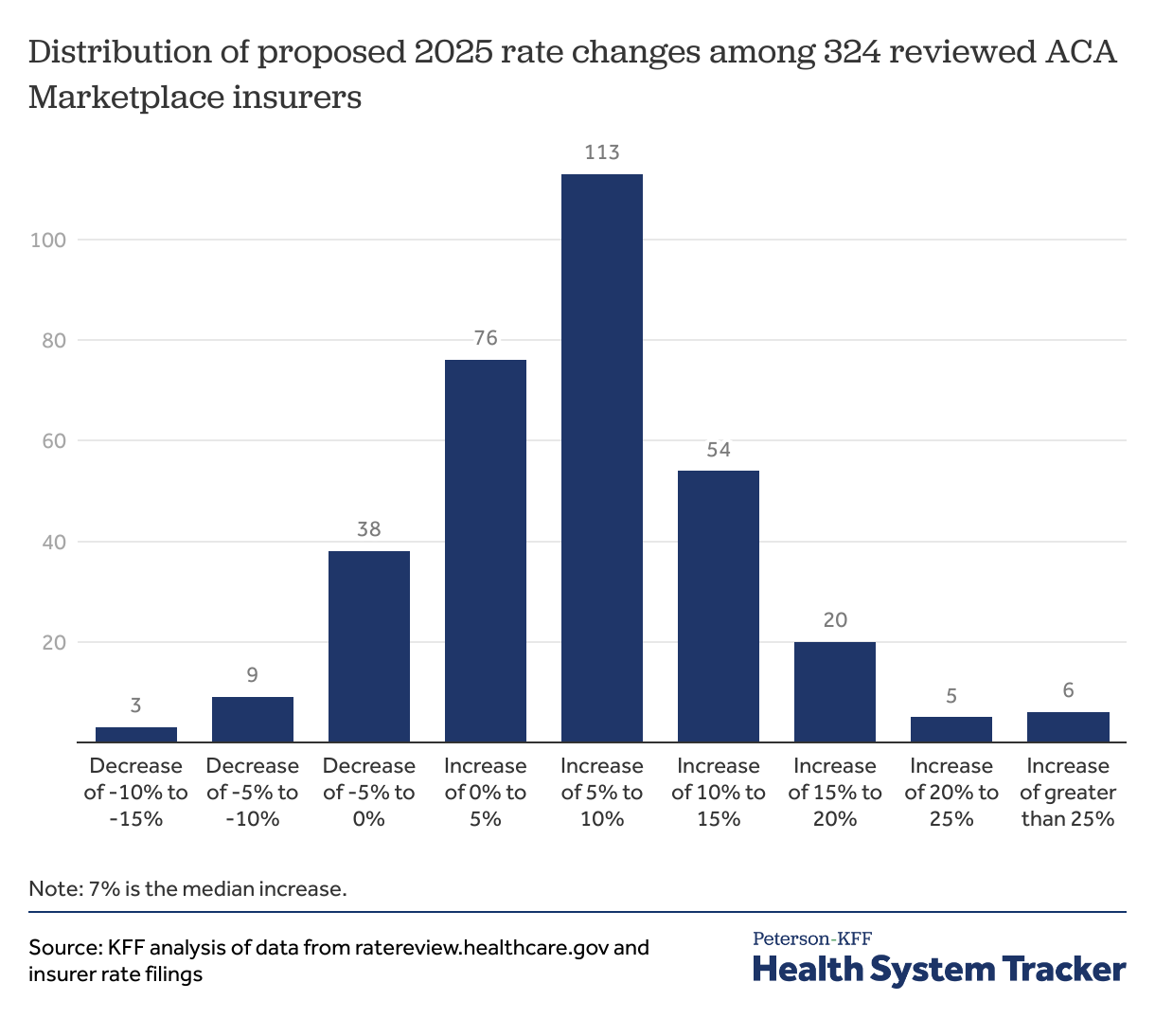

Looking closely at the data, premium changes range from significant decreases to moderate increases: : 3 insurers : 9 insurers : 38 insurers : 76 insurers : 113 insurers As evident, the majority of insurers fall into the category of proposing increases between 5% to 10%, with 113 insurers proposing such changes. A substantial number, 76 insurers, are seeking smaller increases between 0% and 5%. Despite the relatively balanced spread, the wide variance—ranging from a 14% decrease to a 51% increase—reflects the different cost pressures that insurers face based on their regional markets and client demographics.

While the above factors are having a substantial impact on premiums for 2025, other potential drivers, such as COVID-19 and the unwinding of Medicaid continuous coverage, appear to be having little effect on premiums. As the nation moves further away from the height of the pandemic, insurers are reporting fewer costs related to COVID-19 treatment and testing. Most insurers noted that the impact of COVID-19 on their 2025 premiums is minimal.

Similarly, the end of Medicaid continuous enrollment, which began in April 2023, is having a muted effect on premiums. While millions of people have transitioned from Medicaid to ACA Marketplace coverage, most insurers reported that this shift has had little to no impact on their rate filings for 2025. However, a few insurers did report minor impacts, ranging from a 1-2% increase to a similar decrease in premiums as a result of the Medicaid unwinding process.

As in previous years, there is substantial variation in premium changes across different insurers and states. For example, while most insurers are proposing increases between 2% and 10%, a notable number are either reducing premiums or raising them more substantially. In the subset of insurers whose filings were reviewed in detail, those in states like Washington and Oregon were facing higher rate increases due to workforce shortages and hospital market consolidation, while insurers in other states, like New York, were seeing premium hikes due to rising drug costs.

The data on premium changes by insurer and state underscores the wide-ranging pressures facing the healthcare market. Some insurers are managing to keep their premium increases modest or even decrease rates, while others are forced to request substantial increases to cover rising costs. It is important to note that the vast majority of ACA Marketplace enrollees receive subsidies that help offset the cost of their premiums.

As a result, many consumers will not directly experience the full impact of these rate increases. Federal subsidies are based on the benchmark silver plan in each state, and as premiums rise, so too does the amount the federal government spends on subsidies. For most consumers, the out-of-pocket cost of their premiums will remain relatively stable, even as the overall cost of premiums continues to increase.

However, higher premiums do mean higher federal spending, which has implications for the sustainability of the ACA program over the long term. Here is a bar chart visualizing the distribution of ACA Marketplace premium changes for 2025. The chart shows the number of insurers within each premium change category, ranging from decreases of -15% to increases of over 10%.

This helps illustrate how the majority of insurers are proposing moderate increases, with fewer proposing significant decreases or substantial increases. The ACA Marketplace premiums for 2025 are set to rise by a median of 7%, reflecting broader economic trends and specific pressures within the healthcare system. Inflation, rising medical costs, workforce shortages, hospital market consolidation, and the growing utilization of weight loss and specialty drugs are the primary drivers behind these increases.

While some insurers are managing to keep premium hikes in check, others are facing double-digit increases due to these ongoing challenges. Despite these increases, most consumers will be shielded from the full brunt of these changes due to federal subsidies. However, the continued rise in premiums raises questions about the future sustainability of the ACA Marketplace and the broader healthcare system's ability to contain costs in the face of growing economic and demographic pressures.

To remove this article -.