone sales festive season smartphone demand smartphone market growth 2024 generative AI smartphones Counterpoint Research IDC smartphone sales data mass-market smartphone devices IDC India smartphone shipments.