Mukesh Ambani-led Reliance Industries Ltd (RIL) has emerged as a key contender for a significant stake in the Indian operations of Chinese consumer electronics and appliance manufacturer Haier, which is seeking to localise the business by roping in a homegrown strategic partner, said people in the know. The move pits RIL against a consortium that includes Sunil Mittal of the Bharti Group, mirroring their competition in the telecommunications sector. Haier Appliances India, ranked third after LG and Samsung, has been considering a plan to dilute 25% to 51% equity, including an MG Motors-style structure, in which an Indian entity becomes the single largest shareholder.

It has been seeking a $2-2.3 billion valuation, which includes a control premium, said the people cited. The company has been working with Citi since late last year to tap large family offices and private equity funds for a stake sale.

ET was first to report on December 25 that Mittal had formed a consortium with Warburg Pincus. In this battle of billionaires, the other groupings include TPG and the Burman family of Dabur; Goldman Sachs and the Amit Jatia family; and GIC of Singapore with BK Goenka of Welspun, after initially joining forces with Uday Kotak ( yes GIC) The combine of the family office of Puneet Dalmia of the Dalmia Bharat Group and Bain Capital have opted out.120674533 Chinese companies are now more amenable to conditions requiring stake dilution in favour of Indian entities if they want to expand in the country following Donald Trump’s tariff blitz.

With that threatening to price their products out of the US market, Chinese companies are eager to gain ground in India. Reliance entered the race after non-binding offers were made in the beginning of the year. Its advisors have directly approached Haier’s headquarters in Qingdao, according to people in the know.

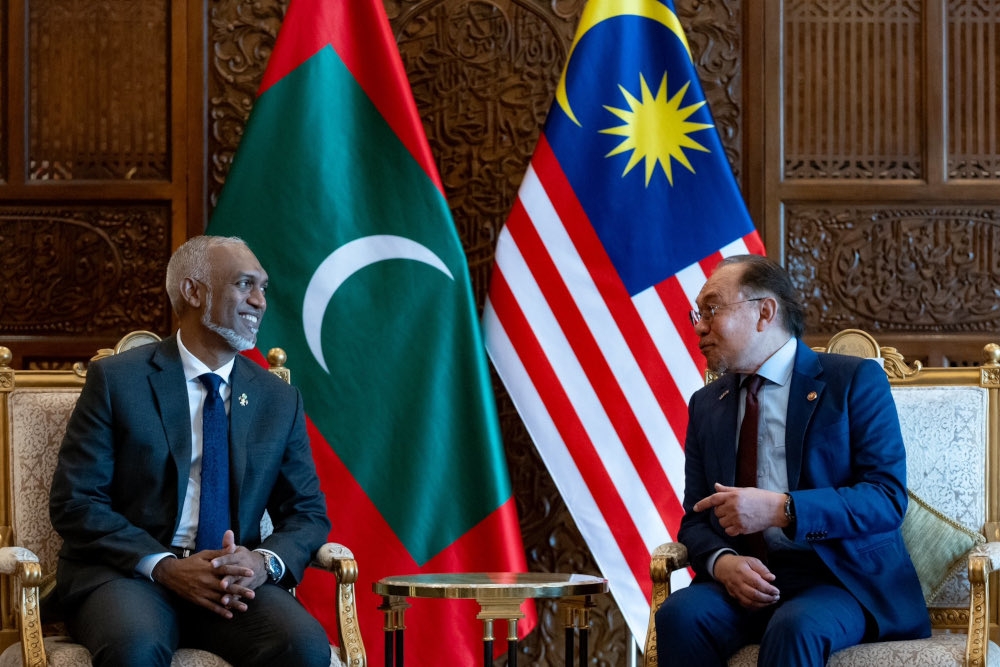

Mittal too had gone to China a few weeks ago to meet the Haier top management, two industry executives said. It’s understood that the Reliance retail unit will be the vehicle for the potential acquisition, said the people cited. Reliance is keen on going solo, unlike the others, as of now, they said.

It’s been building its own-brand business in electronics with licensed labels such as BPL and Kelvinator. Reconnect and Wyzr, brands that Reliance founded, have met with limited success.With most Indian companies and private equity firms making clear they are unlikely to remain junior partners in any alliance, the Chinese company is exploring the dilution of 45-48% equity to a local partner with another 3-6% set aside for Indian employees and local distributors, while retaining the rest.

The final structure is expected to evolve in the next few weeks, added the people cited above. “Reliance was nowhere in the initial list of suitors who had placed a non-binding bid for the Haier India stake,” one of them said. “They entered the race recently and have directly reached Haier headquarters.

They are very keen since they want a larger play in their own brand space in electronics like they are doing in FMCG with Campa Cola.”Reliance and Haier didn’t respond to queries.Third & Growing Haier, which sells refrigerators, washing machines, televisions and air-conditioners in India, posted sales of Rs 8,900 crore in calendar 2024, up 33% from 2023, when it started local operations.

It’s targeting Rs 11,500 crore sales in calendar 2025. Haier has been keen to strike an equity alliance with a prominent Indian business group so that it can receive prompt approvals for its ambitious plans to expand the business in the country. Apart from the South Korean companies, it competes with Whirlpool, Havells-owned Lloyd, Godrej Appliances and Voltas Beko in India.

Since tensions rose between the two countries, India has been going slow on most investments from China under Press Note 3 norms, which mandate government clearance instead of automatic approval for countries that share a border with the country. The move has hit several Chinese investments, even though some joint venture proposals, mainly in components, have been cleared in recent months. Haier India had applied for Rs 1,000 crore foreign direct investment (FDI) in 2023 but hasn’t yet received approval.

Its plans include expansion of plants in Greater Noida and Pune, and setting up a third greenfield facility in the south, for which it’s seeking land in Andhra Pradesh and Tamil Nadu. Capacities will be saturated at the Pune and Greater Noida plants in another two to three years, going by the current pace of growth. Industry watchers say the Haier transaction got delayed by a few weeks due to the US-China tariff war as well as mixed signals.

Prime minister Narendra Modi has been talking about improving bilateral relationship but in a recent interaction commerce minister Piyush Goyal said India does not intend to encourage foreign direct investment (FDI) from China. On the other hand, government officials have recently indicated to industry that joint venture proposals with Chinese minority ownership will be cleared as long as such partnerships involve transfer of critical technology that will help India build its component ecosystem.The recent volatility in global equities has dampened several high-profile listing plans, including the Indian IPO of market leader LG Electronics.

Reliance is said to have raised this point to negotiate discounted valuations. The LG Electronics IPO outcome is being studied closely by the Chinese company, said executives in the know. Merger markets was the first to report that Reliance had submitted an initial bid.

“There has been a change in Reliance’s thinking about their China engagement,” said a veteran group watcher. “There has been a realisation that without China its new energy business will find it difficult to scale up. The group has also tied up with Shien for fast fashion, a move that was unthinkable some years back.

” Reliance Retail chief financial officer Dinesh Taluja told analysts on Friday that its own-brand business in electronics was up 30% on a year-on-year basis in FY25. The company sells these brands not only in its Reliance Digital stores but also through distribution channels. Taluja said the merchant base selling its own brands was up 60% in FY25 from the year before.

.

Business

After Sunil Mittal, Mukesh Ambani's Reliance aims for Haier India stake

Reliance Industries has emerged as a strong contender for a significant stake in Haier India, potentially competing with a consortium led by Sunil Mittal. Haier aims to localize its operations by diluting 25% to 51% equity, seeking a valuation of $2-2.3 billion.